Solar Financing

Executive Summary

The market for residential solar panels continues to grow, in large part due to declining solar panel costs and increased government incentives, including tax credits. With that growth, the marketing and door-to-door sales of solar-related financial products have become more prevalent.

This Issue Spotlight provides an overview of the most common solar financing business models. Due to the size of the marketplace and the scope of potential consumer harm, this spotlight pays specific attention to risks stemming from the presentation and structure of “solar-specific” loans, which are often facilitated by large financial technology (“fintech”) firms via a point-of-sale partnership with solar installers.

Consumer Risks

- Hidden markups and fees. The CFPB has found that some lenders include substantial markups and fees that can increase the loan principal by 30 percent or more above the cash price. Lenders frequently bake these fees (commonly referred to within the industry as “dealer fees”) into the loan principal but often do not indicate that these fees are a markup from the total cash price that consumers pay for the system installation.

- Misleading statements concerning federal tax credits. Many solar loan sales pitches promote the 30 percent federal “Investment Tax Credit” for residential solar installations with a presumption of universality. However, the tax credit is not a guarantee—it depends on the consumer’s federal tax liability. Compounding the potential harm are solar loan marketing materials that deduct the presumed tax credit from the loan amount to present a so-called “net cost.” This framing can hide the true cost of the loan by leading consumers to believe that the “disclosed net cost” is in fact the loan principal. Low-income consumers are less likely to receive a tax credit and therefore more likely to face unexpected costs.

- Misrepresentations and omissions concerning “voluntary” prepayments. Many solar loans are structured to increase the required monthly payment unless the borrower prepays a large share of the loan principal—typically 30 percent, which is the presumptive amount of the federal tax credit. However, many consumers are surprised by the prepayment expectation, do not receive the presumptive amount of the tax credit, or will not have the funds to remit that prepayment. As a result, they will face large increases to their monthly payments.

- Misrepresentations regarding financial benefits. While households can generate substantial savings from solar energy installation, the CFPB identified misleading statements and marketing materials. Consumers report being told that solar panels will not only cover the cost of the financing but also eliminate future energy bills, when the actual financial benefits are uncertain and can vary significantly by geographic location and season, among other factors.

Market Overview

Scope

The market for solar-powered electricity in the United States continues to expand, with a corresponding growth in financing methods. This Issue Spotlight addresses the most common methods for financing the cost of residential solar panels. It includes descriptions of loans and leases for at-home rooftop solar installations, along with an overview of the market for community solar, an option for solar energy located away from the consumer's residence.1

Market Summary

Industry reports state that in 2023, solar energy represented 55 percent of new electricity-generating capacity added to the U.S. grid, up from 44 percent in 2022, 23 percent in 2018, and 4 percent in 2010.2 The residential segment, approximately one fifth of the overall solar market, installed 6.8 direct-current gigawatts of solar capacity in 2023—up 13 percent from 2022 and 62 percent from 2021.3

A major driver of this growth is the falling cost of solar panels. According to one study from an alternative energy marketplace, the median nationwide installation cost of residential solar panels fell from $3.80 per watt in 2014 to $2.80 in 2023.4

Federal legislation encouraging the adoption of solar energy has also contributed to the heightened demand. In 2005, the Energy Policy Act created a new tax credit (often referred to as the “Investment Tax Credit”) specifically tied to the installation of residential solar projects.5 Eligible homeowners can use the credit to reduce their federal income tax liability by a certain percentage of the project’s installation cost. The size of the credit has varied over time based on subsequent legislation, never exceeding 30 percent. The credit is also non-refundable, meaning that if the potential credit exceeds a person’s federal tax liability, they can only claim enough to reduce their liability to zero. Individuals or households with no federal tax liability will not be able to claim any of the tax credit.

The Investment Tax Credit was set to expire at the end of 2024, but the Inflation Reduction Act of 2022 renewed it through 2034. From 2022 through 2032, the value of the tax credit will be 30 percent of the solar panels’ installation cost, before dropping to 26 percent in 2033 and 22 percent in 2034.6

Many private lenders and their sales partners have made tax benefits a staple of their marketing and customer acquisition strategies. As described in the next section, lenders can exaggerate or double count these benefits in ways that are potentially misleading.

