Appendix A to Part 1005 — Model Disclosure Clauses and Forms

A-1 - Model Clauses for Unsolicited Issuance (§ 1005.5(b)(2))

A-2 - Model Clauses for Initial Disclosures (§ 1005.7(b))

A-3 - Model Forms for Error Resolution Notice (§§ 1005.7(b)(10) and 1005.8(b))

A-4 - Model Form for Service-Providing Institutions (§ 1005.14(b)(1)(ii))

A-5 - Model Clauses for Government Agencies (§ 1005.15(e)(1) AND (2))

A-6 - Model Clauses for Authorizing One-Time Electronic Fund Transfers Using Information From a Check (§ 1005.3(b)(2))

A-7 - Model Clauses for Financial Institutions Offering Prepaid Accounts (§ 1005.18(d) and (e)(3))

A-8 - Model Clause for Electronic Collection of Returned Item Fees (§ 1005.3(b)(3))

A-9 - Model Consent Form for Overdraft Services (§ 1005.17)

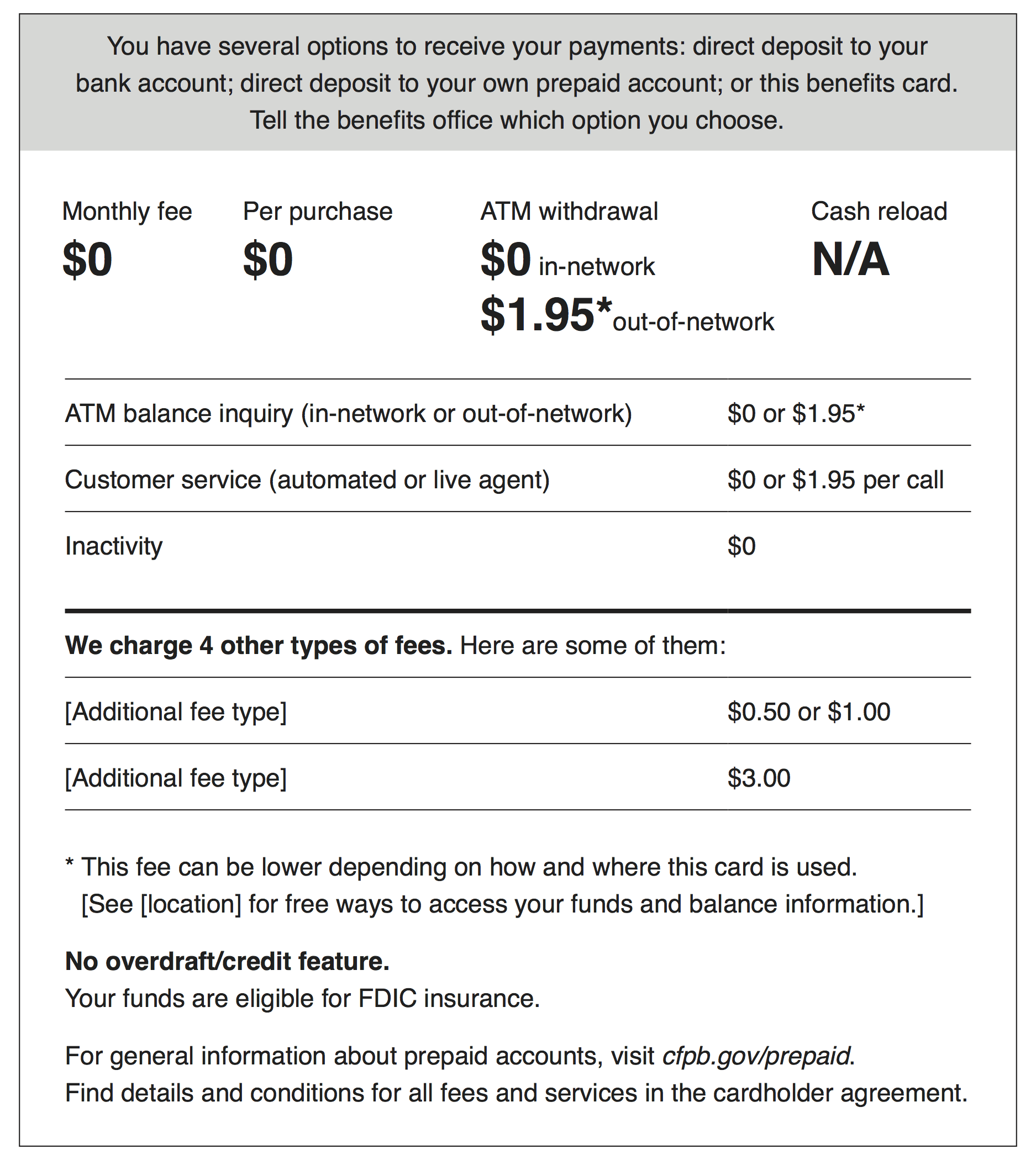

A–10(a)—Model Form for Short Form Disclosures for Government Benefit Accounts (§§ 1005.15(c) and 1005.18(b)(2), (3), (6), and (7))

