Appendix H to Part 1026 — Closed-End Model Forms and Clauses

H-1 Credit Sale Model Form (§ 1026.18)

H-2 Loan Model Form (§ 1026.18)

H-3 Amount Financed Itemization Model Form (§ 1026.18(c))

H-4(A) Variable-Rate Model Clauses (§ 1026.18(f)(1))

H-4(B) Variable-Rate Model Clauses (§ 1026.18(f)(2))

H-4(C) Variable-Rate Model Clauses (§ 1026.19(b))

H-4(D)(1) Adjustable-Rate Mortgage Model Form (§ 1026.20(c))

H-4(D)(2) Adjustable-Rate Mortgage Sample Form (§ 1026.20(c))

H-4(D)(3) Adjustable-Rate Mortgage Model Form (§ 1026.20(d))

H-4(D)(4) Adjustable-Rate Mortgage Sample Form (§ 1026.20(d))

H-4(E) Fixed-Rate Mortgage Interest Rate and Payment Summary Model Clause (§ 1026.18(s))

H-4(F) Adjustable-Rate Mortgage or Step-Rate Mortgage Interest Rate and Payment Summary Model Clause (§ 1026.18(s))

H-4(G) Mortgage with Negative Amortization Interest Rate and Payment Summary Model Clause (§ 1026.18(s))

H-4(H) Fixed-Rate Mortgage with Interest-Only Interest Rate and Payment Summary Model Clause (§ 1026.18(s))

H-4(I) Adjustable-Rate Mortgage Introductory Rate Disclosure Model Clause (§ 1026.18(s)(2)(iii))

H-4(J) Balloon Payment Disclosure Model Clause (§ 1026.18(s)(5))

H-5 Demand Feature Model Clauses (§ 1026.18(i))

H-6 Assumption Policy Model Clause (§ 1026.18(q))

H-7 Required Deposit Model Clause (§ 1026.18(r))

H-8 Rescission Model Form (General) (§ 1026.23)

H-9 Rescission Model Form (Refinancing (with Original Creditor)) (§ 1026.23)

H-10 Credit Sale Sample

H-11 Installment Loan Sample

H-12 Refinancing Sample

H-13 Closed-End Transaction With Demand Feature Sample

H-14 Variable-Rate Mortgage Sample (§ 1026.19(b))

H-15 Closed-End Graduated-Payment Transaction Sample

H-16 Mortgage Sample

H-17(A) Debt Suspension Model Clause

H-17(B) Debt Suspension Sample

H-18 Private Education Loan Application and Solicitation Model Form

H-19 Private Education Loan Approval Model Form

H-20 Private Education Loan Final Model Form

H-21 Private Education Loan Application and Solicitation Sample

H-22 Private Education Loan Approval Sample

H-23 Private Education Loan Final Sample

H-24(A) Mortgage Loan Transaction Loan Estimate - Model Form

H-24(B) Mortgage Loan Transaction Loan Estimate - Fixed Rate Loan Sample

H-24(C) Mortgage Loan Transaction Loan Estimate - Interest Only Adjustable Rate Loan Sample

H-24(D) Mortgage Loan Transaction Loan Estimate - Refinance Sample

H-24(E) Mortgage Loan Transaction Loan Estimate - Balloon Payment Sample

H-24(F) Mortgage Loan Transaction Loan Estimate - Negative Amortization Sample

H-24(G) Mortgage Loan Transaction Loan Estimate - Modification to Loan Estimate for Transaction Not Involving Seller - Model Form