Another source of recent notable solar-related federal subsidies is the Greenhouse Gas Reduction Fund: $27 billion directed by the Inflation Reduction Act of 2022 for “mobilizing financing and private capital for greenhouse gas- and air pollution-reducing projects in communities across the country.”7 A portion of the program’s funds will address the residential solar market, though the specifics are the purview of the over 60 grant recipients that were finalized in April 2024.8

Analysis from researchers at the Lawrence Berkeley National Laboratory (Berkeley Lab), sponsored by the U.S. Department of Energy, provides insight into the income and demographic trends of consumers who purchased residential solar panels.9 The researchers found that approximately 45 percent of solar adopters in 2022 had incomes below 120 percent of their area median income, with 23 percent of adopters falling below 80 percent of area median income. They also found that “[s]olar adoption continues to shift toward less affluent households, with the median current income of solar adopters dropping from $140k for households that installed systems in 2010 to $117k in 2022.” While overall solar adopters are more likely to identify as non-Hispanic white, Berkeley Lab found that among owner-occupied households, “minority households collectively have a greater propensity to adopt [residential solar panels] than non-Hispanic White households.”10

Solar Financing Models

Consumers can access solar energy either directly, via at-home rooftop installations, or indirectly, via largescale community solar projects located away from individual homeowners’ property. The at-home rooftop installation market is available almost exclusively to homeowners, while community solar projects are often open to both homeowners and renters. Within those two broad categories, consumers have several options for securing loans and leases to defray the upfront costs of solar energy.11

At-home rooftop installations

Consumers who wish to avoid paying the cost of installation of solar panels on their rooftops upfront can purchase the panels with a loan or rent the panels. These options are popular because of the high sticker cost: the average residential solar panel installation costs approximately $25,000.12 Another industry report found that cash purchases comprised just 19 percent of the at-home residential solar market in 2023, with loans accounting for 58 percent and third-party ownership 23 percent.13

In many instances, at-home solar panels are designed to allow the homeowner to receive the “net metering” benefits of selling the solar energy they create back to the electrical grid and reduce their monthly electricity bill.14 “In effect,” per the U.S. Department of Energy, “the customer uses excess generation to offset electricity that the customer otherwise would have to purchase at the utility’s full retail rate.”15 However, net metering is not available in all jurisdictions and, where available, it can have terms and conditions that reduce the value to residential utility customers.16

Consumers who purchase solar panels (either with cash or a loan) may be eligible for two additional financial benefits. The first are tax credits, most notably the federal Investment Tax Credit described in Section 2.2. The second is the Solar Renewable Energy Certificate program, in which utility companies pay homeowners for every megawatt hour17 of solar energy that their panels generate. Solar Renewable Energy Certificates only exist in jurisdictions with specific requirements in their state renewable standards for how much energy must come from renewable sources. Certain jurisdictions require utilities to purchase solar credits from home and business owners that “count” toward those standards.18

Solar-specific loans

The most common form of solar financing consists of fixed-term, usually fixed-rate installment loans that cover the price of the panels and installation. These loans are typically referred to as private because they are not issued by a federal or state agency.

There are several types of private loans for solar installations. The first is a loan from a lender who specializes in solar finance (“solar-specific loan”), which is often offered with the panel installation contract and includes provisions unique to the solar industry. Other options include general-purpose unsecured installment loans, lines of credit, and home equity loans and lines from banks, credit unions, and nonbank financial technology firms.

This Issue Spotlight focuses on solar-specific loans due to their complex presentation and structure. The distinctions from other loan options begin at the initial point of contact. For general-purpose loans and home equity financing, there is typically a clear dividing line between the financing contract and the installation contract. For solar-specific loans, the sales, installation, and financing often blend into a single interaction, as salespersons, installers, and lenders may work in concert to consummate the sale of a solar system and financing.

Solar salespeople commonly make their first contact with potential customers via a door-to-door introduction.19 The solar salespeople and installers often have agreements between each other, as well as agreements with one or more solar-specific lenders that enable instantaneous loan offers with the installation contract via a digital tablet.

Some of the largest solar-specific private lenders are fintech firms that offer near-nationwide coverage via partnerships with one or more banks to originate their loans. An online industry marketplace that pairs consumers with installers and lenders states that the largest fintech solar lenders by financing quotes offered in H2 ’23 were Solar Mosaic, Inc. (via partner banks Truist, WebBank, DCU, and Connexus), ATMOS Financial Services Inc. (via partner bank Five Star Bank), Dividend Finance Inc. (acquired by Fifth Third Bancorp in 2022), Sunlight Financial LLC (via partner bank Cross River Bank), and EnFin Co. (via partner banks Hatch Bank and EnFin Corp.).20 The report notes a “fragmented” market, with no one lender comprising more than 12 percent of the financing quotes.21 Two years prior, a pair of lenders (Sunlight and Mosaic) collectively captured over 30 percent of the market.22

The stated annual percentage rates (APRs) on solar-specific loans typically range from 1 to 7 percent. However, as discussed later, those APRs often do not include fees that increase the loan principal on top of the cash price of the solar panels.

Solar-specific loan term lengths typically range from 8 to 25 years, but industry data show solar loans are typically repaid in 7 to 9 years due to prepayments.23 Some solar loans are secured by collateral (typically with a lien on the panels themselves), while others are unsecured. As is the case in other consumer lending, secured loans usually come with lower APRs than comparable unsecured loans because the lender has the right to repossess the panels in cases of nonpayment.