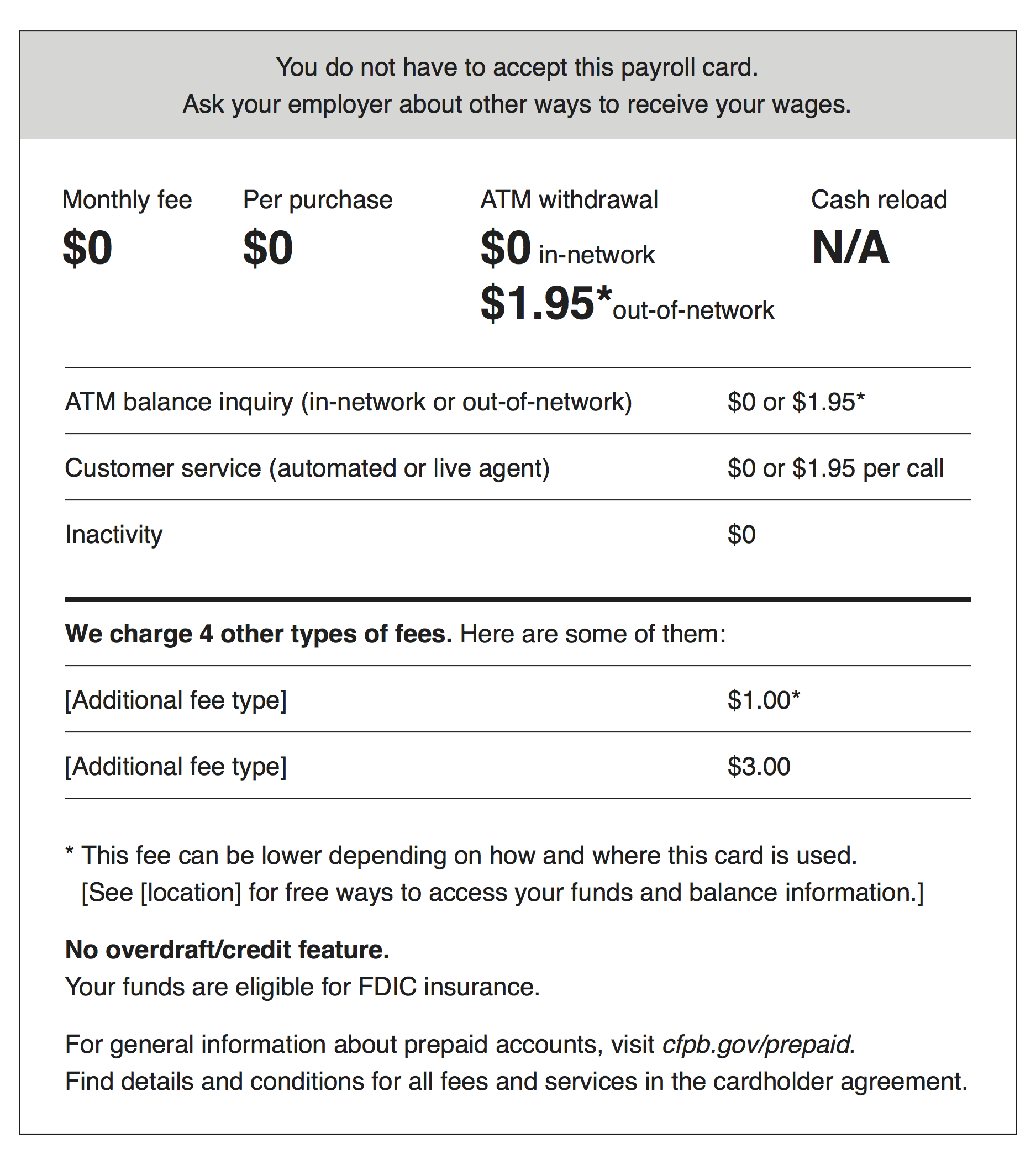

A–10(b)—Model Form for Short Form Disclosures for Payroll Card Accounts (§ 1005.18(b)(2), (3), (6), and (7))