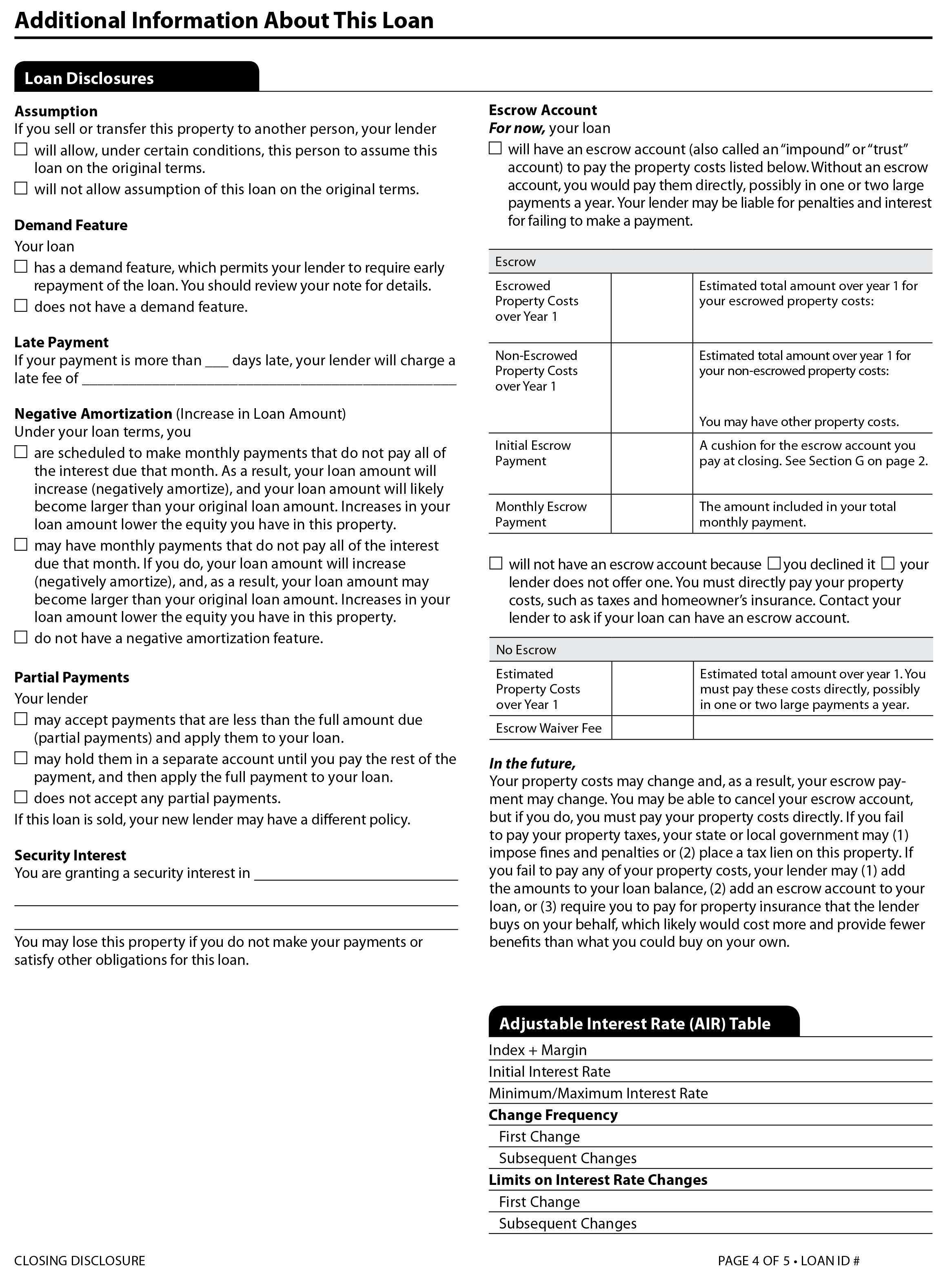

H-25(A) Mortgage Loan Transaction Closing Disclosure - Model Form

H-25(B) Mortgage Loan Transaction Closing Disclosure - Fixed Rate Loan Sample

H-25(C) Mortgage Loan Transaction Closing Disclosure - Borrower Funds From Second-Lien Loan in Summaries of Transactions Sample

H-25(D) Mortgage Loan Transaction Closing Disclosure - Borrower Satisfaction of Seller's Second-Lien Loan Outside of Closing in Summaries of Transactions Sample

H-25(E) Mortgage Loan Transaction Closing Disclosure - Refinance Transaction Sample

H-25(F) Mortgage Loan Transaction Closing Disclosure - Refinance Transaction Sample (amount in excess of § 1026.19(e)(3))

H-25(G) Mortgage Loan Transaction Closing Disclosure - Refinance Transaction With Cash From Consumer at Consummation Sample

H-25(H) Mortgage Loan Transaction Closing Disclosure - Modification to Closing Cost Details - Model Form

H-25(I) Mortgage Loan Transaction Closing Disclosure - Modification to Closing Disclosure for Disclosure Provided to Seller - Model Form

H-25(J) Mortgage Loan Transaction Closing Disclosure - Modification to Closing Disclosure for Transaction Not Involving Seller - Model Form

H-26 Mortgage Loan Transaction - Pre-Loan Estimate Statement - Model Form

H-27(A) Mortgage Loan Transaction - Written List of Providers - Model Form

H-27(B) Mortgage Loan Transaction - Sample of Written List of Providers

H-27(C) Mortgage Loan Transaction - Sample of Written List of Providers with Services You Cannot Shop For

H-28(A) Mortgage Loan Transaction Loan Estimate - Spanish Language Model Form

H-28(B) Mortgage Loan Transaction Loan Estimate - Spanish Language Purchase Sample

H-28(C) Mortgage Loan Transaction Loan Estimate - Spanish Language Refinance Sample

H-28(D) Mortgage Loan Transaction Loan Estimate - Spanish Language Balloon Payment Sample

H-28(E) Mortgage Loan Transaction Loan Estimate - Spanish Language Negative Amortization Sample