If the homeowner sells their home before their solar loan is paid off, they typically have two options that leave the panels with the home: the buyer agrees to legally assume the solar loan if permitted by the lender, or the homeowner pays off the remaining solar loan balance prior to the sale of the home. It is not typical for homeowners to move their panels to a new home due to the potential for damaging the panels or the house.

Government-backed loans

There are several existing federal- and state-sponsored loan programs to finance residential solar projects.24 In some cases, tax dollars directly subsidize the program and pass those benefits along to consumers in the form of lower interest rates. Three existing federal programs are:

- The Federal Housing Administration (FHA)’s Solar and Wind Technologies program, which is an amendment to a mortgage at the time of purchase that adds the full cost of the solar panel installation to a regular FHA-insured mortgage.

- The FHA and Department of Veterans Affairs Energy Efficient Mortgage program, which is a refinance of a mortgage to include an eligible energy efficient upgrade.

- The FHA’s PowerSaver program, which is a second mortgage just for energy-efficient upgrades. Loan sizes range up to $25,000 and up to 20 years at rates of 5 to 10 percent, with the FHA guaranteeing up to 90 percent of the loan.

Lease

In a lease, sometimes referred to in the industry as a “straight solar lease,” the homeowner enters into a contract—either directly with the installer of solar panels or with a third-party lessor—to lease solar panels for a fixed period of time rather than purchase them outright.

Typical solar leases last for 15 to 20 years and require no down payment. In some cases, monthly payments are the same for the life of the lease, but in many cases the payments increase each year by a predetermined amount. The homeowner is still responsible for their standard monthly electricity bills, but they benefit from the solar net metering (if available in their jurisdiction) in many of the same ways as homeowners who choose to purchase the panels. At the end of the lease, the lessor is responsible for uninstalling and removing the panels.

Power Purchase Agreement

Like solar leases, Power Purchase Agreements (PPAs) are another option in which consumers can benefit from rooftop solar energy without bearing the panel ownership responsibility. PPAs also involve an upfront long-term contract between the consumer and a lessor/installer, but the terms differ from a lease in important ways.

In a PPA, the installer is responsible for setting up and maintaining the solar system on the consumer’s rooftop and for providing electricity to the consumer at a predetermined per-kilowatt-hour rate. This model is known as “paying for energy,” since the consumer pays the installer for the electricity they consume rather than a fixed cost for the panels. In some PPA contracts, the rate is fixed for the duration of the agreement. In others, there are delineated “escalators” that increase the rate in future years and range from 1 to 5 percent.25 Typical PPA contract lengths are six to twenty-five years.26

Community Solar

Community solar has many different forms and business models. The term applies to any agreement between an individual and a third party to finance a large-scale solar project (often called a “solar farm”) situated away from the consumer’s home.27

Community solar enables renters and residents in multi-family homes and apartment buildings to invest in and benefit from renewable electricity. This essentially doubles the potential addressable market for residential solar energy. According to a 2015 National Renewable Energy Laboratory study, “over 50 percent of Americans who would like to use solar energy are unable to install a rooftop solar array.”28 Some community solar business models provide consumers with fixed discounts from their retail electricity bills, while others charge based on individual energy consumption.

Industry reports found that community solar installation volumes (as measured on a per-megawatt basis) stayed relative constant between 2022 and 2023; the lack of growth was attributed to “[i]nterconnection delays and permitting challenges.”29 In 2023, community solar installation volumes were roughly one-sixth the size of at-home residential solar installation volumes.30

Risks of Solar-Specific Loans

There are several consumer risks that apply specifically to private solar-specific loans. Some risks may stem from aggressive sales tactics, but the underlying loan contracts have the potential for consumer harm as well. Four of the most prominent risks are described below. The section concludes with a review of specific consumer populations with the potential for heightened risk.

Hidden Markups and Fees

Many solar-specific lenders assess hidden fees that increase the amount of the loan principal above the cash price. Within the solar industry, these fees are often called “‘program fees,’ ‘lending fees,’ ‘finance fees,’ ‘platform fees,’ ‘original issue discounts,’ and ‘dealer fees.’”31 Hidden fees typically range from between 10 to 30 percent of the cash price but can exceed 50 percent.32

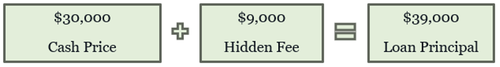

As an example, consider a solar project that would cost $30,000 if the consumer paid in cash (“cash price”), with a $9,000 hidden fee (30 percent of the cash price).