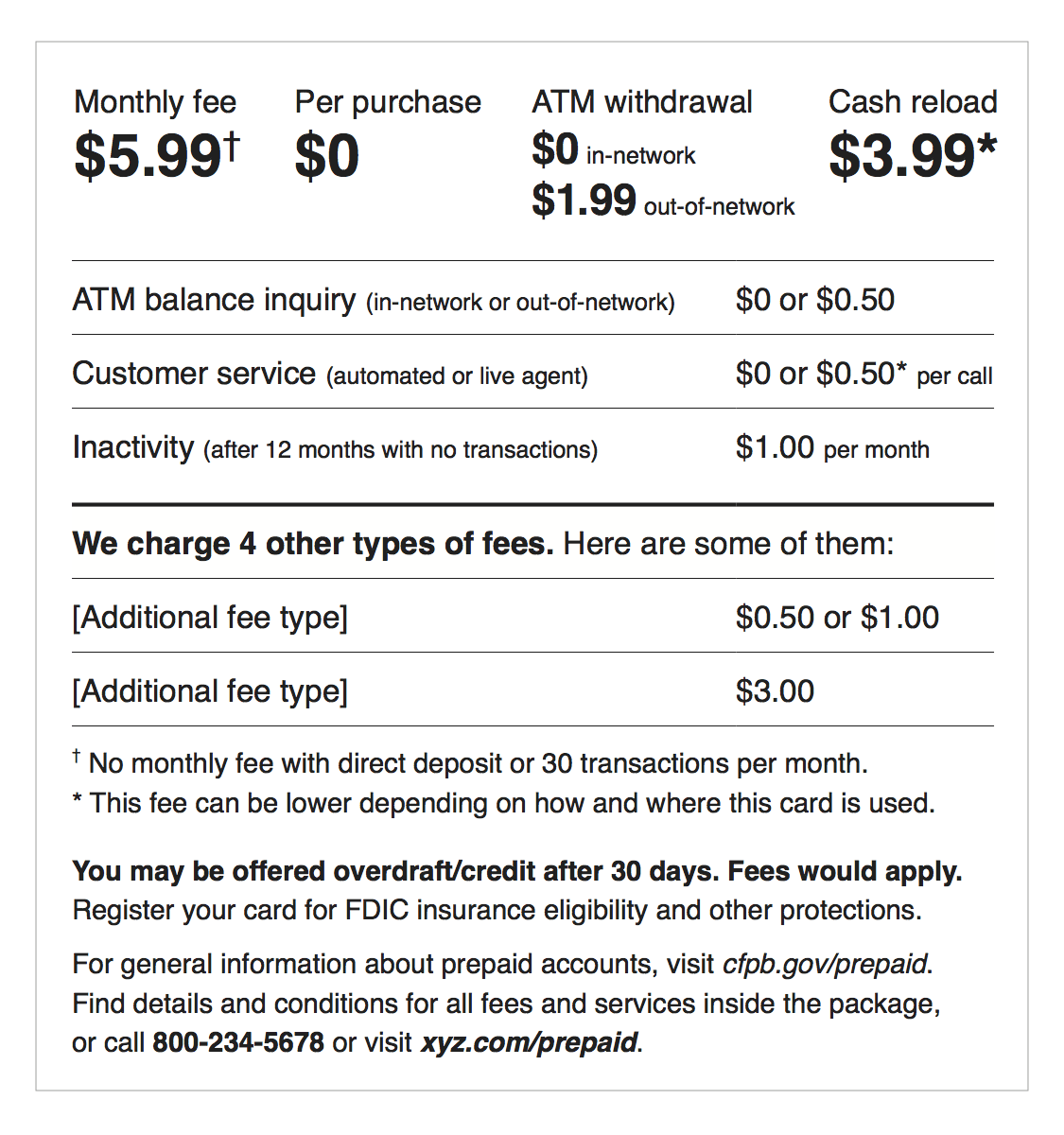

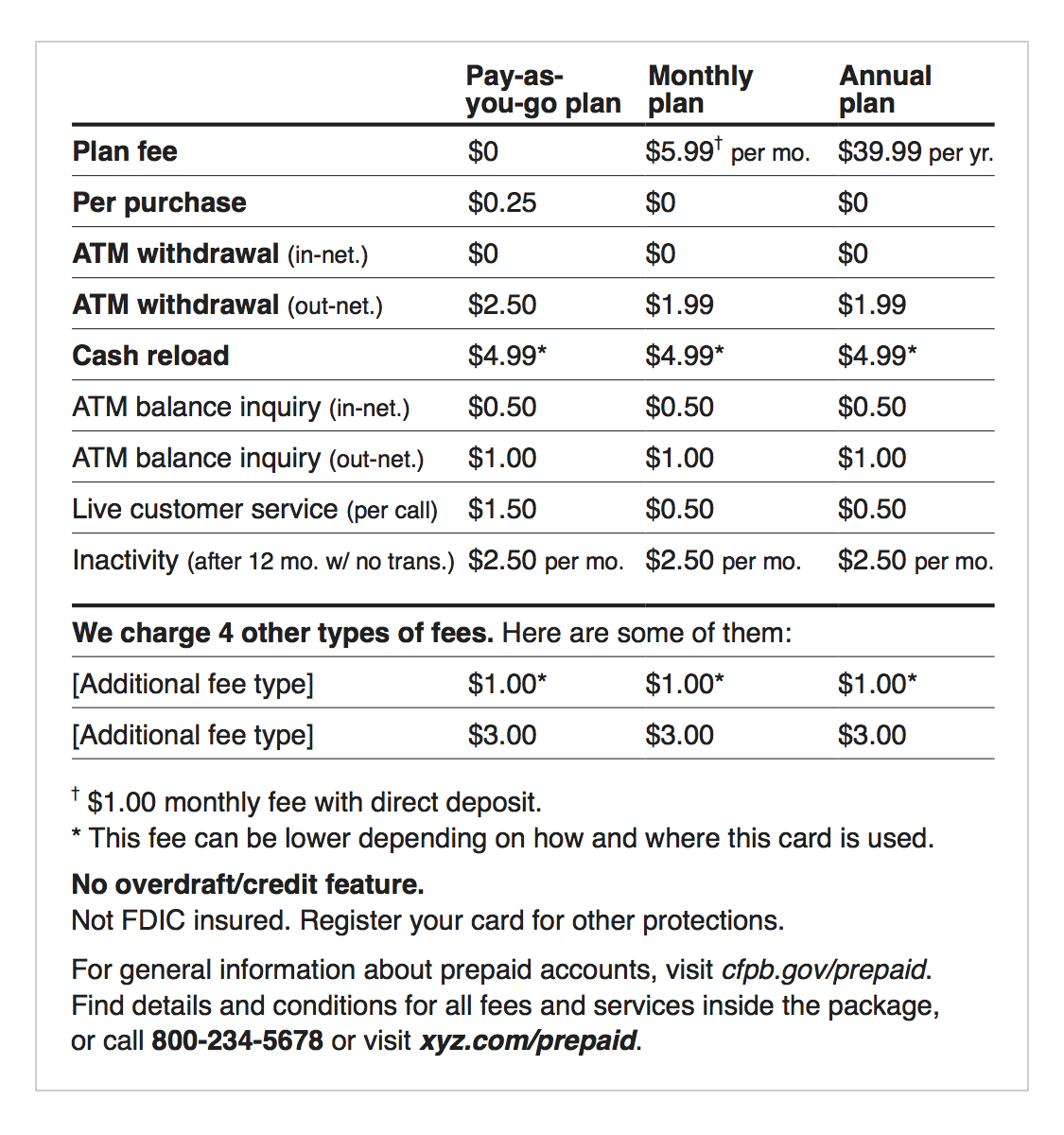

A–10(c)—Model Form for Short Form Disclosures for Prepaid Accounts, Example 1 (§ 1005.18(b)(2), (3), (6), and (7))

