Managing someone else’s money

Millions of Americans manage money or property for a loved one who’s unable to pay bills or make financial decisions. To help financial caregivers, we offer easy-to-understand guides.

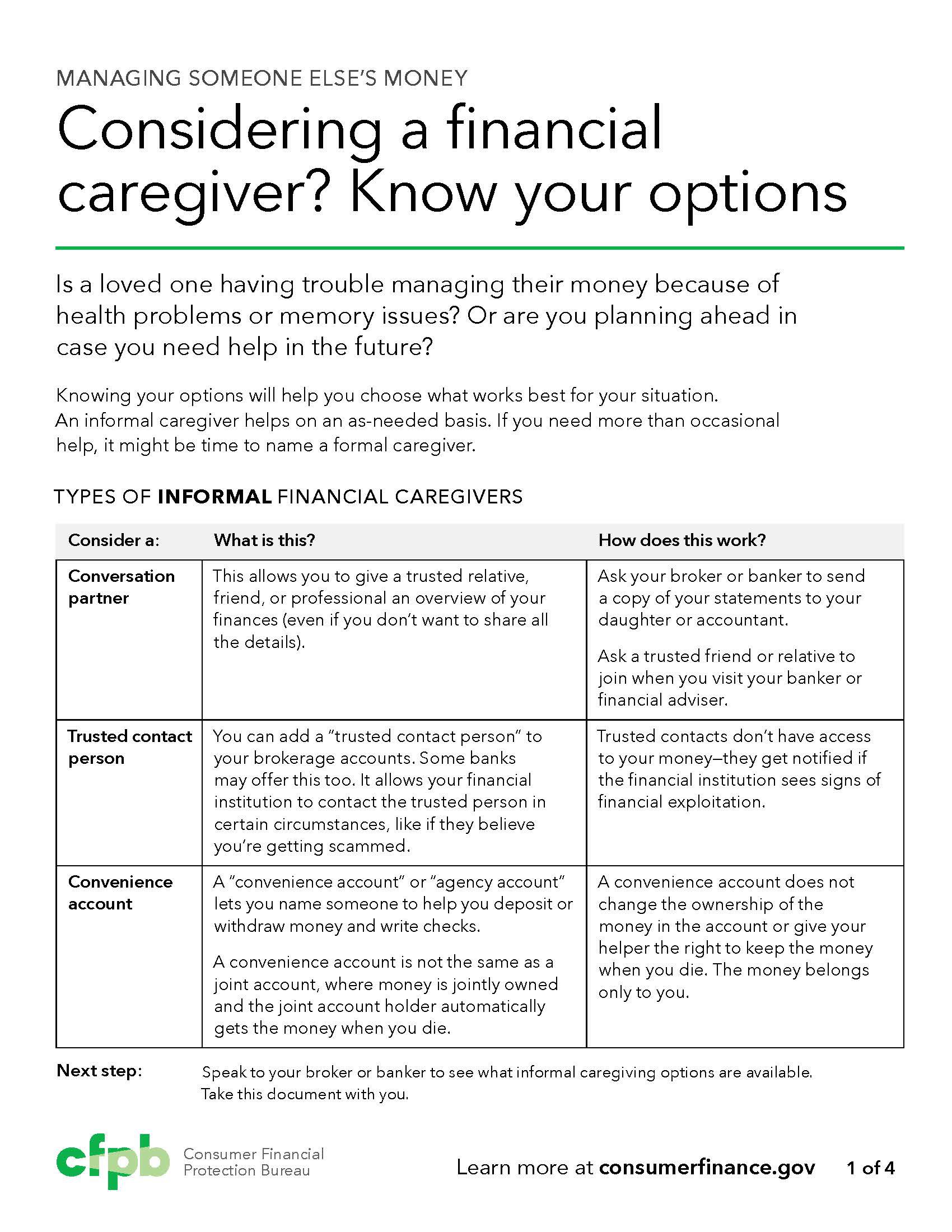

Considering a financial caregiver?

Are you or a loved one planning ahead in case you need help managing your money in the future? Knowing your options will help you choose what works best for your situation.

Find the right guide for you

The guides are tailored to the needs of people in four different fiduciary roles:

Power of attorney

Guides for those who have been named in a power of attorney to make decisions about money and property for someone else.

Court-appointed guardians

Guides for those who have been appointed by a court to be guardians of property or conservators, giving them the duty and the power to make financial decisions on someone’s behalf.

Trustees

Guides for those who have been named as trustees under revocable living trusts.

Government fiduciaries

Guides for those who have been appointed by a government agency to manage another person's income benefits, such as Social Security or Veterans Affairs benefit checks.

Co-brand the guides

Want to share the Managing Someone Else’s Money guides with customers and clients? Learn how to co-brand the CFPB booklets .