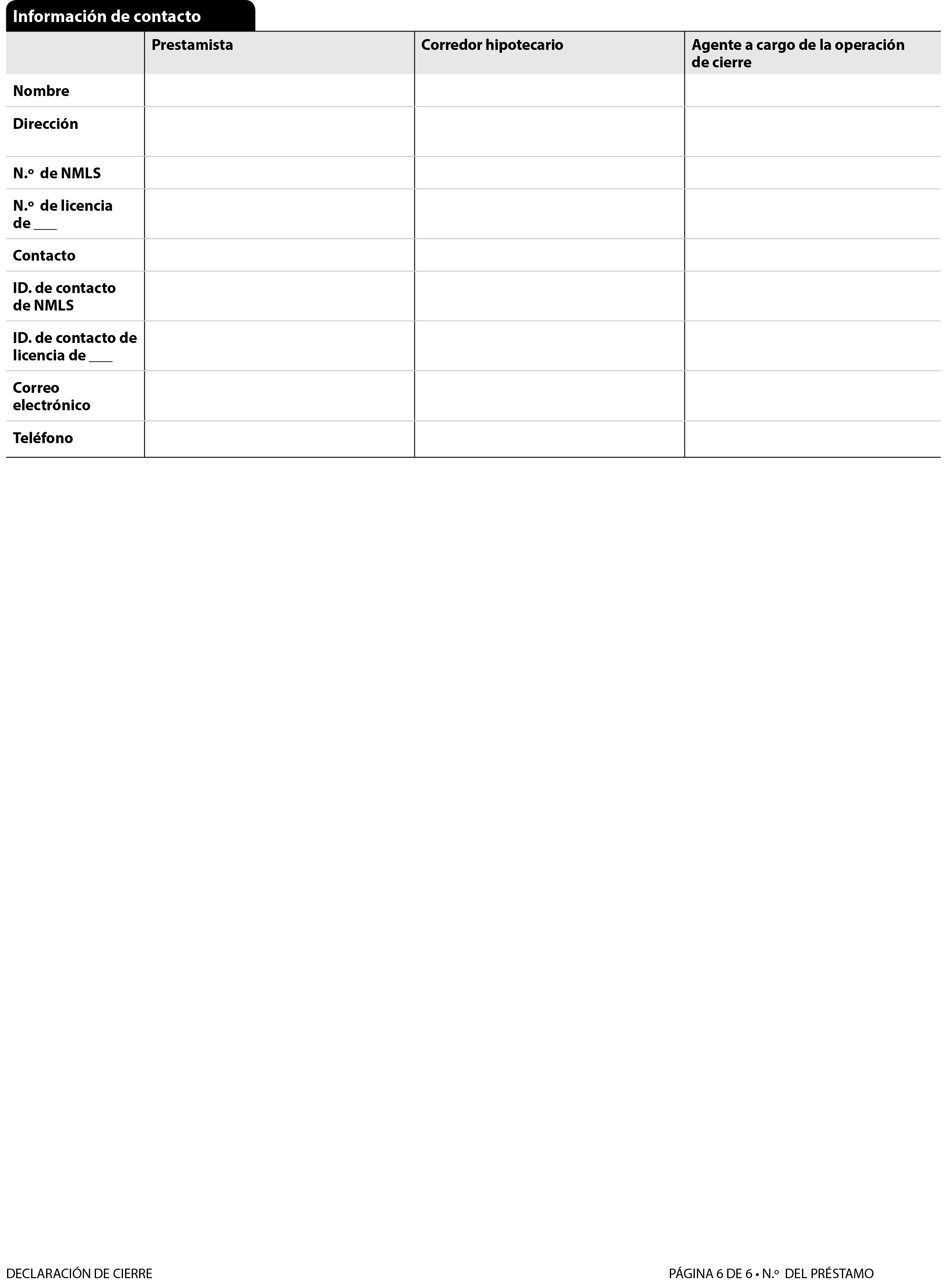

H-28(F) Mortgage Loan Transaction Closing Disclosure - Spanish Language Model Form

H-28(G) Mortgage Loan Transaction Closing Disclosure - Spanish Language Purchase Sample

H-28(H) Mortgage Loan Transaction Closing Disclosure - Spanish Language Refinance Sample

H-28(I) Mortgage Loan Transaction Loan Estimate - Modification to Loan Estimate for Transaction Not Involving Seller - Spanish Language Model Form

H-28(J) Mortgage Loan Transaction Closing Disclosure - Modification to Closing Disclosure for Transaction Not Involving Seller - Spanish Language Model Form

H-29 Escrow Cancellation Notice Model Form (§ 1026.20(e))

H-30(A) Sample Form of Periodic Statement (§ 1026.41)

H-30(B) Sample Form of Periodic Statement with Delinquency Box (§ 1026.41)

H-30(C) Sample Form of Periodic Statement for a Payment-Option Loan (§ 1026.41)

H-30(D) Sample Clause for Homeownership Counselor Contact Information (§ 1026.41)

H-30(E) Sample Form of Periodic Statement for Consumer in Chapter 7 or Chapter 11 Bankruptcy

H-30(F) Sample Form of Periodic Statement for Consumer in Chapter 12 or Chapter 13 Bankruptcy

H-1—Credit Sale Model Form

H-2—Loan Model Form

H-3—Amount Financed Itemization Model Form

Itemization of Amount Financed of $

$__________ Amount given to you directly

$__________ Amount paid on your account

Amount paid to others on your behalf

$__________ to [public officials] [credit bureau] [appraiser] [insurance company]

$__________ to (name of another creditor)

$__________ to (other)

$__________ Prepaid finance charge

H-4(A)—Variable-Rate Model Clauses

The annual percentage rate may increase during the term of this transaction if:

[the prime interest rate of (creditor) increases.]

[the balance in your deposit account falls below $___________.]

[you terminate your employment with (employer) .]

[The interest rate will not increase above ___________%.]

[The maximum interest rate increase at one time will be ___________%.]

[The rate will not increase more than once every (time period) .]

Any increase will take the form of:

[higher payment amounts.]

[more payments of the same amount.]

[a larger amount due at maturity.]

EXAMPLE BASED ON THE SPECIFIC TRANSACTION.