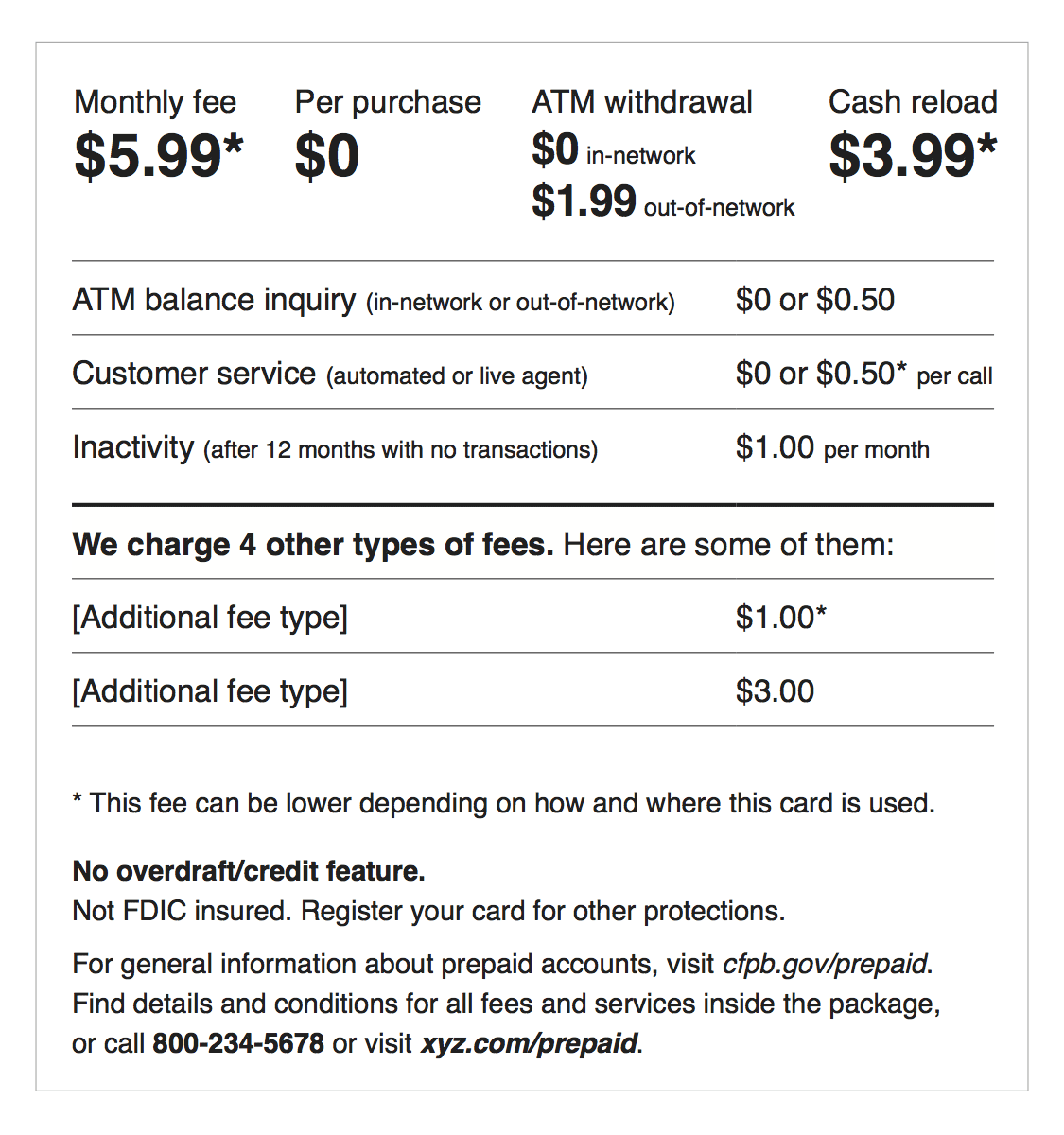

A–10(d)—Model Form for Short Form Disclosures for Prepaid Accounts, Example 2 (§ 1005.18(b)(2), (3), (6), and (7))

A–10(e)—Model Form for Short Form Disclosures for Prepaid Accounts with Multiple Service Plans (§ 1005.18(b)(2), (3), (6), and (7))