The loan documents would show a loan principal of $39,000 plus interest. The lender would remit the $30,000 cash price to the installer and keep the $9,000 hidden fee. Typically, lenders do not include the hidden fees in the total costs of credit that they present to consumers, and salespeople offering financing often do not explain the difference in the cash price and loan principal.

Consumers' and market participants’ experiences reveal several concerns about hidden fees.33 The following complaints to the CFPB illustrate these concerns.

"I'm currently working with a solar rooftop installer that is offering financing by [LENDER NAME]. The solar installer is saying that if I would like to have financing through this company, that they have to add on 26% of the total cost of the system as an upfront fee. This is a fee that the [LENDER NAME] retains, and not the dealer fee, although it is called a " dealer fee ''. I confirmed this through many different solar installers that utilized this finance company. I called the company directly to ask for the APR and they said they do not have one. Normally when I [either] apply for or inquire about any loan, the federal government requires the percentage rate be listed, as well as the APR which is the percentage rate plus any fees or charges in relation to the loan. This federal requirement is so that the consumer will know exactly what they are spending on debt service. [LENDER NAME] refused to provide the APR, and instead, they stated that their APR was the interest rate. This meant that they were saying that the interest rate was 1.99 %, and that the APR interest rate was also 1.99 % for a 25 year loan. Mathematically this can not be possible when they are charging a 26 % upfront fee, again called the dealer fee... They are not living up to the spirit or letter of the law and are blatantly lying to the consumer…When I talked with [LENDER NAME], their managerial representation was very angry that I was even asking these questions and seemed shady." 34

"[LENDERS] pass off HIGH percentage origination charges to the contractor to avoid QC problems of disclosing that as a loan cost is also the point of XXXX I believe…My loan amount was XXXX, so they increased my loan amount to XXXX. I asked the contract how and why and they said [LENDER NAME] added charges to the contractor knowing it would be passed to the consumer." 35

Some industry stakeholders oppose the use of hidden fees and have combined resources to propose alternative financing solutions.36 They offer loans that do not include a markup on the solar panels’ cash price and instead price all costs of credit into the APR. However, they acknowledge that even when their all-in costs are actually lower, it is difficult to compete for consumers’ business when their disclosed costs of credit are higher than those advertised by lenders who charge hidden fees.

Misleading Statements Concerning Federal Tax Credits

Lenders and installers often incorporate the default expectation of a 30 percent federal tax credit into their marketing materials and loan documentation, giving a potentially misleading impression of the overall price.

A common solar lending industry practice is to present the actual loan in a small, light font, and the “net system cost” (i.e., the loan amount minus the presumed 30 percent tax benefit) in a large, bright font. Consumers may not be familiar with using a tax credit to pay off a portion of a loan and may not fully understand that the actual loan amount is displayed in the smaller, gray font. Often, lenders and installers place disclaimers on the “expected tax credits” in the fine print of consumer agreements or footnotes of advertisements, but these disclaimers may not be obvious enough for consumers to notice.

Promising specific tax savings up front is problematic because lenders and installers seldom if ever know the consumer’s tax situation. This creates at least three problems: First, the credit is not issued until the consumer files federal taxes for the year in which solar project is installed. A consumer who purchased panels in January 2024, for example, may not receive any tax benefit until they file their 2024 taxes in 2025. Second, only higher-income consumers will typically have the requisite federal tax liability to receive the full tax credit. Third, even consumers who do receive the full tax credit may not see any or all those funds in the form of a refund check if their other tax liabilities are large enough that the solar panel credit only reduces their overall taxes owed.

Misrepresentations and Omissions Concerning Prepayments

Unlike some consumer loans that impose prepayment penalties for early repayment, many solar-specific loans effectively require consumers to make substantial partial prepayments. These lenders rely on consumers’ presumptive federal tax credits as the basis for requiring partial loan prepayments.

It is commonplace for solar-specific loans to re-amortize at a higher monthly payment amount at the 19th month of the loan term if the consumer does not make a substantial prepayment before then. Frequently, the necessary prepayment to avoid that re-amortization is 30 percent of the loan principal, which is the current size of the federal Investment Tax Credit.

There are at least two sets of risks and potential harms inherent in this “expected prepayment” practice. First, some consumers have asserted that prepayment was not clearly discussed at the time that they signed the loan documents. Even in instances when the different payment amounts are discussed, the often quick and digital nature of the sales process increases the likelihood that salespeople may guide consumers past these sections. A 2024 investigative report into the industry found that “[c]onsumers don’t catch these extra costs in part because salespeople often present documents to potential customers on tablets or phones, making it easy to skip over the fine print.”37 The report quoted an attorney representing consumers in several civil suits against solar lenders who argued that “finance companies are well aware that salesmen are taking advantage of electronic devices to hide documents from consumers.”38

The second set of risks and potential harms inherent in the “expected prepayment” practice pertains to the payment expectations. As discussed in prior sections, there is no guarantee that all consumers will receive the full federal tax credit or that they will receive a cash refund equal to the size of the full credit. Consumers who do not receive the full 30 percent tax credit as a cash refund and are unable to remit the full expected prepayment will experience a sudden and significant increase in their monthly payment. Those who do receive the full tax credit but are not aware of the prepayment expectation may allocate funds to other financial obligations and thus not have the ability to make the prepayment necessary to prevent the higher payment re-amortization.