[If the interest rate increases by ___________% in (time period),

[your regular payments will increase to $___________.]

[you will have to make ___________ additional payments.]

[your final payment will increase to $___________.]]

EXAMPLE BASED ON A TYPICAL TRANSACTION.

[If your loan were for $___________ at ___________% for (term) and the rate increased to ___________% in (time period),

[your regular payments would increase by $___________.]

[you would have to make ___________ additional payments.]

[your final payment would increase by $___________.]]

H-4(B)—Variable-Rate Model Clauses

Your loan contains a variable-rate feature. Disclosures about the variable-rate feature have been provided to you earlier.

[H-4(C) - Variable Rate Model Clauses

This disclosure describes the features of the adjustable-rate mortgage (ARM) program you are considering. Information on other ARM programs is available upon request.

How Your Interest Rate and Payment Are Determined

• Your interest rate will be based on [an index plus a margin] [a formula].

• Your payment will be based on the interest rate, loan balance, and loan term.

- [The interest rate will be based on (identification of index) plus our margin. Ask for our current interest rate and margin.] - [The interest rate will be based on (identification of formula). Ask us for our current interest rate.] - Information about the index [formula for rate adjustments] is published [can be found] ___ - [The initial interest rate is not based on the (index) (formula) used to make later adjustments. Ask us for the amount of current interest rate discounts.]

How Your Interest Rate Can Change

• Your interest rate can change (frequency).

• [Your interest rate cannot increase or decrease more than __ percentage points at each adjustment.]

• Your interest rate cannot increase [or decrease] more than __ percentage points over the term of the loan.

How Your Payment Can Change

• Your payment can change (frequency) based on changes in the interest rate.

• [Your payment cannot increase more than (amount or percentage) at each adjustment.]

• [You will be notified at least 210, but no more than 240, days before first payment at the adjusted level is due after the initial interest rate adjustment of the loan. This notice will contain information about the adjustment, including the interest rate, payment amount, and loan balance.]

• [You will be notified at least 60, but no more than 120, days before first payment at the adjusted level is due after any interest rate adjustment resulting in a corresponding payment change. This notice will contain information about the adjustment, including the interest rate, payment amount, and loan balance.]

• [For example, on a $10,000 [term] loan with an initial interest rate of __ [(the rate shown in the interest rate column below for the year 19 __)] [(in effect (month) (year)], the maximum amount that the interest rate can rise under this program is __ percentage points, to __%, and the monthly payment can rise from a first-year payment of $__ to a maximum of $__ in the __ year. To see what your payments would be, divide your mortgage amount by $10,000; then multiply the monthly payment by that amount. (For example, the monthly payment for a mortgage amount of $60,000 would be: $60,000 ÷ $10,000 = 6; 6 × __ = $__ per month.)]

[Example

The example below shows how your payments would have changed under this ARM program based on actual changes in the index from 1982 to 1996. This does not necessarily indicate how your index will change in the future.

The example is based on the following assumptions:

| Amount | $10,000. |

| Term | - - . |

| Change date | - - . |

| Payment adjustment | (frequency). |

| Interest adjustment | (frequency). |

| [Margin] * | - - . |

| Caps __ [periodic interest rate cap]. | |

| __ [lifetime interest rate cap. | |

| __ [payment cap]. | |

| [Interest rate carryover]. | |

| [Negative amortization]. | |

| [Interest rate discount].** | |

| Index(identification of index or formula). | |

* This is a margin we have used recently, your margin may be different. ** This is the amount of a discount we have provided recently; your loan may be discounted by a different amount.]

| Year | Index (%) | Margin (percentage points) | Interest rate (%) | Monthly payment ($) | Remaining balance ($) |

|---|---|---|---|---|---|

| 1982 | |||||

| 1983 | |||||

| 1984 | |||||

| 1985 | |||||

| 1986 | |||||

| 1987 | |||||

| 1988 | |||||

| 1989 | |||||

| 1990 | |||||

| 1991 | |||||

| 1992 | |||||

| 1993 | |||||

| 1994 | |||||

| 1995 | |||||

| 1996 |

Note: To see what your payments would have been during that period, divide your mortgage amount by $10,000; then multiply the monthly payment by that amount. (For example, in 1996 the monthly payment for a mortgage amount of $60,000 taken out in 1982 would be: $60,000 ÷ $10,000 = 6; 6 × __ = $__ per month.)

H-4(D)(1) Adjustable-Rate Mortgage Model Form for § 1026.20(c)

H-4(D)(2) Sample Form for § 1026.20(c)

H-4(D)(3) Model Form for § 1026.20(d)

H-4(D)(4) Sample Form for § 1026.20(d)

H-4(E) Fixed Rate Mortgage Interest Rate and Payment Summary Model Clause

H-4(F) Adjustable-Rate Mortgage or Step-Rate Mortgage Interest Rate and Payment Summary Model Clause

H-4(G) Mortgage with Negative Amortization Interest Rate and Payment Summary Model Clause

H-4(H) Fixed Rate Mortgage with Interest Only Interest Rate and Payment Summary Model Clause

H-4(I) - Introductory Rate Model Clause

[Introductory Rate Notice

You have a discounted introductory rate of ____ % that ends after (period).

