Loan Estimate Explainer

A Loan Estimate tells you important details about a mortgage loan you have requested. Use this tool to review your Loan Estimate to make sure it reflects what you discussed with the lender. If something looks different from what you expected, ask why. Request multiple Loan Estimates from different lenders so you can compare and choose the loan that's right for you.

How to use the tool to review your Loan Estimate: Below you'll see the actions you should take to review your Loan Estimate and some handy definitions to know when you do.

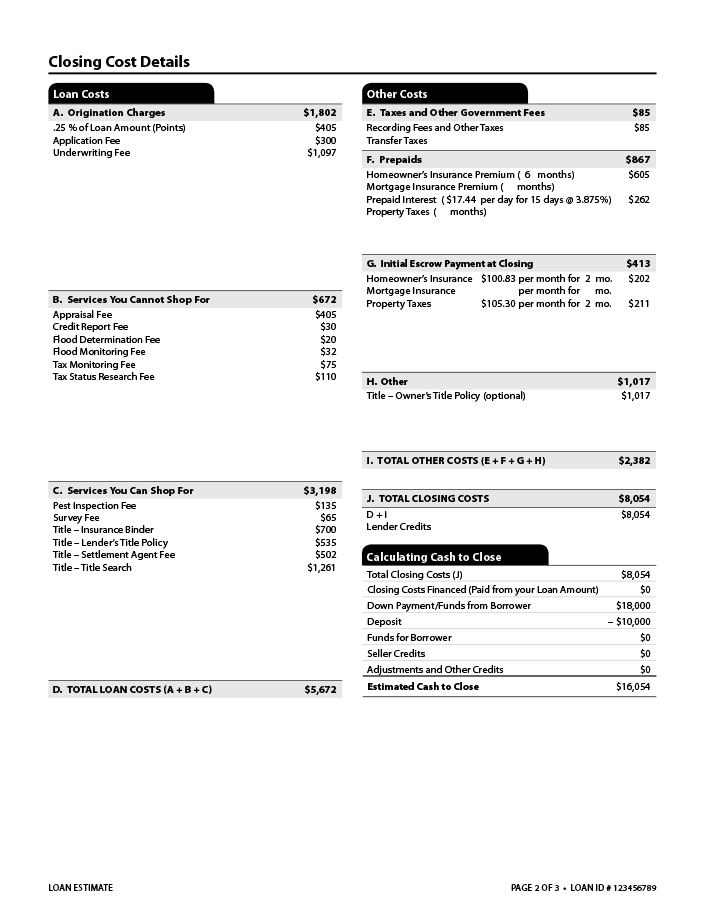

The sample Loan Estimate shows you where you'll find information on your own form. When you select any of the items on the Loan Estimate, the tool highlights the information on the image and also highlights the explanation. You can download the sample Loan Estimate if you'd like to print it or just get a better look.

Sample Loan Estimate

Check the spelling of your name

Check loan term, purpose, product, and loan type

Check that the loan amount is what you are expecting

Understand your monthly principal & interest

Are there additional charges are included in your payment?

Does your Estimated Total Monthly Payment match your expectations?

Do you have items in Estimated Taxes, Insurance & Assessments that are not escrowed?

What are your estimated closing costs?

Do you have enough cash on hand to pay your Estimated Cash to Close?

Rate lock

Fixed and adjustable interest rates

Prepayment penalty

Balloon payment

Monthly Principal & Interest

Mortgage insurance

Check the spelling of your name

Check loan term, purpose, product, and loan type

Check that the loan amount is what you are expecting

Understand your monthly principal & interest

Are there additional charges are included in your payment?

Does your Estimated Total Monthly Payment match your expectations?

Do you have items in Estimated Taxes, Insurance & Assessments that are not escrowed?

What are your estimated closing costs?

Do you have enough cash on hand to pay your Estimated Cash to Close?

Rate lock

Fixed and adjustable interest rates

Prepayment penalty

Balloon payment

Monthly Principal & Interest

Mortgage insurance

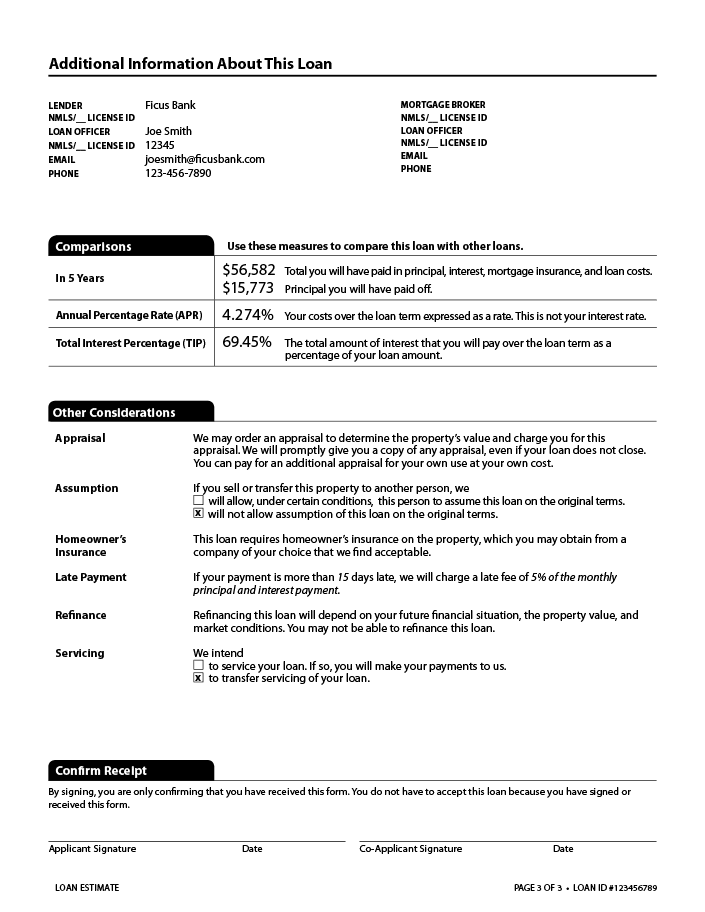

Compare the Origination Charges to Loan Estimates from other lenders

Compare the Services You Cannot Shop For to Loan Estimates from other lenders

Review the Services You Can Shop For and shop for these services

Why are other costs listed?

Is the homeowner’s insurance premium accurate?

Are the property taxes accurate?

Does your loan include lender credits?

Is the Estimated Cash to Close what you were expecting?

Points

Compare the Origination Charges to Loan Estimates from other lenders

Compare the Services You Cannot Shop For to Loan Estimates from other lenders

Review the Services You Can Shop For and shop for these services

Why are other costs listed?

Is the homeowner’s insurance premium accurate?

Are the property taxes accurate?

Does your loan include lender credits?

Is the Estimated Cash to Close what you were expecting?

Points