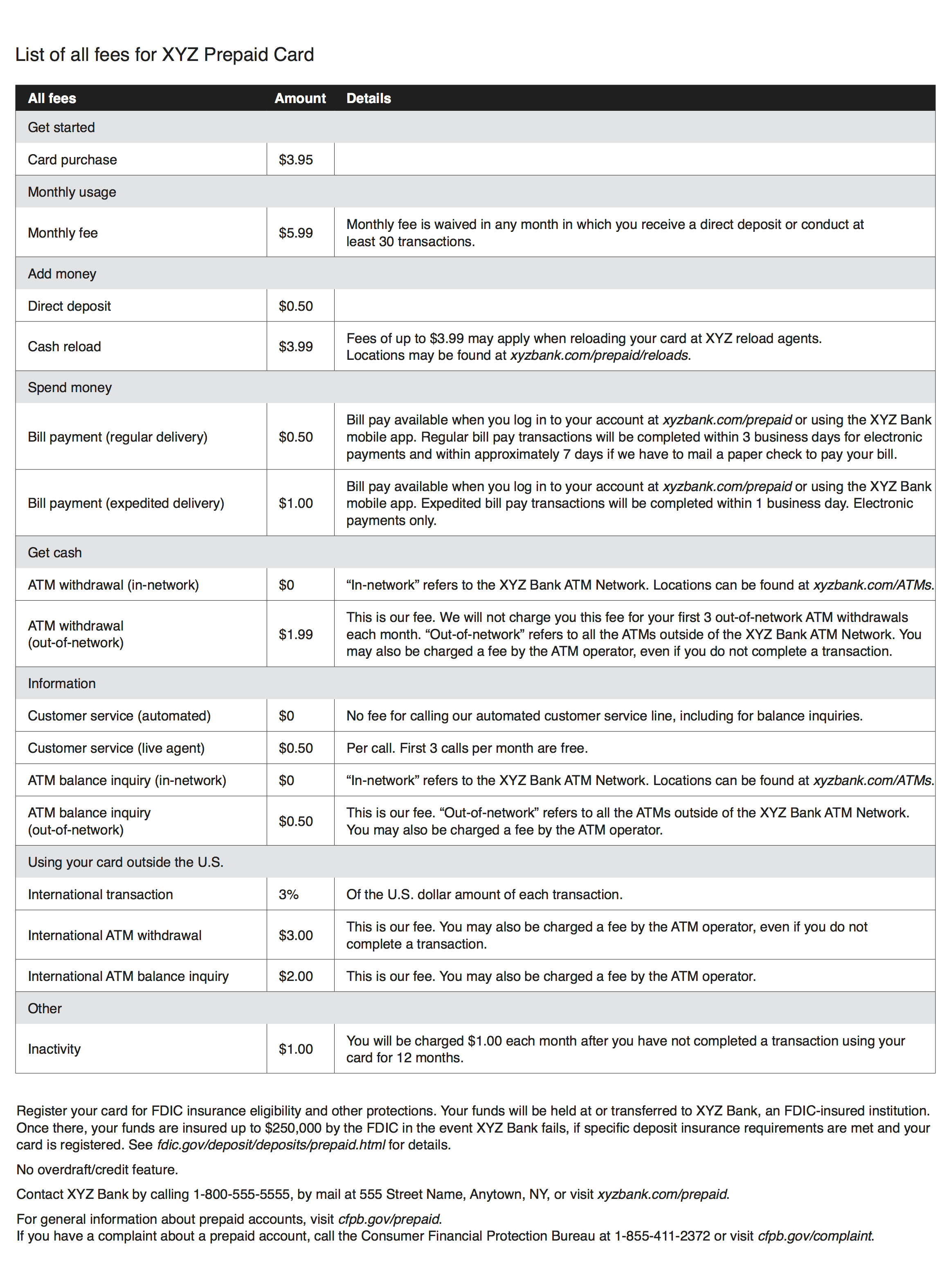

A–10(f)—Sample Form for Long Form Disclosures for Prepaid Accounts (§ 1005.18(b)(4), (6), and (7))

A-11 through A-30 [Reserved]

A-30(a) - Model Form for Pre-Payment Disclosures for Remittance Transfers Exchanged into Local Currency including a disclaimer where non-covered third-party fees and foreign taxes may apply (§ 1005.31(b)(1))

A-30(b)(1) and § 1005.32(b)(3)))

A-30(c) - Model Form for Pre-Payment Disclosures for Remittance Transfers Exchanged into Local Currency including a disclaimer with estimate for foreign taxes (§ 1005.31(b)(1) and § 1005.32(b)(3))

A-30(d) - Model Form for Pre-Payment Disclosures for Remittance Transfers Exchanged into Local Currency, including a disclaimer with estimates for non-covered third-party fees and foreign taxes (§ 1005.31(b)(1) and § 1005.32(b)(3))

A-31 - Model Form for Receipts for Remittance Transfers Exchanged into Local Currency (§ 1005.31(b)(2))

A-32 - Model Form for Combined Disclosures for Remittance Transfers Exchanged into Local Currency (§ 1005.31(b)(3))

A-34 - Model Form for Receipts for Dollar-to-Dollar Remittance Transfers (§ 1005.31(b)(2))

A-35 - Model Form for Combined Disclosures for Dollar-to-Dollar Remittance Transfers (§ 1005.31(b)(3))

A-36 - Model Form for Error Resolution and Cancellation Disclosures (Long) (§ 1005.31(b)(4))

A-37 - Model Form for Error Resolution and Cancellation Disclosures (Short) (§ 1005.31(b)(2)(iv) and (b)(2)(vi))

A-39 - Model Form for Receipts for Remittance Transfers Exchanged into Local Currency - Spanish (§ 1005.31(b)(2))

A-40 - Model Form for Combined Disclosures for Remittance Transfers Exchanged into Local Currency - Spanish (§ 1005.31(b)(3))

A-41 - Model Form for Error Resolution and Cancellation Disclosures (Long) - Spanish (§ 1005.31(b)(4))

A-1 - Model Clauses for Unsolicited Issuance (§ 1005.5(b)(2))

(a) Accounts using cards. You cannot use the enclosed card to transfer money into or out of your account until we have validated it. If you do not want to use the card, please (destroy it at once by cutting it in half).

[Financial institution may add validation instructions here.]

(b) Accounts using codes. You cannot use the enclosed code to transfer money into or out of your account until we have validated it. If you do not want to use the code, please (destroy this notice at once).

[Financial institution may add validation instructions here.]

A-2 - Model Clauses for Initial Disclosures (§ 1005.7(b))

(a) Consumer Liability (§ 1005.7(b)(1)).

(Tell us AT ONCE if you believe your [card] [code] has been lost or stolen, or if you believe that an electronic fund transfer has been made without your permission using information from your check. Telephoning is the best way of keeping your possible losses down. You could lose all the money in your account (plus your maximum overdraft line of credit). If you tell us within 2 business days after you learn of the loss or theft of your [card] [code], you can lose no more than $50 if someone used your [card][code] without your permission.)

If you do NOT tell us within 2 business days after you learn of the loss or theft of your [card] [code], and we can prove we could have stopped someone from using your [card] [code] without your permission if you had told us, you could lose as much as $500.

Also, if your statement shows transfers that you did not make, including those made by card, code or other means, tell us at once. If you do not tell us within 60 days after the statement was mailed to you, you may not get back any money you lost after the 60 days if we can prove that we could have stopped someone from taking the money if you had told us in time. If a good reason (such as a long trip or a hospital stay) kept you from telling us, we will extend the time periods.

(b) Contact in event of unauthorized transfer (§ 1005.7(b)(2)). If you believe your [card] [code] has been lost or stolen, call: [Telephone number] or write: [Name of person or office to be notified] [Address].

You should also call the number or write to the address listed above if you believe a transfer has been made using the information from your check without your permission.

(c) Business days (§ 1005.7(b)(3)). For purposes of these disclosures, our business days are (Monday through Friday) (Monday through Saturday) (any day including Saturdays and Sundays). Holidays are (not) included.

(d) Transfer types and limitations (§ 1005.7(b)(4))

(1) Account access. You may use your [card][code] to:

(i) Withdraw cash from your [checking] [or] [savings] account.

(ii) Make deposits to your [checking] [or] [savings] account.

(iii) Transfer funds between your checking and savings accounts whenever you request.

(iv) Pay for purchases at places that have agreed to accept the [card] [code].

(v) Pay bills directly [by telephone] from your [checking] [or] [savings] account in the amounts and on the days you request.

Some of these services may not be available at all terminals.

(2) Electronic check conversion. You may authorize a merchant or other payee to make a one-time electronic payment from your checking account using information from your check to:

(i) Pay for purchases.

(ii) Pay bills.

(3) Limitations on frequency of transfers.

(i) You may make only [insert number, e.g., 3] cash withdrawals from our terminals each [insert time period, e.g., week].