In the (period in sequence), even if market rates do not change, this rate will increase to __ %.]

H-4(J) - Balloon Payment Model Clause

[Final Balloon Payment due (date): $______]

H-4(K) - “No-Guarantee-to-Refinance” Statement Model Clause

There is no guarantee that you will be able to refinance to lower your rate and payments.

H-5–Demand Feature Model Clauses

This obligation [is payable on demand.]

[has a demand feature.]

[All disclosures are based on an assumed maturity of one year.]

H-6–Assumption Policy Model Clause

Assumption: Someone buying your house [may, subject to conditions, be allowed to] [cannot] assume the remainder of the mortgage on the original terms.

H-7–Required Deposit Model Clause

The annual percentage rate does not take into account your required deposit.

H-8—Rescission Model Form (General)

H-9 - Rescission Model Form (Refinancing With Original Creditor)

NOTICE OF RIGHT TO CANCEL

Your Right To Cancel

You are entering into a new transaction to increase the amount of credit previously provided to you. Your home is the security for this new transaction. You have a legal right under Federal law to cancel this new transaction, without cost, within three business days from whichever of the following events occurs last:

(1) the date of this new transaction, which is ______; or

(2) the date you received your new Truth in Lending disclosures; or

(3) the date you received this notice of your right to cancel.

If you cancel this new transaction, it will not affect any amount that you presently owe. Your home is the security for that amount. Within 20 calendar days after we receive your notice of cancellation of this new transaction, we must take the steps necessary to reflect the fact that your home does not secure the increase of credit. We must also return any money you have given to us or anyone else in connection with this new transaction.

You may keep any money we have given you in this new transaction until we have done the things mentioned above, but you must then offer to return the money at the address below.

If we do not take possession of the money within 20 calendar days of your offer, you may keep it without further obligation.

How To Cancel

If you decide to cancel this new transaction, you may do so by notifying us in writing, at

__

(Creditor's name and business address).

You may use any written statement that is signed and dated by you and states your intention to cancel, or you may use this notice by dating and signing below. Keep one copy of this notice because it contains important information about your rights.

If you cancel by mail or telegram, you must send the notice no later than midnight of

__

(Date)__

(or midnight of the third business day following the latest of the three events listed above).

If you send or deliver your written notice to cancel some other way, it must be delivered to the above address no later than that time.

I WISH TO CANCEL

Consumer's Signature__

Date__

H-10—Credit Sale Sample

![image-H-10

H-11—Installment Loan Sample

![image-H-11

H-12—Refinancing Sample

![image-H-12

H-13—Closed-End Transaction with Demand Feature Sample

![image-H-13

H-14 - Variable Rate Mortgage Sample

This disclosure describes the features of the adjustable-rate mortgage (ARM) program you are considering. Information on other ARM programs is available upon request.

How Your Interest Rate and Payment Are Determined

• Your interest rate will be based on an index rate plus a margin.

• Your payment will be based on the interest rate, loan balance, and loan term.

-

Information about the index rate is published weekly in the Wall Street Journal.

• Your interest rate will equal the index rate plus our margin unless your interest rate “caps” limit the amount of change in the interest rate.

How Your Interest Rate Can Change

• Your interest rate can change yearly.

• Your interest rate cannot increase or decrease more than 2 percentage points per year.

• Your interest rate cannot increase or decrease more than 5 percentage points over the term of the loan.

How Your Monthly Payment Can Change

• Your monthly payment can increase or decrease substantially based on annual changes in the interest rate.

• [For example, on a $10,000, 30-year loan with an initial interest rate of 12.41 percent in effect in July 1996, the maximum amount that the interest rate can rise under this program is 5 percentage points, to 17.41 percent, and the monthly payment can rise from a first-year payment of $106.03 to a maximum of $145.34 in the fourth year. To see what your payment is, divide your mortgage amount by $10,000; then multiply the monthly payment by that amount. (For example, the monthly payment for a mortgage amount of $60,000 would be: $60,000 ÷ $10,000 = 6; 6 × 106.03 = $636.18 per month.)]

• [You will be notified at least 210, but no more than 240, days before first payment at the adjusted level is due after the initial interest rate adjustment of the loan. This notice will contain information about the adjustment, including the interest rate, payment amount, and loan balance.]

• [You will be notified at least 60, but no more than 120, days before first payment at the adjusted level is due after any interest rate adjustment resulting in a corresponding payment change. This notice will contain information about the adjustment, including the interest rate, payment amount, and loan balance.]

[Example

The example below shows how your payments would have changed under this ARM program based on actual changes in the index from 1982 to 1996. This does not necessarily indicate how your index will change in the future. The example is based on the following assumptions:

| Amount | $10,000. |

| Term | 30 years. |

| Payment adjustment | 1 year. |

| Interest adjustment | 1 year. |

| Margin | 3 percentage points. |

| Caps 2 percentage points annual interest rate. | |

| 5 percentage points lifetime interest rate. | |

| Index Weekly average yield on U.S. Treasury securities adjusted to a constant maturity of one year. | |

| Year (as of 1st week ending in July) | Index | Margin * (percentage points) | Interest rate (%) | Monthly payment ($) | Remaining balance ($) |

