Who are the Credit Invisible?

How to help people with limited credit histories

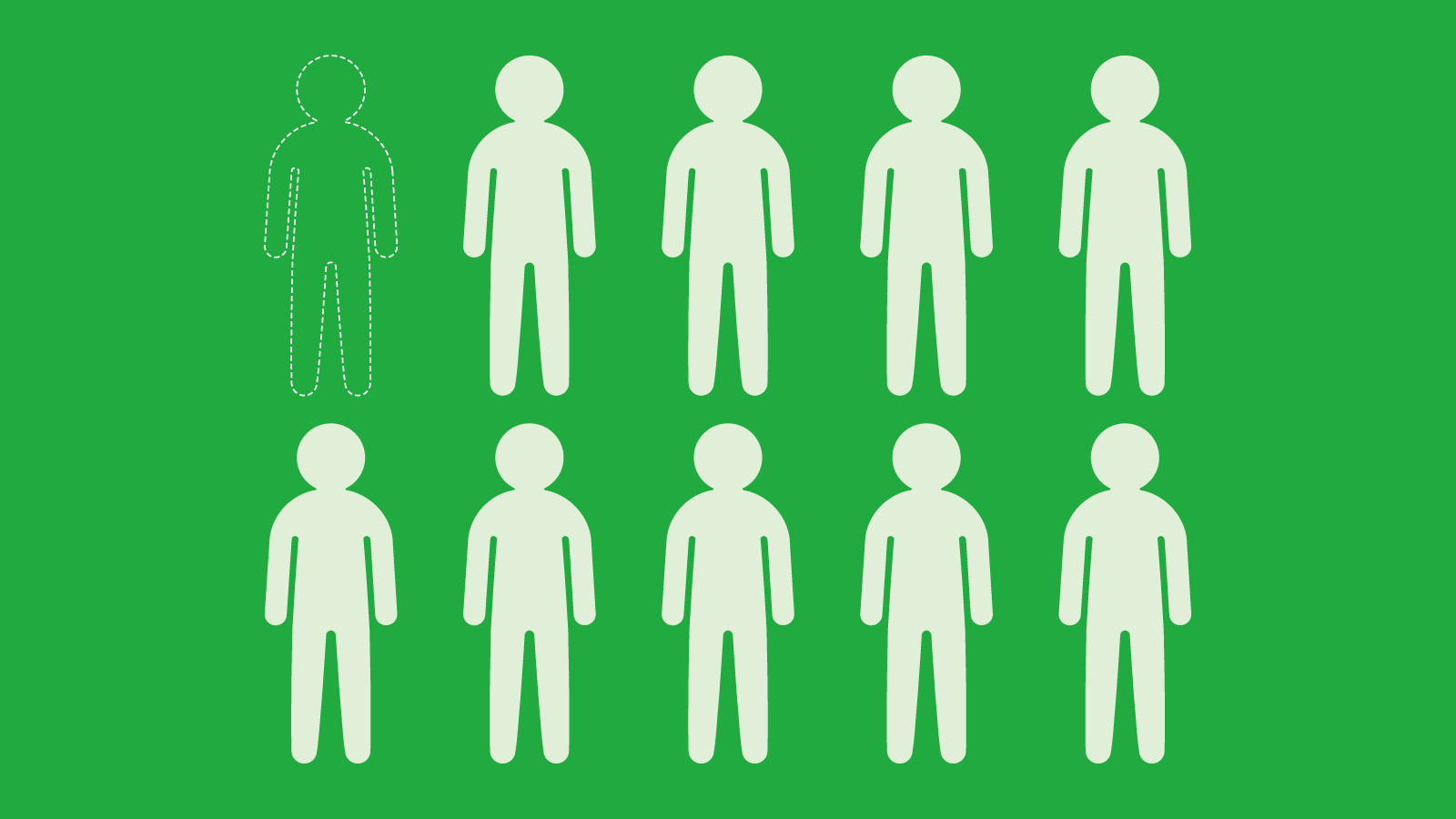

In 2015, we published a report finding that 26 million Americans are “credit invisible.” This figure indicates that one in every ten adults does not have any credit history with one of the three nationwide credit reporting companies. The report also found that Black consumers, Hispanic consumers, and consumers in low-income neighborhoods are more likely to have no credit history or not enough current credit history to produce a credit score.

Today, we’re releasing a brief of the most significant findings, as well as a checklist of action items to help consumers who are new to credit or looking to rebuild.

Check out our brief on credit invisibility , as well as our checklist .

Credit reports and credit scores play a crucial role in the lives of consumers in America. Fortunately, there are actions you can take to build credit.

Know what matters

Paying your bills on time, every time, is one critical step in building a good credit score. Also, don’t get too close to your credit limit. Experts advise keeping your use at no more than 30 percent of your total credit limit.

Find products that will help you to build your credit history responsibly

There are a number of existing products considered helpful in establishing or rebuilding credit histories, and provide you with the opportunity to practice making on-time payments that are reported to the credit reporting companies. Below is a list of common credit-building products to explore:

- Secured credit cards: You can apply for this card like a traditional credit card and after approval, deposit an amount of money –which can range from $50 to $300 depending on the credit card company – into a separate account. The bank holds onto this deposit and extends you a credit line matching the deposit amount that you made. Banks typically report to the credit reporting companies about card activity – so you build credit with its use, but be sure to ask your card issuer. Many secured cards also include a “graduation” component, so you are able to move from a secured card to a traditional credit card seamlessly after establishing a pattern of consistent payments.

- Credit builder loans: Financial institutions, typically credit unions, deposit a small “loan” (often $300-$1000) into a locked savings account and you pay the institution back with small-dollar payments over 6 to 24 months. These payments are reported to the credit reporting companies. Once you come to the end of the loan term, you receive the accumulated money back in total. These loans often have the dual benefit of building credit and savings. The savings could be used for an emergency (in lieu of a more costly financial products) or as the deposit for a secured credit card. This can help you establish a credit history for the first time.

- Retail store credit cards: Many gas stations, department stores or retail chains offer credit cards. These cards tend to be easier to obtain and typically offer lower credit lines. This combination makes them an option when you’re looking to build up a thin or nonexistent credit record.

Reporting rent and other, less traditional payment data to the credit reporting companies

There are a number of payments you make that credit reporting companies don’t currently receive information about, but could be captured to record on-time payment history. This data could include monthly rent or cell phone payments. You can also leverage this opportunity by opting into self-reported payments through a company that offers this service. Fees and conditions may apply for such services, so be sure to do your homework before enrolling.

Know how to access credit reports

You have the right to request your credit report from each of the three nationwide credit reporting companies once every twelve months free of charge at annualcreditreport.com . Having this information on-hand is the most important first step to building or rebuilding credit.

Take steps to correct errors

You should actively take steps to correct any accuracy issues with your credit reports. In fact, accuracy issues are the top cited issues in credit reporting complaints we handle. We have forms you can use to dispute errors on your credit report.

You have the legal right to dispute errors on report with the credit reporting company and the company that furnished the information to the reporting company such as your lender. Companies are obligated to conduct – free of charge – a reasonable investigation of your dispute. The company that has provided the incorrect information must correct the error, and notify all of the credit reporting companies to whom it provided the inaccurate information.

We have other tools to help you get the information you need. If you have questions about credit reporting and building your credit, visit Ask CFPB. If you are facing an issue with credit reporting, or other financial products or services, you can submit a complaint at consumerfinance.gov/complaint or by phone at 855-411-2372.