(ii) You can use your telephone bill-payment service to pay [insert number] bills each [insert time period] [telephone call].

(iii) You can use our point-of-sale transfer service for [insert number] transactions each [insert time period].

(iv) For security reasons, there are limits on the number of transfers you can make using our [terminals] [telephone bill-payment service] [point-of-sale transfer service].

(4) Limitations on dollar amounts of transfers

(i) You may withdraw up to [insert dollar amount] from our terminals each [insert time period] time you use the [card] [code].

(ii) You may buy up to [insert dollar amount] worth of goods or services each [insert time period] time you use the [card] [code] in our point-of-sale transfer service.

(e) Fees (§ 1005.7(b)(5))

(1) Per transfer charge. We will charge you [insert dollar amount] for each transfer you make using our [automated teller machines] [telephone bill-payment service] [point-of-sale transfer service].

(2) Fixed charge. We will charge you [insert dollar amount] each [insert time period] for our [automated teller machine service] [telephone bill-payment service] [point-of-sale transfer service].

(3) Average or minimum balance charge. We will only charge you for using our [automated teller machines] [telephone bill-payment service] [point-of-sale transfer service] if the [average] [minimum] balance in your [checking account] [savings account] [accounts] falls below [insert dollar amount]. If it does, we will charge you [insert dollar amount] each [transfer] [insert time period].

(f) Confidentiality (§ 1005.7(b)(9)). We will disclose information to third parties about your account or the transfers you make:

(i) Where it is necessary for completing transfers, or

(ii) In order to verify the existence and condition of your account for a third party, such as a credit bureau or merchant, or

(iii) In order to comply with government agency or court orders, or

(iv) If you give us your written permission.

(g) Documentation (§ 1005.7(b)(6))

(1) Terminal transfers. You can get a receipt at the time you make any transfer to or from your account using one of our [automated teller machines] [or] [point-of-sale terminals].

(2) Preauthorized credits. If you have arranged to have direct deposits made to your account at least once every 60 days from the same person or company, (we will let you know if the deposit is [not] made.) [the person or company making the deposit will tell you every time they send us the money] [you can call us at (insert telephone number) to find out whether or not the deposit has been made].

(3) Periodic statements. You will get a [monthly] [quarterly] account statement (unless there are no transfers in a particular month. In any case you will get the statement at least quarterly).

(4) Passbook account where the only possible electronic fund transfers are preauthorized credits. If you bring your passbook to us, we will record any electronic deposits that were made to your account since the last time you brought in your passbook.

(h) Preauthorized payments (§ 1005.7(b) (6), (7) and (8); § 1005.10(d))

(1) Right to stop payment and procedure for doing so. If you have told us in advance to make regular payments out of your account, you can stop any of these payments. Here's how:

Call us at [insert telephone number], or write us at [insert address], in time for us to receive your request 3 business days or more before the payment is scheduled to be made. If you call, we may also require you to put your request in writing and get it to us within 14 days after you call. (We will charge you [insert amount] for each stop-payment order you give.)

(2) Notice of varying amounts. If these regular payments may vary in amount, [we] [the person you are going to pay] will tell you, 10 days before each payment, when it will be made and how much it will be. (You may choose instead to get this notice only when the payment would differ by more than a certain amount from the previous payment, or when the amount would fall outside certain limits that you set.)

(3) Liability for failure to stop payment of preauthorized transfer. If you order us to stop one of these payments 3 business days or more before the transfer is scheduled, and we do not do so, we will be liable for your losses or damages.

(i) Financial institution's liability (§ 1005.7(b)(8)). If we do not complete a transfer to or from your account on time or in the correct amount according to our agreement with you, we will be liable for your losses or damages. However, there are some exceptions. We will not be liable, for instance:

(1) If, through no fault of ours, you do not have enough money in your account to make the transfer.

(2) If the transfer would go over the credit limit on your overdraft line.

(3) If the automated teller machine where you are making the transfer does not have enough cash.

(4) If the [terminal] [system] was not working properly and you knew about the breakdown when you started the transfer.

(5) If circumstances beyond our control (such as fire or flood) prevent the transfer, despite reasonable precautions that we have taken.

(6) There may be other exceptions stated in our agreement with you.

(j) ATM fees (§ 1005.7(b)(11)). When you use an ATM not owned by us, you may be charged a fee by the ATM operator [or any network used] (and you may be charged a fee for a balance inquiry even if you do not complete a fund transfer).

A-3 - Model Forms for Error Resolution Notice (§§ 1005.7(b)(10) and 1005.8(b))

(a) Initial and annual error resolution notice (§§ 1005.7(b)(10) and 1005.8(b)).

In Case of Errors or Questions About Your Electronic Transfers Telephone us at [insert telephone number] Write us at [insert address] [or email us at [insert email address]] as soon as you can, if you think your statement or receipt is wrong or if you need more information about a transfer listed on the statement or receipt. We must hear from you no later than 60 days after we sent the FIRST statement on which the problem or error appeared.

(1) Tell us your name and account number (if any).

(2) Describe the error or the transfer you are unsure about, and explain as clearly as you can why you believe it is an error or why you need more information.

(3) Tell us the dollar amount of the suspected error.

If you tell us orally, we may require that you send us your complaint or question in writing within 10 business days.

We will determine whether an error occurred within 10 business days after we hear from you and will correct any error promptly. If we need more time, however, we may take up to 45 days to investigate your complaint or question. If we decide to do this, we will credit your account within 10 business days for the amount you think is in error, so that you will have the use of the money during the time it takes us to complete our investigation. If we ask you to put your complaint or question in writing and we do not receive it within 10 business days, we may not credit your account.

For errors involving new accounts, point-of-sale, or foreign-initiated transactions, we may take up to 90 days to investigate your complaint or question. For new accounts, we may take up to 20 business days to credit your account for the amount you think is in error.

We will tell you the results within three business days after completing our investigation. If we decide that there was no error, we will send you a written explanation. You may ask for copies of the documents that we used in our investigation.

(b) Error resolution notice on periodic statements (§ 1005.8(b)).

