What is the difference between a credit report and a credit score?

- English

- Español

Your credit reports and your credit scores are two different things. A credit report is a statement that has information about your credit activity and current credit situation such as loan paying history and the status of your credit accounts. Your credit scores are calculated based on the information in your credit report.

Your credit score, as well as the information on your credit report, are important for determining whether you’ll be able to get a mortgage, credit card, auto loan, or other credit product, and the rate you’ll pay. Your credit scores are calculated based on the information in your credit report.

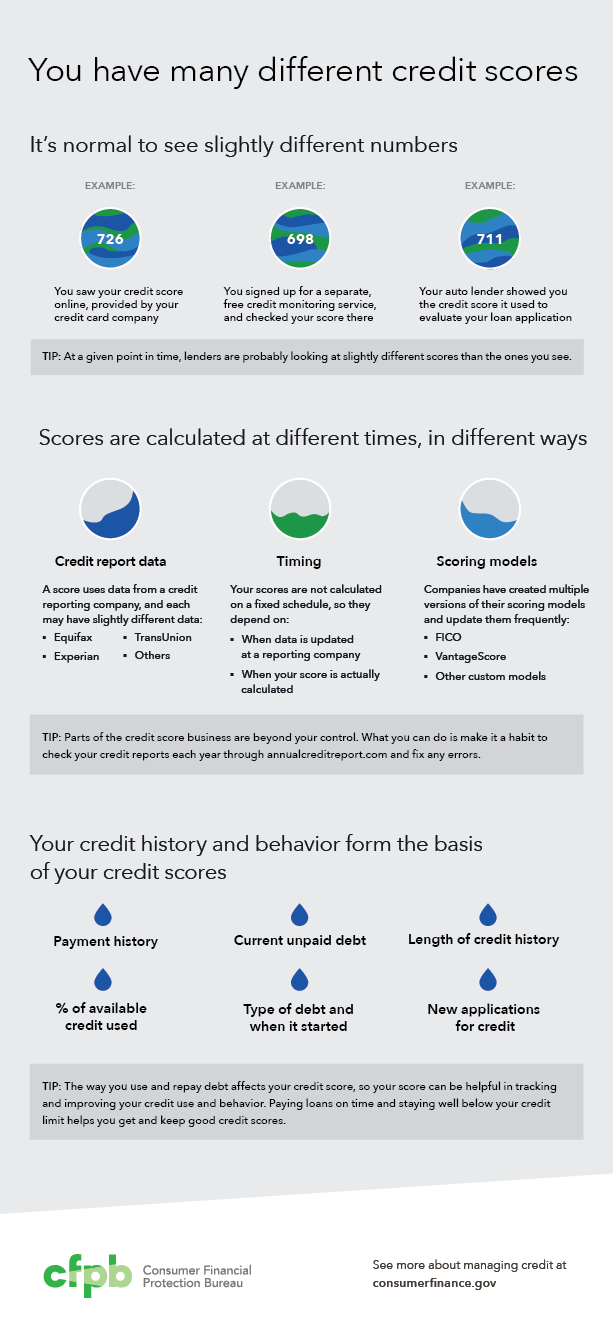

You have many different credit scores, and there are many ways to get a credit score. Your score can differ depending on which credit reporting agency provided the information, the scoring model, the type of loan product, and even the day when it was calculated. Higher scores reflect a better loan paying history and make you eligible for lower interest rates.

Errors on your credit report can reduce your score artificially - which could mean a higher interest rate and less money in your pocket - so it is important to check your credit report and correct any errors well before you apply for a loan.