|---|---|---|---|---|---|

| 1982 | 14.41 | 3 | 17.41 | 145.90 | 9,989.37 |

| 1983 | 9.78 | 3 | * * 15.41 | 129.81 | 9,969.66 |

| 1984 | 12.17 | 3 | 15.17 | 127.91 | 9,945.51 |

| 1985 | 7.66 | 3 | ** 13.17 | 112.43 | 9,903.70 |

| 1986 | 6.36 | 3 | *** 12.41 | 106.73 | 9,848.94 |

| 1987 | 6.71 | 3 | *** 12.41 | 106.73 | 9,786.98 |

| 1988 | 7.52 | 3 | *** 12.41 | 106.73 | 9,716.88 |

| 1989 | 7.97 | 3 | *** 12.41 | 106.73 | 9,637.56 |

| 1990 | 8.06 | 3 | *** 12.41 | 106.73 | 9,547.83 |

| 1991 | 6.40 | 3 | *** 12.41 | 106.73 | 9,446.29 |

| 1992 | 3.96 | 3 | *** 12.41 | 106.73 | 9,331.56 |

| 1993 | 3.42 | 3 | *** 12.41 | 106.73 | 9,201.61 |

| 1994 | 5.47 | 3 | *** 12.41 | 106.73 | 9,054.72 |

| 1995 | 5.53 | 3 | *** 12.41 | 106.73 | 8,888.52 |

| 1996 | 5.82 | 3 | *** 12.41 | 106.73 | 8,700.37 |

* This is a margin we have used recently; your margin may be different. ** This interest rate reflects a 2 percentage point annual interest rate cap. *** This interest rate reflects a 5 percentage point lifetime interest rate cap.

Note:

To see what your payments would have been during that period, divide your mortgage amount by $10,000; then multiply the monthly payment by that amount. (For example, in 1996 the monthly payment for a mortgage amount of $60,000 taken out in 1982 would be: $60,000 ÷ $10,000 = 6; 6 × $106.73 = $640.38.)]

• [You will be notified at least 210, but no more than 240, days before first payment at the adjusted level is due after the initial interest rate adjustment of the loan. This notice will contain information about the adjustment, including the interest rate, payment amount, and loan balance.]

• [You will be notified at least 60, but no more than 120, days before first payment at the adjusted level is due after any interest rate adjustment resulting in a corresponding payment change. This notice will contain information about the adjustment, including the interest rate, payment amount, and loan balance.]

H-15 Closed-End Graduated Payment Transaction Sample

H-16—Mortgage Sample

H-17(A) Debt Suspension Model Clause

Please enroll me in the optional [insert name of program], and bill my account the fee of [insert charge for the initial term of coverage]. I understand that enrollment is not required to obtain credit. I also understand that depending on the event, the protection may only temporarily suspend my duty to make minimum payments, not reduce the balance I owe. I understand that my balance will actually grow during the suspension period as interest continues to accumulate.

[To Enroll, Sign Here]/[To Enroll, Initial Here].

X__

[H-17(B) Debt Suspension Sample

Please enroll me in the optional [name of program], and bill my account the fee of $200.00. I understand that enrollment is not required to obtain credit. I also understand that depending on the event, the protection may only temporarily suspend my duty to make minimum payments, not reduce the balance I owe. I understand that my balance will actually grow during the suspension period as interest continues to accumulate.

To Enroll, Initial Here.

X__

H-18—Private Education Loan Application and Solicitation Model Form

H-19—Private Education Loan Approval Model Form

H-20—Private Education Loan Final Model Form

H-21—Private Education Loan Application and Solicitation Sample

H-22—Private Education Loan Approval Sample

H-23—Private Education Loan Final Sample

H-24(A) Mortgage Loan Transaction Loan Estimate - Model Form

Description: This is a blank model Loan Estimate that illustrates the application of the content requirements in § 1026.37. This form provides two variations of page one, four variations of page two, and four variations of page three, reflecting the variable content requirements in § 1026.37.

H-24(B) Mortgage Loan Transaction Loan Estimate - Fixed Rate Loan Sample

Description: This is a sample of a completed Loan Estimate for a fixed rate loan. This loan is for the purchase of property at a sale price of $180,000 and has a loan amount of $162,000, a 30-year loan term, a fixed interest rate of 3.875 percent, and a prepayment penalty equal to 2.00 percent of the outstanding principal balance of the loan for the first two years after consummation of the transaction. The consumer has elected to lock the interest rate. The creditor requires an escrow account and that the consumer pay for private mortgage insurance.

H-24(C) Mortgage Loan Transaction Loan Estimate - Interest Only Adjustable Rate Loan Sample

Description: This is a sample of a completed Loan Estimate for an adjustable rate loan with interest only payments. This loan is for the purchase of property at a sale price of $240,000 and has a loan amount of $211,000 and a 30-year loan term. For the first five years of the loan term, the scheduled payments cover only interest and the loan has an introductory interest rate that is fixed at 4.00 percent. After five years, the payments include principal and the interest rate adjusts every three years based on the value of the Monthly Treasury Average index plus a margin of 4.00 percent. The consumer has elected to lock the interest rate. The creditor does not require an escrow account with the loan. The creditor requires that the consumer pay for private mortgage insurance.