In Case of Errors or Questions About Your Electronic Transfers Telephone us at [insert telephone number] or Write us at [insert address] as soon as you can, if you think your statement or receipt is wrong or if you need more information about a transfer on the statement or receipt. We must hear from you no later than 60 days after we sent you the FIRST statement on which the error or problem appeared.

(1) Tell us your name and account number (if any).

(2) Describe the error or the transfer you are unsure about, and explain as clearly as you can why you believe it is an error or why you need more information.

(3) Tell us the dollar amount of the suspected error.

We will investigate your complaint and will correct any error promptly. If we take more than 10 business days to do this, we will credit your account for the amount you think is in error, so that you will have the use of the money during the time it takes us to complete our investigation.

A-4 - Model Form for Service-Providing Institutions (§ 1005.14(b)(1)(ii))

ALL QUESTIONS ABOUT TRANSACTIONS MADE WITH YOUR (NAME OF CARD) CARD MUST BE DIRECTED TO US (NAME OF SERVICE PROVIDER), AND NOT TO THE BANK OR OTHER FINANCIAL INSTITUTION WHERE YOU HAVE YOUR ACCOUNT. We are responsible for the [name of service] service and for resolving any errors in transactions made with your [name of card] card.

We will not send you a periodic statement listing transactions that you make using your [name of card] card. The transactions will appear only on the statement issued by your bank or other financial institution. SAVE THE RECEIPTS YOU ARE GIVEN WHEN YOU USE YOUR [NAME OF CARD] CARD, AND CHECK THEM AGAINST THE ACCOUNT STATEMENT YOU RECEIVE FROM YOUR BANK OR OTHER FINANCIAL INSTITUTION. If you have any questions about one of these transactions, call or write us at [telephone number and address] [the telephone number and address indicated below].

IF YOUR [NAME OF CARD] CARD IS LOST OR STOLEN, NOTIFY US AT ONCE by calling or writing to us at [telephone number and address].

A-5 - Model Clauses for Government Agencies (§ 1005.15(e)(1) AND (2))

(a) Disclosure by government agencies of information about obtaining account information for government benefit accounts (§ 1005.15(e)(1)(i)).

You may obtain information about the amount of benefits you have remaining by calling [telephone number]. That information is also available [on the receipt you get when you make a transfer with your card at (an ATM) (a POS terminal)] [when you make a balance inquiry at an ATM] [when you make a balance inquiry at specified locations]. This information, along with a 12-month history of account transactions, is also available online at [Internet address].

You also have the right to obtain at least 24 months of written history of account transactions by calling [telephone number], or by writing to us at [address]. You will not be charged a fee for this information unless you request it more than once per month. [Optional: Or you may request a written history of account transactions by contacting your caseworker.]

(b) Disclosure of error resolution procedures for government agencies that do not provide periodic statements (§ 1005.15(e)(1)(ii) and (e)(2)).

In Case of Errors or Questions About Your Electronic Transfers Telephone us at [telephone number] Write us at [address] [or email us at [email address]] as soon as you can, if you think an error has occurred in your [agency’s name for program] account. We must allow you to report an error until 60 days after the earlier of the date you electronically access your account, if the error could be viewed in your electronic history, or the date we sent the FIRST written history on which the error appeared. You may request a written history of your transactions at any time by calling us at [telephone number] or writing us at [address] [optional: or by contacting your caseworker]. You will need to tell us:

• Your name and [case] [file] number.

• Why you believe there is an error, and the dollar amount involved.

• Approximately when the error took place.

If you tell us orally, we may require that you send us your complaint or question in writing within 10 business days.

We will determine whether an error occurred within 10 business days after we hear from you and will correct any error promptly. If we need more time, however, we may take up to 45 days to investigate your complaint or question. If we decide to do this, we will credit your account within 10 business days for the amount you think is in error, so that you will have the use of the money during the time it takes us to complete our investigation. If we ask you to put your complaint or question in writing and we do not receive it within 10 business days, we may not credit your account.

For errors involving new accounts, point-of-sale, or foreign-initiated transactions, we may take up to 90 days to investigate your complaint or question. For new accounts, we may take up to 20 business days to credit your account for the amount you think is in error.

We will tell you the results within three business days after completing our investigation. If we decide that there was no error, we will send you a written explanation.

You may ask for copies of the documents that we used in our investigation.

If you need more information about our error resolution procedures, call us at [telephone number][the telephone number shown above].

A-6 - Model Clauses for Authorizing One-Time Electronic Fund Transfers Using Information From a Check (§ 1005.3(b)(2))

(a) Notice About Electronic Check Conversion.

When you provide a check as payment, you authorize us either to use information from your check to make a one-time electronic fund transfer from your account or to process the payment as a check transaction.

(b) Alternative Notice About Electronic Check Conversion (Optional).

When you provide a check as payment, you authorize us to use information from your check to make a one-time electronic fund transfer from your account. In certain circumstances, such as for technical or processing reasons, we may process your payment as a check transaction.

[Specify other circumstances (at payee's option).]

(c) Notice For Providing Additional Information About Electronic Check Conversion.

When we use information from your check to make an electronic fund transfer, funds may be withdrawn from your account as soon as the same day [you make] [we receive] your payment[, and you will not receive your check back from your financial institution].

Model Clauses for Financial Institutions Offering Prepaid Accounts (§ 1005.18(d) and (e)(3))

(a) Disclosure by financial institutions of information about obtaining account information for prepaid accounts (§ 1005.18(d)(1)(i)).

You may obtain information about the amount of money you have remaining in your prepaid account by calling [telephone number]. This information, along with a 12-month history of account transactions, is also available online at [internet address].

[For accounts that are or can be registered:] [If your account is registered with us,] You also have the right to obtain at least 24 months of written history of account transactions by calling [telephone number], or by writing us at [address]. You will not be charged a fee for this information unless you request it more than once per month.

(b) Disclosure of error-resolution procedures for financial institutions that do not provide periodic statements (§ 1005.18(d)(1)(ii) and (d)(2)).

