Problems sending money to another country?

- English

- Español

- 中文

- Tiếng Việt

- 한국어

- Tagalog

- Pусский

- العربية

- Kreyòl Ayisyen

You came to the right place. The Consumer Financial Protection Bureau is a U.S. government agency dedicated to making sure you are treated fairly by banks, lenders, and other financial institutions. We regulate companies that provide money transfers.

On this page:

Know what to do first

If you are having a problem with a money transfer, contact the company right away.

In some cases, you could receive a refund or have the transfer resent at no extra cost.

Cancelling a money transfer

Generally, you can cancel an international money transfer within 30 minutes after it is sent. There’s an exception: when the person receiving the money has already picked it up or the money has been deposited into their account. You don’t pay a fee for cancellation.

When you contact the company, be prepared and have your information on hand

- Your name, address, phone number, and account number or transaction number

- What happened—as clear and to-the-point as you can

- What you need in order to fix the problem

- Documents or screen shots that show what happened

- To keep in mind

- Never post your personal data on social media or review sites

- Avoid angry, sarcastic, or threatening language

- Keep notes as you go—who you spoke with, when, and what they said

You have the right to an investigation of problems

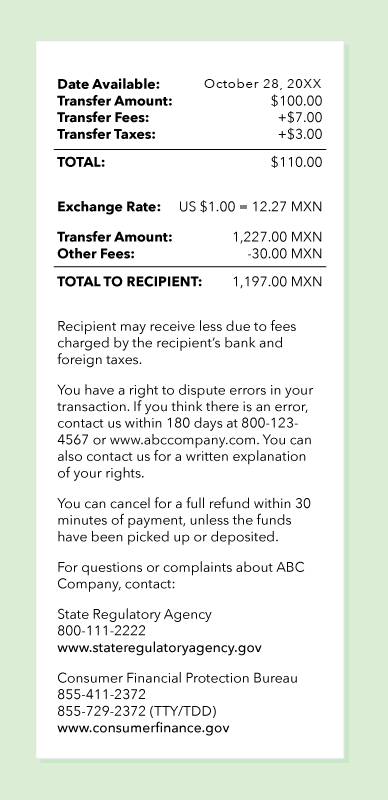

You can report a problem with a transfer up to 180 days from the date the funds are available, according to the date shown on your receipt. The company has to look into it within 90 days of when you notified them and must report the results to you. In some cases, you could get a refund or have the transfer sent again.

Find out how the CFPB can help

Submit a complaint about a money transfer

If you've already tried reaching out to the company and your issue was not resolved, you can submit a complaint with the CFPB. Tell us about your issue—we'll forward it to the company and work to get you a response, generally within 15 days.

Find answers to frequently asked money transfer questions

- Can I cancel a money transfer?

- I sent money to someone and she couldn't get the money because her information didn't match what I provided. What can I do?

- I sent money to someone in a foreign country, but the amount received was less than what I sent. What can I do?

For answers to other frequent questions, check out all our resources on money transfers.

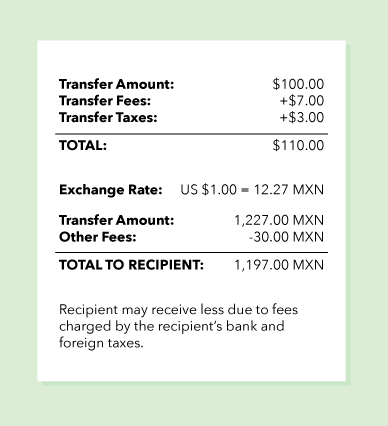

Information you receive before and after you pay

When you send money to another country, federal laws generally apply. Below are examples of the information that most providers are required to give to you before and after you send money.