For many struggling mortgage borrowers with home equity, selling their home could be an alternative to foreclosure

Mortgage servicers are often the first to communicate with struggling homeowners about options available to them to avoid foreclosure. In today’s market, many homeowners, including those potentially facing foreclosure, have sufficient equity in their homes that a traditional sale could be a better alternative to foreclosure. Servicers can remind homeowners that a traditional sale might be one option to avoid foreclosure. Servicers can (and, in many circumstances, are required to) refer homeowners to a HUD-approved housing counseling agency to discuss their options. And servicers may want to suggest homeowners contact a real estate agent if the distressed homeowner is considering selling their home.

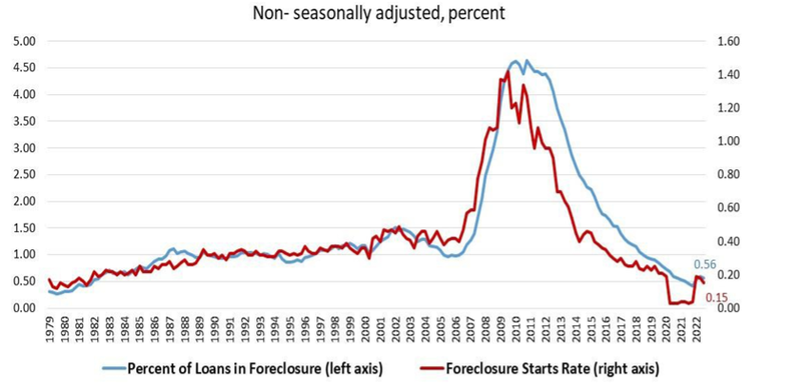

Foreclosures are relatively low but still affecting thousands

As a result of the ongoing pandemic, many homeowners are facing foreclosure, especially those who were delinquent at the start of the pandemic and who therefore may be at heightened risk. Although foreclosure starts are relatively low compared to pre-pandemic levels, according to Black Knight’s mortgage data , November 2022 saw an increase of 23,400 foreclosure starts, which represented two consecutive months of increases.

Figure 1: Loans in Foreclosure and New Foreclosures Started

Source: Mortgage Bankers Association National Delinquency Survey from Q3 2022

Foreclosures can be expensive for homeowners

The foreclosure process can be expensive for homeowners and affects wealth accumulation, which is further impacted by the costs of the foreclosure process. A homeowner’s average cost from a completed foreclosure was approximately $12,500 (in 2021 dollars, after adjusting for inflation), as noted in the Mortgage Servicing COVID-19 Final Rule . The costs and fees associated with foreclosure can reduce the proceeds a homeowner may get from selling their home. Generally, these fees include late charges, title fees, property maintenance charges, and legal fees associated with the mortgage servicer’s foreclosure attorney.

Foreclosure damages a consumer’s credit and stays on their credit report for seven years. Given that, homeowners may end up paying higher interest rates on future home purchases and on other products they buy with credit, even if those credit products are not related to owning a home.

Selling the home may be a better alternative to foreclosure and can make financial sense for homeowners with equity

Given rising rents, it may make economic sense for many struggling homeowners who are delinquent or could be at risk of delinquency to remain in their home, if possible. A payment deferral, standalone partial claim, or loan modification is often the preferred option. However, if these or other home-retention options are unaffordable for a homeowner, a traditional sale is one strategy to help them avoid foreclosure.

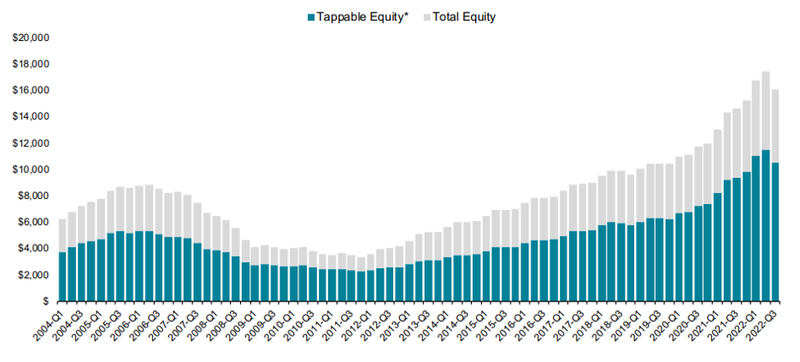

Many struggling homeowners have accumulated equity

Black Knight reports that the share of total equity on mortgaged properties is sizable, and 81 percent of homeowners in active foreclosure had at least 10 percent equity in their home as of Q3 2022.

Figure 2: Home Equity on Mortgaged Properties

Source: Black Knight’s Mortgage Monitoring Report, September 2022

* Black Knight defines “Tappable Equity” as the share of equity that could be withdrawn while still maintaining an 80 percent or lower loan-to-value ratio.

Customer service representatives, real estate professionals, and housing counselors can help in the traditional sale process

Servicers are reminded that Regulation X requires servicers to reach out to delinquent borrowers promptly to discuss available loss mitigation options. Servicers may, in those conversations, in addition to reviewing other available options, discuss the possibility of a traditional sale with the homeowner. A traditional sale may benefit a homeowner compared to the short-term and long-term effects of foreclosure when a loan modification or short-term loss mitigation option is not available.

There are resources servicers can use to help homeowners understand the option of a traditional sale for homeowners who may otherwise be at risk of losing their home to foreclosure. For example, Appendix MS-4(B) to Regulation X contains sample language that can be used to inform homeowners of the option to sell their home.

Often, the mortgage servicer’s phone representatives are the first line of communication with homeowners. For this reason, servicers are encouraged to provide information and training to representatives, so they are ready to have conversations with equity-positive homeowners facing foreclosure about the possible advantages of selling the home. Of course, conversations about selling the home cannot substitute for the Regulation X requirement that mortgage servicers present all available loss mitigation alternatives to borrowers.

To help homeowners who are considering a traditional sale, servicers can point out ways that homeowners can find current estimates of their home’s value. Online sites and local real estate professionals can provide free estimates of property values. Real estate professionals with firsthand experience and local knowledge can help homeowners understand the housing environment, housing supply shortages, and seasonal shifts in home sales. All of this can help inform a homeowner’s decision about when and if to put their home on the market.

Servicers can also direct homeowners to a housing counselor who can help them understand the implications of each foreclosure avoidance option. Servicers can provide the CFPB’s Find a Housing Counselor tool to homeowners.