In Case of Errors or Questions About Your Prepaid Account Telephone us at [telephone number] or Write us at [address] [or email us at [email address]] as soon as you can, if you think an error has occurred in your prepaid account. We must allow you to report an error until 60 days after the earlier of the date you electronically access your account, if the error could be viewed in your electronic history, or the date we sent the FIRST written history on which the error appeared. You may request a written history of your transactions at any time by calling us at [telephone number] or writing us at [address]. You will need to tell us:

Your name and [prepaid account] number.

Why you believe there is an error, and the dollar amount involved.

Approximately when the error took place.

If you tell us orally, we may require that you send us your complaint or question in writing within 10 business days.

We will determine whether an error occurred within 10 business days after we hear from you and will correct any error promptly. If we need more time, however, we may take up to 45 days to investigate your complaint or question. If we decide to do this, [and your account is registered with us,] we will credit your account within 10 business days for the amount you think is in error, so that you will have the money during the time it takes us to complete our investigation. If we ask you to put your complaint or question in writing and we do not receive it within 10 business days, we may not credit your account. [Keep reading to learn more about how to register your card.]

For errors involving new accounts, point-of-sale, or foreign-initiated transactions, we may take up to 90 days to investigate your complaint or question. For new accounts, we may take up to 20 business days to credit your account for the amount you think is in error.

We will tell you the results within three business days after completing our investigation. If we decide that there was no error, we will send you a written explanation.

You may ask for copies of the documents that we used in our investigation.

If you need more information about our error-resolution procedures, call us at [telephone number] [the telephone number shown above] [or visit [internet address]].

(c) Warning regarding unverified prepaid accounts (§ 1005.18(e)(3)).

It is important to register your prepaid account as soon as possible. Until you register your account and we verify your identity, we are not required to research or resolve any errors regarding your account. To register your account, go to [internet address] or call us at [telephone number]. We will ask you for identifying information about yourself (including your full name, address, date of birth, and [Social Security Number] [government-issued identification number]), so that we can verify your identity.

A-8 - Model Clause for Electronic Collection of Returned Item Fees (§ 1005.3(b)(3))

If your payment is returned unpaid, you authorize [us/name of person collecting the fee electronically] to make a one-time electronic fund transfer from your account to collect a fee of [$____]. [If your payment is returned unpaid, you authorize [us/name of person collecting the fee electronically] to make a one-time electronic fund transfer from your account to collect a fee. The fee will be determined [by]/[as follows]:

A-9 - Model Consent Form for Overdraft Services § 1005.17

A-10(a)—Model Form for Short Form Disclosures for Government Benefit Accounts (§§ 1005.15(c) and 1005.18(b)(2), (3), (6), and (7))

A-10(b)—Model Form for Short Form Disclosures for Payroll Card Accounts (§ 1005.18(b)(2), (3), (6), and (7))

A-10(c)—Model Form for Short Form Disclosures for Prepaid Accounts, Example 1 (§ 1005.18(b)(2), (3), (6), and (7))

A-10(d)—Model Form for Short Form Disclosures for Prepaid Accounts, Example 2 (§ 1005.18(b)(2), (3), (6), and (7))

A-10(e)—Model Form for Short Form Disclosures for Prepaid Accounts with Multiple Service Plans (§ 1005.18(b)(2), (3), (6), and (7))

A-10(f)—Sample Form for Long Form Disclosures for Prepaid Accounts (§ 1005.18(b)(4), (6), and (7))

A-11 through A-29 [Reserved]

A-30(a) — Model Form for Pre-Payment Disclosures for Remittance Transfers Exchanged into Local Currency (§ 1005.31(b)(1))

A-30(b)

Model Form for Pre-Payment Disclosures for Remittance Transfers Exchanged into Local Currency (§ 1005.31(b)(1))

A-30(c) — Model Form for Pre-Payment Disclosures for Remittance Transfers Exchanged into Local Currency (§ 1005.31(b)(1))

A-30(d) — Model Form for Pre-Payment Disclosures for Remittance Transfers Exchanged into Local Currency (§ 1005.31(b)(1))

A-31 - Model Form for Receipts for Remittance Transfers Exchanged into Local Currency (§ 1005.31(b)(2))

A-32 - Model Form for Combined Disclosures for Remittance Transfers Exchanged into Local Currency (§ 1005.31(b)(3))

A-33 - Model Form for Pre-Payment Disclosures for Dollar-to-Dollar Remittance Transfers (§ 1005.31(b)(1))

A-34 - Model Form for Receipts for Dollar-to-Dollar Remittance Transfers (§ 1005.31(b)(2))

A-35 - Model Form for Combined Disclosures for Dollar-to-Dollar Remittance Transfers (§ 1005.31(b)(3))

A-36 - Model Form for Error Resolution and Cancellation Disclosures (Long) (§ 1005.31(b)(4))

A-37 - Model Form for Error Resolution and Cancellation Disclosures (Short)

(§ 1005.31(b)(2)(iv) and (b)(2)(vi))

You have a right to dispute errors in your transaction. If you think there is an error, contact us within 180 days at [insert telephone number] or [insert website]. You can also contact us for a written explanation of your rights.

You can cancel for a full refund within 30 minutes of payment, unless the funds have been picked up or deposited.

For questions or complaints about [insert name of remittance transfer provider], contact:

State Regulatory Agency, 800-111-2222, www.stateregulatoryagency.gov

Consumer Financial Protection Bureau, 855-411-2372, 855-729-2372 (TTY/TDD), www.consumerfinance.gov

A-38 - Model Form for Pre-Payment Disclosures for Remittance Transfers Exchanged into Local Currency - Spanish (§ 1005.31(b)(1))

A-39 - Model Form for Receipts for Remittance Transfers Exchanged into Local Currency - Spanish (§ 1005.31(b)(2))

A-40 - Model Form for Combined Disclosures for Remittance Transfers Exchanged into Local Currency - Spanish (§ 1005.31(b)(3))

A-41 - Model Form for Error Resolution and Cancellation Disclosures (Long) - Spanish (§ 1005.31(b)(4))