H-24(D) Mortgage Loan Transaction Loan Estimate - Refinance Sample

Description: This is a sample of a completed Loan Estimate for a transaction that is for a refinance of an existing mortgage loan that secures the property, for which the consumer is estimated to receive funds from the transaction. The estimated property value is $180,000, the loan amount is $150,000, the estimated outstanding balance of the existing mortgage loan is $120,000, and the interest rate is 4.25 percent. The consumer has elected to lock the interest rate. The creditor requires an escrow account and that the consumer pay for private mortgage insurance.

H-24(E) Mortgage Loan Transaction Loan Estimate - Balloon Payment Sample

Description: This is a sample of the information required by § 1026.37(a) through (c) for a transaction with a loan term of seven years that includes a final balloon payment.

[H-24(F) Mortgage Loan Transaction Loan Estimate - Negative Amortization Sample

Description: This is a sample of the information required by § 1026.37(a) and (b) for a transaction with negative amortization.

H-24(G) Mortgage Loan Transaction Loan Estimate - Modification to Loan Estimate for Transaction Not Involving Seller - Model Form

Description: This is a blank model Loan Estimate that illustrates the application of the content requirements in § 1026.37, with the optional alternative tables permitted by § 1026.37(d)(2) and (h)(2) for transactions without a seller. This form provides one variation of page one, four variations of page two, and four variations of page three, reflecting the variable content requirements in § 1026.37.

H-25(A) Mortgage Loan Transaction Closing Disclosure - Model Form

Description: This is a blank model Closing Disclosure that illustrates the content requirements in § 1026.38. This form provides three variations of page one, one page two, one page three, four variations of page four, and four variations of page five, reflecting the variable content requirements in § 1026.38. This form does not reflect modifications permitted under § 1026.38(t).

H-25(B) Mortgage Loan Transaction Closing Disclosure - Fixed Rate Loan Sample

Description: This is a sample of a completed Closing Disclosure for the fixed rate loan illustrated by form [H-24(B). The purpose, product, sale price, loan amount, loan term, and interest rate have not changed from the estimates provided on the Loan Estimate. The creditor requires an escrow account and that the consumer pay for private mortgage insurance for the transaction.

H-25(C) Mortgage Loan Transaction Closing Disclosure - Borrower Funds From Second-Lien Loan in Summaries of Transactions Sample

Description: This is a sample of the information required on the Closing Disclosure by § 1026.38(j) for disclosure of consumer funds from a simultaneous second-lien credit transaction not otherwise disclosed pursuant to § 1026.38(j)(2)(iii) or (iv) that is used to finance part of the purchase price of the property subject to the transaction.

H-25(D) Mortgage Loan Transaction Closing Disclosure - Borrower Satisfaction of Seller's Second-Lien Loan Outside of Closing in Summaries of Transactions Sample

Description: This is a sample of the information required on the Closing Disclosure by § 1026.38(j) and (k) for the satisfaction of a junior-lien transaction by the consumer, which was not paid from closing funds.

H-25(E) Mortgage Loan Transaction Closing Disclosure - Refinance Transaction Sample

Description: This is a sample of a completed Closing Disclosure for the refinance transaction illustrated by form [H-24(D). The purpose, loan amount, loan term, and interest rate have not changed from the estimates provided on the Loan Estimate. The outstanding balance of the existing mortgage loan securing the property was less than estimated on the Loan Estimate. The creditor requires an escrow account and that the consumer pay for private mortgage insurance for the transaction.

H-25(F) Mortgage Loan Transaction Closing Disclosure - Refinance Transaction Sample (Amount in Excess of § 1026.19(e)(3))

Description: This is a sample of the completed disclosures required by § 1026.38(e) and (h) for a completed Closing Disclosure for the refinance transaction illustrated by form [H-24(D). The Closing Costs have increased in excess of the good faith requirements of § 1026.19(e)(3) by $200, for which the creditor has provided a refund under § 1026.19(f)(2)(v).

[H-25(G) Mortgage Loan Transaction Closing Disclosure - Refinance Transaction With Cash From Consumer at Consummation

Description: This is a sample of a completed Closing Disclosure for a refinance transaction in which the consumer must pay additional funds to satisfy the existing mortgage loan securing the property and other existing debt to consummate the transaction.

H-25(H) Mortgage Loan Transaction Closing Disclosure - Modification to Closing Cost Details - Model Form

Description: This is a blank model form of the modification to Closing Cost Details permitted by § 1026.38(t)(5)(iv)(B).

H-25(I) Mortgage Loan Transaction Closing Disclosure - Modification to Closing Disclosure for Disclosure Provided to Seller - Model Form

Description: This is a blank model form of the modification permitted by § 1026.38(t)(5)(vi).

H-25(J) Mortgage Loan Transaction Closing Disclosure - Modification to Closing Disclosure for Transaction Not Involving Seller - Model Form

Description: This is a blank model form of the alternative disclosures and modifications permitted by § 1026.38(d)(2), (e), and (t)(5)(vii) for transactions without a seller.

H-26 Mortgage Loan Transaction - Pre-Loan Estimate Statement - Model Form

Description: This is a model of the statement required by § 1026.19(e)(2)(ii) to be stated at the top of the front of the first page of a written estimate of terms or costs specific to a consumer that is provided to a consumer before the consumer receives the disclosures required under § 1026.19(e)(1)(i).

