Office of Research blog: Credit score transitions during the COVID-19 pandemic

Many households found that their financial fortunes changed during the pandemic, and these changes were often reflected in their credit scores. A recent CFPB analysis found that the distribution of credit scores shifted upward during the pandemic, suggesting that pandemic-era mortgage forbearances, the federal student loan repayment pauses, and federal cash transfers that improved some consumers’ financial wellbeing drove the overall increases in credit scores.1 In this blog, we analyze increases in scores by looking at credit score tiers, labeling consumer credit scores as deep subprime, subprime, near-prime, prime, or superprime. These tiers are important to study because many lenders use them to make loan decisions and set the terms of credit. A higher credit score tier can allow a consumer access to more and cheaper credit, holding all else equal. We found that the deep subprime and subprime tiers experienced the biggest upward shift, though individuals in higher credit score tiers were also more likely to move up at least one tier than they were before the pandemic. Forty-three percent of consumers with subprime credit scores moved up at least one tier during the pandemic, whereas in the ten years prior to the pandemic, only 37 percent moved up at least one tier.

We used data available to the CFPB to examine the transitions of consumers across credit score tiers using a commercially available credit score. The data are quarterly snapshots from June 2010 through June 2022 of the Consumer Credit Panel (CCP). The CCP is a 1-in-48 deidentified longitudinal sample of credit records from one of the nationwide consumer reporting agencies. We assigned consumers to five credit score bins as in other CFPB work characterizing borrower risk profiles: Deep Subprime (300-579); Subprime (580-619); Near-prime (620-659); Prime (660-719); and Superprime (720-850). For each quarter of the CCP through June 2021, we assigned consumers a credit score bin reflecting their credit score, and a score bin reflecting their credit score 12 months in the future. The figures display these 12-month transitions between score bins. Each number represents the percent share of consumers who have transitioned to a particular credit score bin, aggregated across all quarters of the CCP separately by the pre-pandemic and pandemic periods.2 The pre-pandemic era includes consumers in quarters from June 2010 through December 2019 and the pandemic-era includes consumers in quarters from March 2020 through June 2021.

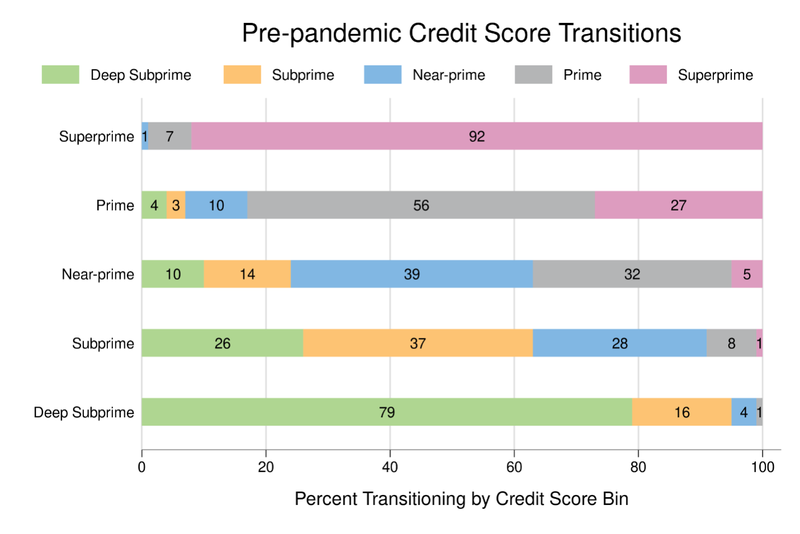

Figure 1: Pre-pandemic Credit Score Transitions

Source: Authors’ calculations from the Consumer Credit Panel. Each bar represents consumers with credit scores in the tier listed on the left-hand-side and provides the share that transitioned to a new tier or remained in their original tier twelve months later. The pre-pandemic period includes consumers’ credit scores between June 2010 and December 2019.