The following complaints to the CFPB exemplify these risks.

"The [LENDER NAME] company stated I signed some [loan agreement] that gave me 18 months to accumulate enough solar tax credits to avoid a 26 % fee based on the loan amount {$34000.00}, which they say comes to {$9000.00} and if I do not send a check by XX/XX/XXXX my payment will go from {$180.00} to {$250.00} for 38 years this will mean that I will be paying {$64000.00} for solar panels over 38 years. I did not understand this from the beginning, I was literally e-signing and it was not explained to me, the new loan amount of {$250.00} is {$65.00} additional per month and over 38 year loan will add {$29000.00} to the {$34000.00} loan amount." 39

"My payment was as expected for a while. Soon I received notice that because my loan balance hadn't fallen below a certain amount, my payment would increase to $ XXXX -- this despite me paying every payment on time for the last XXXX months per the contract ( via autopay ). Over the course of the last XXXX years I have paid only {$2700.00} in principal. I was never informed that I would need to make any additional payments ( on top of my regular installment payments ), nor that if I didn't make additional payments I would also have a greatly increased payment." 40

Misrepresentations of Financial Benefits

Despite various claims, there is no guarantee that a solar loan will pay for itself—especially when considering the substantial upfront fees included with some solar-specific loans. Some installers misrepresent the future cost of energy and overestimate the amount of electricity that solar panels will produce. Some solar loan agreements note that the consumer’s financial obligation does not depend on the system’s performance, yet many factors can impact a system’s performance, including system design, component quality, installation failures, weather, local rate design, tree growth and other variables.

Population-Specific Risks

Consumers and others have expressed concern to the CFPB about high-pressure and misleading solar sales practices and financing impacting particular populations, including those who are older adults or have limited English proficiency.

The following solar-loan-related complaints to the CFPB from older adults illustrate some of these concerns.

"I was told that I wouldn't have to pay an electric bill and now I pay more on my electric bill with the solar panels. They lied to me and took advantage of me…I called and canceled my service due [to] false pretense. I continue to receive calls and emails of harassment from this company after I have filed a cease and desist against them. I am not well health-wise and this is taking a toll on me even more. I have requested my contract from [LENDER NAME] and they have not sent me a copy. I was told that I would not have to pay them for a year which was a lie and that when I did my taxes I would get {$10000.00} reimbursement which was also a lie." 41

"I believe that [LENDER NAME] and XXXX XXXX are responsible for claims made by the sales representative 's misrepresentation of the federal tax credit. I believe that the sales representative knew that the tax credit is usually NOT cash received as he made me believe. But as I have since learned the tax credit is used to pay down any tax liability that I may owe at the end of the year. Had that been made clear to me I never would have agreed to the loan. Again during the loan competition process, it was never mentioned or eluded to that I may have to pay 30 % out of pocket to pay down my loan to the expected sales price of {$45000.00}. I am willing to pay the loan. I'm just not willing to pay the loan inclusive of the {$19000.00} tax credit. I know now that this was a bad deal from the start and the federal tax credit was misrepresented to me by both the seller and the lender." 42

"PREDATORY LENDING, PREDATORY SALES, AND ELDER ABUSE: 30% TAX CREDIT FORCED UPON ME BY BOTH THE SELLER AND THE LENDER WITHOUT MY FULL UNDERSTANDING…Why does the finance company get to further cement the idea that I will be able to use the tax credit to pay down my loan when they have no idea if I even qualify for the tax credit? And, if I did receive the tax credit money in my hand, why does the finance company get to dictate or strongly suggest how I spend the money? [SALESPERSON NAME] leads with the 30 % tax credit and [LENDER NAME] uses the initial low payment as bait to get me to agree to pay the 30 % within 18 months. Because, of course, anyone would rather have a low payment. But, If I dont or cant pay the 30 % then the payment switches to the higher amount. So, instead of starting me at the low payment with the expectation that I will have the money to pay down my loan. LET THE PRICE BE THE PRICE. AND LET MY PAYMENT BE MY PAYMENT. So that the payment doesnt have to balloon after 18 months. Its my right to choose when given a fair choice." 43

CFPB analysis of the Census Bureau’s American Housing Survey finds a relationship between age, having solar panels, and reliance on a form of payment other than cash (such as financing by contractor, home equity loans, and other) to make home improvements. Specifically, between 2020 and 2021, 44 percent of older homeowners with solar panels reported relying on these other methods, compared to 36 percent among homeowners aged 18 to 59.44