H-27(A) Mortgage Loan Transaction - Written List of Providers - Model Form

Description: This is a blank model form for the written list of settlement service providers required by § 1026.19(e)(1)(vi) and the statement required by § 1026.19(e)(1)(vi)(C) that the consumer may select a settlement service provider that is not on the list.

H-27(B) Mortgage Loan Transaction - Sample of Written List of Providers

Description: This is a sample of the Written List of Providers for the transaction in the sample Loan Estimate illustrated by form [H-24(B).

H-27(C) Mortgage Loan Transaction - Sample of Written List of Providers With Services You Cannot Shop for

Description: This is a sample of the Written List of Providers with information about the providers selected by the creditor for the charges disclosed pursuant to § 1026.37(f)(2).

H-28(A) Mortgage Loan Transaction Loan Estimate - Spanish Language Model Form

Description: This is a blank model Loan Estimate that illustrates the application of the content requirements in § 1026.37, and is translated into the Spanish language as permitted by § 1026.37(o)(5)(ii). This form provides two variations of page one, four variations of page two, and four variations of page three, reflecting the variable content requirements in § 1026.37.

H-28(B) Mortgage Loan Transaction Loan Estimate - Spanish Language Purchase Sample

Description: This is a sample of the Loan Estimate illustrated by form [H-24(C) for a 5 Year Interest Only, 5/3 Adjustable Rate loan, translated into the Spanish language as permitted by § 1026.37(o)(5)(ii).

H-28(C) Mortgage Loan Transaction Loan Estimate - Spanish Language Refinance Sample

Description: This is a sample of the Loan Estimate illustrated by form [H-24(D) for a refinance transaction in which the consumer is estimated to receive funds from the transaction, translated into the Spanish language as permitted by § 1026.37(o)(5)(ii).

H-28(D) Mortgage Loan Transaction Loan Estimate - Spanish Language Balloon Payment Sample

Description: This is a sample of the information required by § 1026.37(a) through (c) for a transaction with a loan term of seven years that includes a final balloon payment illustrated by form [H-24(E), translated into the Spanish language as permitted by § 1026.37(o)(5)(ii).

[H-28(E) Mortgage Loan Transaction Loan Estimate - Spanish Language Negative Amortization Sample

Description: This is a sample of the information required by § 1026.37(a) and (b) for a transaction with negative amortization illustrated by form [H-24(F), translated into the Spanish language as permitted by § 1026.37(o)(5)(ii).

H-28(F) Mortgage Loan Transaction Closing Disclosure - Spanish Language Model Form

Description: This is a blank model Closing Disclosure that illustrates the content requirements in § 1026.38, and is translated into the Spanish language as permitted by § 1026.38(t)(5)(viii). This form provides three variations of page one, one page two, one page three, four variations of page four, four variations of page five, and two variations of page six reflecting the variable content requirements in § 1026.38. This form does not reflect any other modifications permitted under § 1026.38(t).

H-28(G) Mortgage Loan Transaction Closing Disclosure - Spanish Language Purchase Sample

Description: This is a sample of the Closing Disclosure illustrated by form [H-25(B) translated into the Spanish language as permitted by § 1026.38(t)(5)(viii).

H-28(H) Mortgage Loan Transaction Closing Disclosure - Spanish Language Refinance Sample

Description: This is a sample of the Closing Disclosure illustrated by form [H-25(E) translated into the Spanish language as permitted by § 1026.38(t)(5)(viii).

H-28(I) Mortgage Loan Transaction Loan Estimate - Modification to Loan Estimate for Transaction Not Involving Seller - Spanish Language Model Form

Description: This is a blank model Loan Estimate that illustrates form [H-24(G), with the optional alternative disclosures permitted by § 1026.37(d)(2) and (h)(2) for transactions without a seller, translated into the Spanish language as permitted by § 1026.37(o)(5)(ii).

H-28(J) Mortgage Loan Transaction Closing Disclosure - Modification to Closing Disclosure for Transaction Not Involving Seller - Spanish Language Model Form

Description: This is a blank model Closing Disclosure that illustrates form [H-25(J), with the alternative disclosures under § 1026.38(d)(2), (e), and (t)(5)(vii) for transactions without a seller, translated into the Spanish language as permitted by § 1026.38(t)(5)(viii).

H-29 Escrow Cancellation Notice Model Form (§ 1026.20(e))

Description: This is a blank model form of the disclosures required by § 1026.20(e).

H-30(A) Sample Form of Periodic Statement

H-30(B) Sample Form of Periodic Statement with Delinquency Box

H-30(C) Sample Form of Periodic Statement for a Payment-Option Loan (§ 1026.41)

H-30(D) Sample Clause for Homeownership Counselor Contact Information

Housing Counselor Information: If you would like counseling or assistance, you can contact the following:

• U.S. Department of Housing and Urban Development (HUD): For a list of homeownership counselors or counseling organizations in your area, go to http://www.hud.gov/offices/hsg/sfh/hcc/hcs.cfm or call 800-569-4287.

H-30(E) Sample Form of Periodic Statement for Consumer in Chapter 7 or Chapter 11 Bankruptcy

[H-30(F) Sample Form of Periodic Statement for Consumer in Chapter 12 or Chapter 13 Bankruptcy