CFPB structure

Learn more about the divisions and organizational structure of the CFPB.

Last updated July 18, 2025

Russell Vought, Acting Director

(Position is required by the Dodd-Frank Act )

Office of the Director

The Chief Operating Officer also reports to the Deputy Director.

Chief of Staff

Vacant

Deputy Chief of Staff

Jocelyn Sutton

Executive Secretary

Vacant

Legislative Affairs

Kellie Larkin, Staff Director

Office of Policy Planning and Strategy

Vacant, Assistant Director

Office of Civil Rights

Melissa Brand, Assistant Director

(Office and position are required under the Elijah E. Cummings Act and EEOC regulations )

Office of Fair Lending & Equal Opportunity

Frank Vespa-Papaleo, Assistant Director

(Position is required by the Dodd-Frank Act )

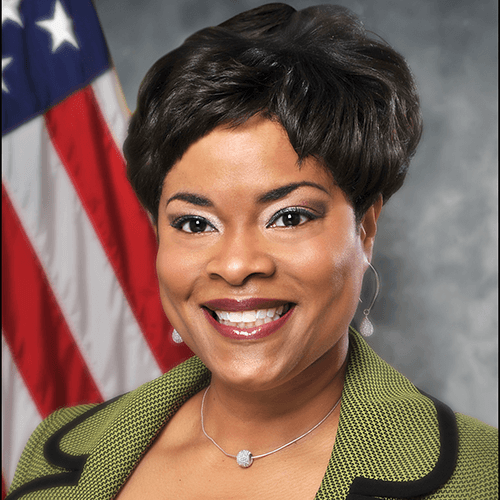

Office of Minority & Women Inclusion (OMWI)

Stacie Jones, Assistant Director

(Position is required by the Dodd-Frank Act )

Divisions

Divisions at the CFPB report directly to the Office of the Director, except for the Operations Division, which reports to the Deputy Director.

Operations is the operational support arm of the CFPB. The Chief Operating Officer reports to the Deputy Director.

Chief Operating Officer

Adam Martinez

Deputy Chief Operating Officer

Jean Chang

Division offices: Operations

Office of Administrative Operations

Martin Michalosky, Chief Administrative Officer

Office of Human Capital

Adam Martinez, Acting Chief Human Capital Officer

Office of the Chief Data Officer

Vacant

Office of Finance and Procurement

Jafnar Gueye, Assistant Director

Office of Technology and Innovation

Chris Chilbert, Chief Information Officer

Associate Director

Chris Johnson

Deputy Associate Director

Darian Dorsey

Division offices: Consumer Response and Education

Office of Consumer Response

Vacant, Assistant Director

Office of Financial Education

Vacant, Assistant Director

Associate Director

Vacant

Deputy Associate Director

LaShaun Warren

Division offices: External Affairs

Office of Communications

Vacant, Assistant Director

Office of Intergovernmental Affairs

Vacant, Assistant Director

Office of Private Sector Engagement

Tricia Kerney-Willis, Assistant Director

Office of Public Engagement

Vacant, Assistant Director

General Counsel

Vacant

Division offices: Legal

Office of General Law & Ethics

Sonya White, Deputy General Counsel

Office of Law & Policy

Vacant, Deputy General Counsel

Office of Litigation

Vacant, Deputy General Counsel

Office of Oversight

Vacant, Deputy General Counsel

Supervision Director

Vacant

Division offices: Supervision

Office of Supervision Policy and Operations

Cassandra Huggins, Principal Deputy Assistant Director

Office of Supervision Examinations

Calvin Hagins, Principal Deputy Assistant Director

Enforcement Director

Vacant

Principal Deputy Enforcement Director

Vacant

Associate Director

Vacant

Deputy Associate Director

Janis K. Pappalardo

Deputy Associate Director

Dan Sokolov

Research, Monitoring & Regulations: Division Offices - Research, Regulations, Competition & Innovation

Office of Research

Jason Brown, Assistant Director

Office of Regulations

Vacant, Assistant Director

Office of Competition and Innovation

Ann Epstein, Assistant Director

Research, Monitoring & Regulations: Office of Markets

Consumer Credit, Payments and Deposits Markets

Vacant, Principal Assistant Director

Mortgage Markets

Vacant, Assistant Director

Small Business Lending Markets

Vacant, Assistant Director

Research, Monitoring & Regulations: Office of Consumer Populations

Consumer Populations

Desmond Brown, Principal Assistant Director

Community Affairs

Daniel Dodd-Ramirez, Assistant Director

Service Members

Jim Rice, Assistant Director

Older Americans

Deborah Royster, Assistant Director

Students and Young Consumers

Vacant, Assistant Director

Office of the Ombudsman

This office is not part of any CFPB division or the Office of the Director.

Ombudsman

Wendy Kamenshine

The CFPB Ombudsman’s Office provides an independent, impartial, and confidential resource to informally assist individuals, companies, consumer and trade groups, and others in resolving process issues with the CFPB.

(Position is required by the Dodd-Frank Act )