According to a company that tracks and analyzes direct marketing activity, between 2021 and 2023, consumers ages 18 and older received 8.4 million pieces of mail advertisement that included promotions for solar energy systems’ financing. About one-third of these pieces (34 percent or 2.8 million) were sent to adults ages 60 and older. A large portion (62 percent) of the mail advertisement for solar systems targeted at older adults was part of promotional packages that included ads for other services such as windows, roofing, kitchen remodeling, and other improvements.45

While there is limited data on the extent of solar adoption among limited English proficiency populations, some reports have flagged that in addition to other practices, some solar salespeople are conducting sales pitches targeting limited English proficiency consumers in their preferred language but are providing the solar purchase contract only in English.46

Conclusion

Homeowners have the potential to generate substantial savings by making improvements to their home that generate clean energy and increase energy efficiency. However, these investments require upfront costs that many families must finance.

The CFPB has been working to ensure that costly financing for clean energy does not wipe away expected energy savings or expose the family to serious financial risks. Last year, the CFPB put forth proposed rules regarding property assessed clean energy (PACE) loans, which increase the cost of monthly tax assessments as a way to finance clean energy improvements.

As solar energy installations continue to grow in popularity, the agency will be working closely with federal and state regulators and law enforcement to ensure that the financing of solar energy installations is fair, transparent, and competitive.

Endnotes

-

There are other solar energy technologies—such as concentrated solar power, which uses mirror or lenses to generate steam-powered electricity—but given their limited use in residential projects they will not be discussed. This Issue Spotlight also does not directly touch upon the growing market for solar energy storage (which allows consumers to store the excess energy produced during the day to use at night) via add-on battery systems.

↩ -

SEIA, Solar Industry Research Data, https://www.seia.org/solar-industry-research-data .

↩ -

SEIA, Solar Market Insight Report 2023 Year in Review, https://www.seia.org/research-resources/solar-market-insight-report-2023-year-review . It is important to note that, although it has experienced rapid growth, the residential market (rooftop and community solar) represent less than a quarter of all cumulative solar installations in the U.S., with installations from utilities alone comprising approximately two thirds. However, residential installations did overtake commercial installations in the late 2010s.

↩ -

EnergySage Solar & Storage Marketplace Report 2023 (Feb 2024), https://www.energysage.com/press/energysage-marketplace-intel-report-18/

↩

Per the International Energy Agency, one factor that has reduced solar prices worldwide is substantial oversupply relative to the number of installations (https://www.spglobal.com/commodityinsights/en/market-insights/latest-news/electric-power/011224-world-stuck-in-major-solar-panel-supply-glut-module-prices-plummet-iea ).

Despite this significant downward pricing trend, the median solar installation cost in the United States ($2.80, as of the end of 2023) is still four times as high as in Australia ($0.70, per https://news.energysage.com/why-is-solar-more-expensive-in-the-us/ ). According to the solar energy marketplace EnergySage, Australia has been able to achieve low installation costs in part by “simplifying the permitting requirements for solar installations and by hiring dedicated solar inspectors.” According to SEIA, approximately two-thirds of solar installation costs in the U.S. are “soft” costs, which includes “installation labor, customer acquisition, and permitting/inspection/interconnection.” (Wood Mackenzie US Solar Market Insight, Q4 2022). -

H.R. 6, 109th Cong. (2005-2006).

↩ -

Id.

↩ -

Environmental Protection Agency, About the Greenhouse Gas Reduction Fund, (April 2024), https://www.epa.gov/greenhouse-gas-reduction-fund/about-greenhouse-gas-reduction-fund .

↩ -

Environmental Protection Agency, Biden-Harris Administration Announces $20 Billion in Grants to Mobilize Private Capital and Deliver Clean Energy and Climate Solutions to Communities Across America (April 2024), https://www.epa.gov/newsreleases/biden-harris-administration-announces-20-billion-grants-mobilize-private-capital-and .

Environmental Protection Agency, Biden-Harris Administration Announces $7 Billion Solar for All Grants to Deliver Residential Solar, Saving Low-Income Americans $350 Million Annually and Advancing Environmental Justice Across America (April 2024), https://www.epa.gov/newsreleases/biden-harris-administration-announces-7-billion-solar-all-grants-deliver-residential .

↩ -

Berkeley Lab, “Residential Solar-Adopter Income and Demographic Trends: 2023 Update,” https://emp.lbl.gov/publications/residential-solar-adopter-income-2 .

↩ -

Id.

