How to reduce your debt

- English

- Español

Getting out of debt is possible when you know what you owe and what you can do to repay it. If you’re ready to begin paying down your debt, start with these three steps.

Step one: Understand debt reduction strategies

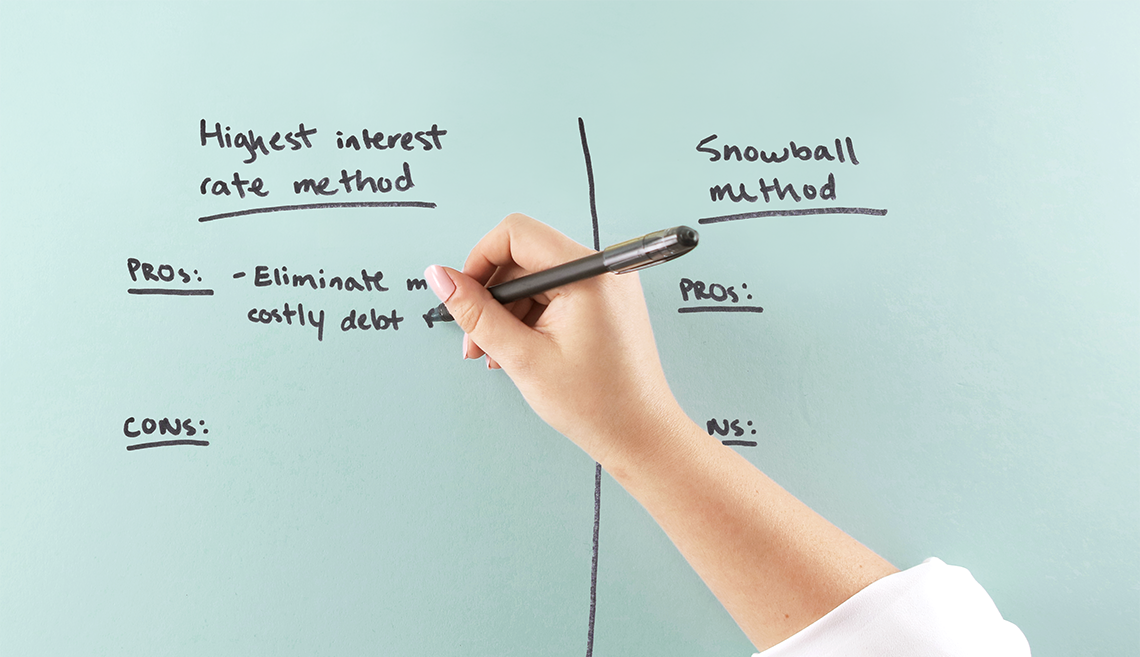

There are two basic strategies that can help you reduce debt: the highest interest rate method and the snowball method.

Highest interest rate method

This approach focuses on your debts like credit card and student loan debts with the highest rate of interest. The goal is to pay off the highest interest rate debt as quickly as possible, because it’s costing you the most. While it may not feel like you’re making progress, this method will help you eliminate your costliest debts first—which can save you money in the long run.

Snowball method

This approach focuses on your smallest debt. The goal is to get rid it as soon as possible. You keep on making the minimum payments on all of your debts, and you put any extra funds you have toward paying off the smallest debt. This will help you pay it off sooner.

Once you’ve paid one smaller debt in full, dedicate that freed up money to the next smallest debt. This way, you create a “snowball” of payments as you eliminate each debt. Unlike the higher interest rate method, you’ll see progress quickly as you pay off smaller debts. However, you may end up paying more in the long run, as you won’t be focusing on the larger or more costly debts.

Step two: Create your debt reduction plan

Download our debt reduction worksheet to put together a strategy that’s right for you. To use the worksheet, you’ll need copies of your bills and interest payment information. If you’re motivated by saving the most money while still paying off your debts, the highest interest rate method might be the right choice for you. However, if you’re motivated by seeing progress quickly, then you may want to consider the snowball method. Choose the strategy that’s best for your situation and put it into action.

Step three: Organize your monthly bills

Understanding what you owe, and when, will help you manage your debt. You can use a bill calendar to keep all your information in one place as you tackle your debt. Use the bill calendar to see all your bills and plan when they’re due. Keeping track of your monthly expenses can help put you one step closer to reaching your goals.

Take control of your finances

The "Get a Handle on Debt" series gives you tools to manage your debt by budgeting smarter, paying your bills on time, tracking your spending, paying down existing debts, and earning extra income. You can also get money management strategies sent directly to your inbox by signing up for our "Get a Handle on Debt" boot camp.

Stay informed

Sign up for the latest financial tips and information right to your inbox.