Your Money, Your Goals

Your Money, Your Goals is a set of financial empowerment materials for organizations that help people meet their financial goals by increasing their knowledge, skills, and resources.

Whether you’re helping people get a job, find a place to live, or deal with a legal problem, money always comes up. You can use these tools to start the conversation.

Resources for the people you serve

Your Money, Your Goals materials can be used in many different settings. If you’re working with people to help set goals and solve financial problems, you’ll find helpful tools and information here.

Toolkit

The toolkit has information that helps you have the money conversation with the people you serve. Use the tools to help achieve goals and work through challenges.

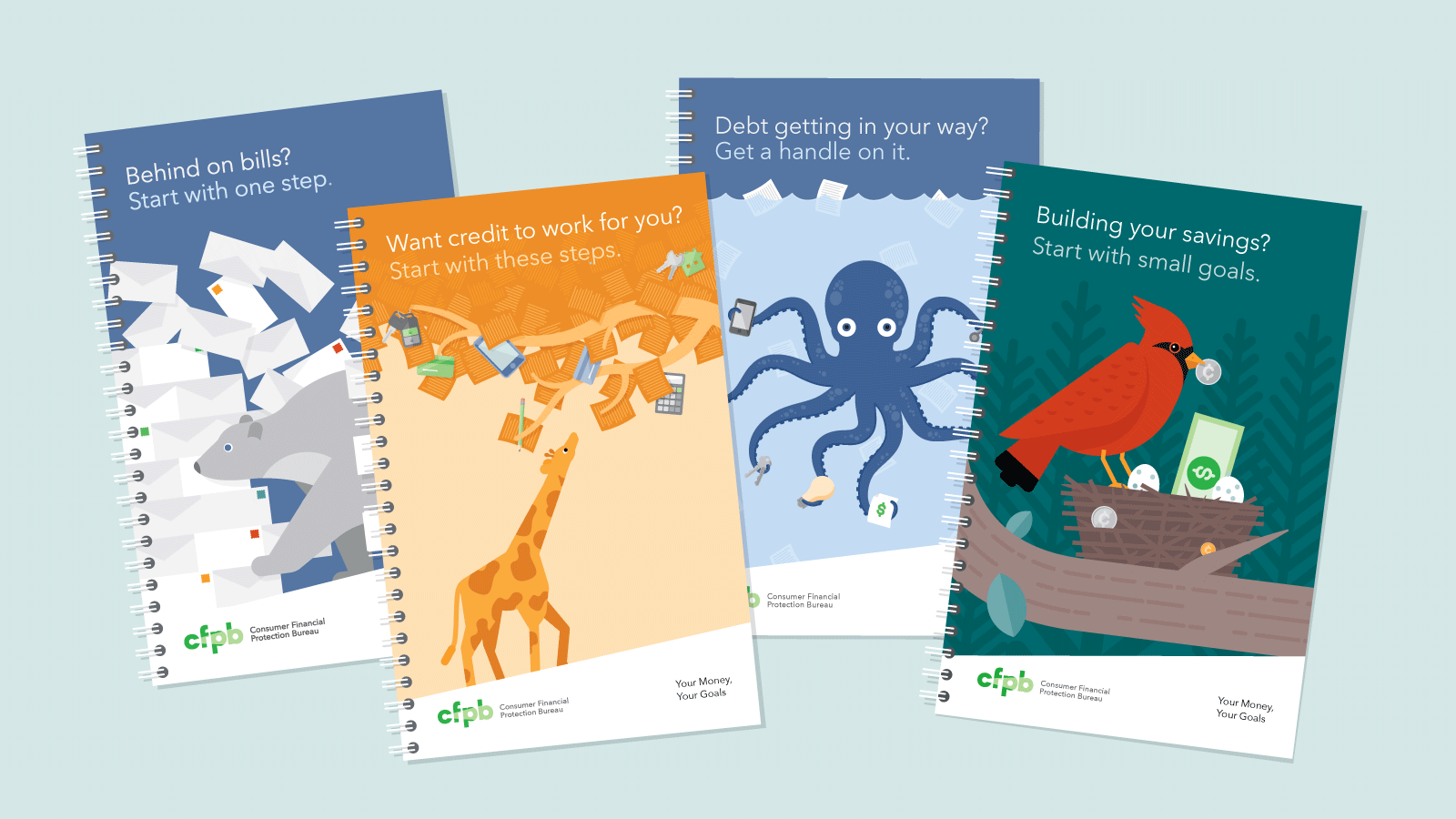

Booklets to help talk about money

Use these bright, interactive booklets to easily help people begin to address common financial stressors.

Companion guides

Companion guides have specific information for populations with unique needs.

Online resources

We've consolidated the websites referenced in the Your Money, Your Goals materials to make them easier to access and share.

Resources for practitioners

Training and implementation

We have everything you need to bring Your Money, Your Goals to your organization. Review our Implementation Guide, watch the trainer videos, adapt the training slides, and you’re on your way.

Videos to spark action

Show these short videos to introduce a topic and connect it to a specific action with our tools and handouts.

Co-brand the booklets

Use the professional print files to add your logo to our booklets and have them printed locally. Or if you need more copies, print them as they are.