↩ -

Property Assessed Clean Energy (PACE) financing is another option some consumers have to finance certain home improvements, including solar panel installation on their homes. The CFPB has proposed rules for PACE financing as mandated by the Economic Growth, Regulatory Relief, and Consumer Protection Act of 2018. See 15 U.S.C. 1639c(b)(3)(C). A Notice of Proposed Rulemaking was published on May 11, 2023, along with a report on the effect of PACE on consumers’ financial outcomes. Both publications can be found at https://www.consumerfinance.gov/rules-policy/rules-under-development/residential-property-assessed-clean-energy-financing-regulation-z/

↩ -

Aly J. Yale, “How Much Do Solar Panels Cost? (And Are They Worth It?),” Wall Street Journal, March 28, 2024, https://www.wsj.com/buyside/personal-finance/mortgage/solar-panel-costs .

↩ -

Zoë Gaston, “US residential solar: cloudy skies will lead to a market reset in 2024,” Wood Mackenzie, (April 2024), https://www.woodmac.com/news/opinion/us-residential-solar-cloudy-skies-will-lead-to-a-market-reset-in-2024/

↩ -

In the jurisdictions that offer net metering, its benefits are traditionally much greater in the warmer and brighter months and in sunnier climates. In some months, the amount of energy generated by the panels may be greater than the amount of energy that the house consumes, which can result in “negative” electricity bills (usually paid in the form of credits to be applied to future bills).

↩ -

U.S. Department of Energy, “Net Metering,” https://www.energy.gov/sites/prod/files/2014/05/f15/fupwg_may2014_net_metering.pdf .

↩ -

As of November 2023, Texas and Idaho do not offer net metering or an equivalent form of state compensation mandate, though some utilities may choose to allow net metering. Tennessee does not offer any form of state-mandated or utility-offered net metering.

https://ncsolarcen-prod.s3.amazonaws.com/wp-content/uploads/2023/11/DSIRE_Net_Metering_Nov2023.pdf .

↩ -

A house with a medium to large solar system can expect to produce around one megawatt hour per month in the months around the summer solstice, and considerably less than that in the winter months.

↩ -

As of the end of 2023, 28 states plus the District of Columbia, Northern Mariana Islands, Puerto Rico, and the U.S. Virgin Islands have a Renewable Portfolio Standard (SEIA, Renewable Energy Standards, https://www.seia.org/initiatives/renewable-energy-standards ), but only eight have a solar-specific carveout and an active Solar Renewable Energy Certificate market (Delaware, District of Columbia, Maryland, Massachusetts, New Jersey, Ohio, Pennsylvania, and Virginia. https://www.srectrade.com/markets/rps/srec/introduction ).

↩ -

Door-to-door solar sales contracts may be subject to the Federal Trade Commission’s Cooling-Off Rule that provides three days to cancel certain sales made at consumers’ homes. See https://consumer.ftc.gov/articles/buyers-remorse-ftcs-cooling-rule-may-help .

↩ -

EnergySage, Solar & Storage Marketplace Report 2023, https://www.energysage.com/data/ . For references to specific company bank partnerships, see Mosaic, “Lending & Financial Partners,” https://joinmosaic.com/lending-financing-partners/ , Atmos Financial, homepage, https://www.joinatmos.com/ , Fifth Third Bank, “Fifth Third Completes Acquisition of Dividend Finance, Leading Lender in High Growth Solar, Sustainable Solutions,” https://www.53.com/content/fifth-third/en/media-center/press-releases/2022/press-release-2022-05-10.html , Sunlight Financial, homepage, https://sunlightfinancial.com/ , EnFin, “Partners,” https://www.enfin.com/partners .

↩ -

Id.

↩ -

Id.

↩ -

EnergySage, Solar Loans Overview, https://news.energysage.com/solar-loans-overview/ .

↩ -

Additional government-sponsored solar loan programs may emanate from the $27 billion Greenhouse Gas Reduction Fund, allocated as part of the 2022 Inflation Reduction Act. The exact parameters of the sourcing and terms of those funds are up to the individual grant recipients.

↩ -

Environmental Protection Agency, “Solar Power Purchase Agreements,” https://www.epa.gov/green-power-markets/solar-power-purchase-agreements .

↩ -

Id.

↩ -

While not technically a necessary condition, government-mandated net metering—which enables solar farms to sell their energy to retail utilities at favorable rates and pass those savings on to community solar subscribers—substantially increases the logistical and financial viability of a potential community solar project. As of 2024, 24 states in addition to the District of Columbia and Puerto Rico have passed legislation enabling some form of these net metering benefits, and those states account for approximately two thirds of the nation’s community solar volume. The remaining third of the community solar market comes in the other 26 states, where participation from the utilities is voluntary and approved on a case-by-case basis by state regulatory commissions.

EPA, Shared Renewables, https://www.epa.gov/green-power-markets/shared-renewables .