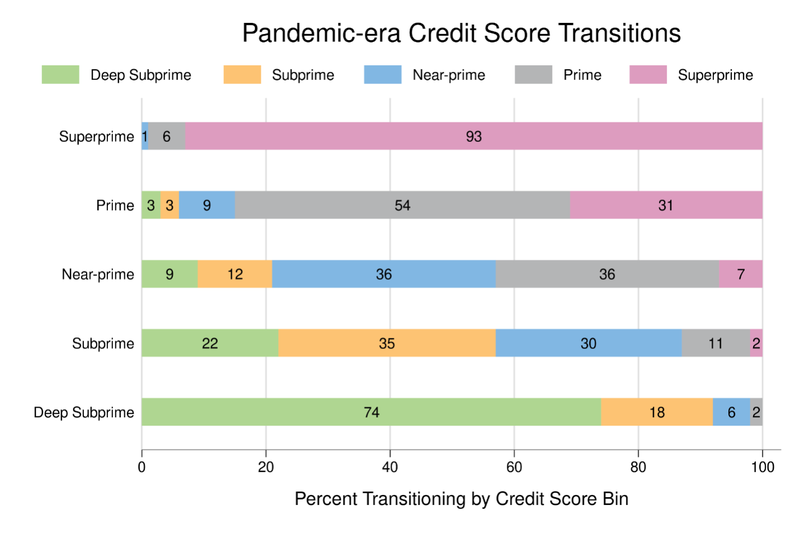

Figure 2: Pandemic-era Credit Score Transitions

Source: Authors’ calculations from the Consumer Credit Panel. Each bar represents consumers with credit scores in the tier listed on the left-hand-side and provides the share that transitioned to a new tier or remained in their original tier twelve months later. The pandemic era includes consumers’ credit scores between March 2020 through June 2021.

The figures compare consumer mobility across credit score tiers before and during the pandemic. Each bar represents the distribution of credit score tiers for consumers who were in the credit score tier labeled on the left-hand side 12 months prior. For example, in the pre-pandemic period, 79 percent of consumers who had deep subprime credit scores were in the same credit score bin one year later. The remaining 21 percent of these consumers moved to higher credit score bins, with 16 percent moving to the subprime credit score tier, four percent moving to the near-prime tier, and one percent moving to the prime tier. Transitions out of the deep subprime tier became more common during the pandemic, with only 74 percent of consumers remaining in that tier one year later. Transitions to the subprime, near-prime, and prime tiers were more common.

Transitions out of the subprime credit score tier also became more common during the pandemic. Before the pandemic, 37 percent of consumers with subprime credit scores remained in the subprime tier after one year, and 26 percent fell to the deep subprime tier. These shares fell to 35 percent and 22 percent, respectively, after the pandemic. Furthermore, the share of consumers transitioning to the near-prime tier increased from 28 percent to 30 percent; to the prime tier, eight percent to 11 percent; and, to the super-prime tier, from one percent to two percent.

Though the changes are less stark than for borrowers with subprime credit scores, consumers with near-prime, prime, or superprime credit scores were also less likely to transition to a lower credit score tier during the pandemic. Of consumers with near-prime credit scores, 24 percent transitioned to a lower tier before the pandemic, compared to 21 percent after. These shares were 17 percent and 15 percent for consumers with prime credit scores, and eight percent and seven percent for consumers with superprime credit scores. Transitions into higher credit score tiers also became more common. Thirty-seven percent of consumers with near-prime credit scores moved to a prime or superprime credit score before the pandemic, while 43 percent of these consumers improved their credit score tier during the pandemic. The share of consumers with prime credit scores that transitioned to superprime increased from 27 percent before the pandemic to 31 percent during the pandemic.

The improvements in consumer credit scores during the pandemic were driven by consumers with deep subprime and subprime credit scores, but consumers in every credit score tier were more likely to transition to a higher tier and less likely to transition to a lower tier than before. Notably, the falling share of consumers with deep subprime and subprime credit scores was not only due to transitions out of these tiers, but also because of reduced rates of transition into these tiers.

Given the importance of prime credit scores in accessing lower-cost auto loans, mortgages, and other credit products, the increasing number of transitions out of subprime credit score bins sheds light on one factor that led to increased access to credit during the pandemic. However, given rapidly rising prices for goods purchased on credit—especially cars and housing—a higher credit score may not be enough to offset rising costs. Longer loan terms may lower payments at the cost of paying more interest, but some consumers are still priced out.

The views expressed here are those of the authors and do not necessarily reflect the views of the Consumer Financial Protection Bureau. Links or citations in this post do not constitute an endorsement by the Bureau.