See also, NREL, “Sharing the Sun,” (July 2021), https://www.nrel.gov/docs/fy21osti/80246.pdf .

↩ -

EPA, Shared Renewables, https://www.epa.gov/green-power-markets/shared-renewables .

↩ -

SEIA, Solar Market Insight Report 2023, https://www.seia.org/research-resources/solar-market-insight-report-2023-year-review .

↩ -

Id. Community solar volumes were estimated at 1,148 direct current megawatts, relative to 6,800 in the residential at-home market.

↩ -

State of Minnesota vs. GoodLeap LLC, Sunlight Financial LLC, Solar Mosaic LLC, and Dividend Solar LLC, 27-CV-24-3558, https://www.ag.state.mn.us/Office/Communications/2024/docs/SolarLending_Complaint.pdf , at 10.

↩ -

See Id., at 10 and 42 and EnergySage, “Understanding solar loan fees: Complete overview,” https://www.energysage.com/solar/solar-loans/understanding-solar-loan-fees/ .

↩ -

See also State of Minnesota vs. GoodLeap LLC, et al. 27-CV-24-3558, https://www.ag.state.mn.us/Office/Communications/2024/docs/SolarLending_Complaint.pdf ; United States District Court Eastern District of Tennessee Knoxville Division, State of Tennessee v. Ideal Horizon Benefits, LLC d/b/a Solar Titan USA, et al. Plaintiffs’ Opposition to Solar Mosaic, LLC’s Motion to Dismiss, March 14, 2024. p. 38.

Additionally, in July 2024, the Center for Responsible Lending published a report, entitled “The Shady Side of Solar System Financing,” that raised several concerns with solar-specific loans. See https://www.responsiblelending.org/sites/default/files/nodes/files/research-publication/crl-shady-side-solar-financing-jul2024.pdf . One of those concerns was hidden fees: “Hidden finance fees harm homeowners because they are unaware of how much they could save if they financed the solar panels through alternative means without a dealer fee.”

An additional concern from the report involves Uniform Commercial Code (UCC) liens. Lenders commonly file UCC liens on the solar panels themselves. As the report notes, a UCC lien is “technically not on the property, but it can muddy the title because some jurisdictions view the lien as applying to the whole property. If this occurs, the lien must either be released or made subordinate to the mortgage or refinance.”

↩ -

CFPB Complaint ID 5893841, https://www.consumerfinance.gov/data-research/consumer-complaints/search/detail/5893841.

↩ -

CFPB Complaint ID 8310301, https://www.consumerfinance.gov/data-research/consumer-complaints/search/detail/8310301.

↩ -

See National Credit Union Administration, “NCUA Charters Clean Energy Federal Credit Union,” https://ncua.gov/newsroom/news/2017/ncua-charters-clean-energy-federal-credit-union and “Are there any ‘dealer fees’ that a contractor must pay to Clean Energy Credit Union?,” https://www.cleanenergycu.org/faq/are-there-any-dealer-fees-that-a-contractor-must-pay-to-clean-energy-credit-union/ .

↩ -

Alana Semuels, “The Rooftop Solar Industry Could Be on the Verge of Collapse,” Time, (January 25, 2024), https://time.com/6565415/rooftop-solar-industry-collapse/ .

↩ -

Id.

↩ -

CFPB Complaint ID 4562186, https://www.consumerfinance.gov/data-research/consumer-complaints/search/detail/4562186.

↩ -

CFPB Complaint ID 6339885, https://www.consumerfinance.gov/data-research/consumer-complaints/search/detail/6339885.

↩ -

CFPB Complaint ID 8688897, https://www.consumerfinance.gov/data-research/consumer-complaints/search/detail/8688897.

↩ -

CFPB Complaint ID 9025559, https://www.consumerfinance.gov/data-research/consumer-complaints/search/detail/9025559.

↩ -

CFPB Complaint ID 8661726, https://www.consumerfinance.gov/data-research/consumer-complaints/search/detail/8661726.

↩ -

CFPB analysis of the 2021, Census Bureau, American Housing Survey. This analysis uses variable JOBFUNDS. The question routing and responses can be found at: https://www.census.gov/data-tools/demo/codebook/ahs/ahsdict.html?s_keyword=jobfunds . Financing could include, but was not limited to, financing the purchase through the solar panel company, or obtaining a home equity loan or reverse mortgage.

↩ -

https://www.competiscan.com/ . Competiscan provided data to the CFPB.

↩ -

See e.g., Univision, “Mujer Debe Mas de $90,000 por instalacion de panels solares de un supuesto-programs del gobierno,” August 1, 2023, https://www.univision.com/local/los-angeles-kmex/mujer-debe-mas-de-90-000-por-instalacion-de-paneles-solares-de-un-supuesto-programa-del-gobierno-video .

↩