Take this quiz to see how prepared you are to make financial decisions

When it comes to making financial decisions, do you feel prepared?

For example, if you need to buy a new car, are you prepared to make the financial decisions that come with taking out an auto loan? What if you are ready to get a new credit card? How will you decide which one offers you the terms and conditions that will work for you?

Below are a few examples of the questions 15-year-olds around the world were tested on to measure how ready they are to make real-world financial decisions. So, why not find out how you’d do?

We know that teaching children about money is important and we believe it’s never too early—or too late—to develop these life skills.

Instructions

Below are five examples of questions from the 2012 financial literacy portion of PISA. They represent each of the five proficiencies. Under each question, you’ll find a button that expands the page to show you the answer and explain the concepts and skills it tested. We’ve also listed a few CFPB tools and resources per question that can help you build your financial literacy.

Note: PISA questions often refer to situations that take place in the fictional country of Zedland, where the Zed is the unit of currency.

Question 1:

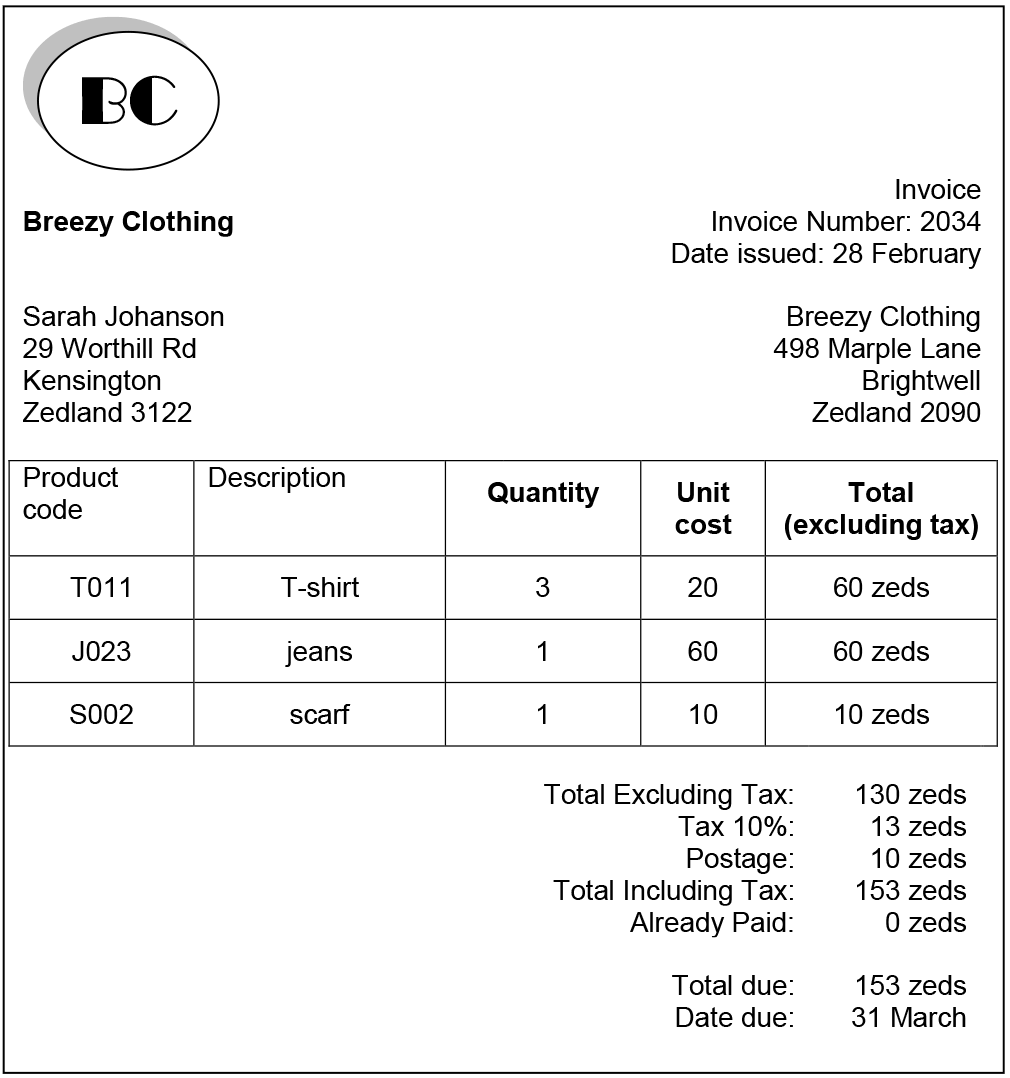

Sarah receives this invoice in the mail.

Question: Why was this invoice sent to Sarah?

A. Because Sarah needs to pay the money to Breezy Clothing.

B. Because Breezy Clothing needs to pay the money to Sarah.

C. Because Sarah has paid the money to Breezy Clothing.

D. Because Breezy Clothing has paid the money to Sarah.

Question 2:

Using the invoice from Question 1:

Question: How much has Breezy Clothing charged for delivering the clothes?

Delivery charge in zeds: _______

Question 3:

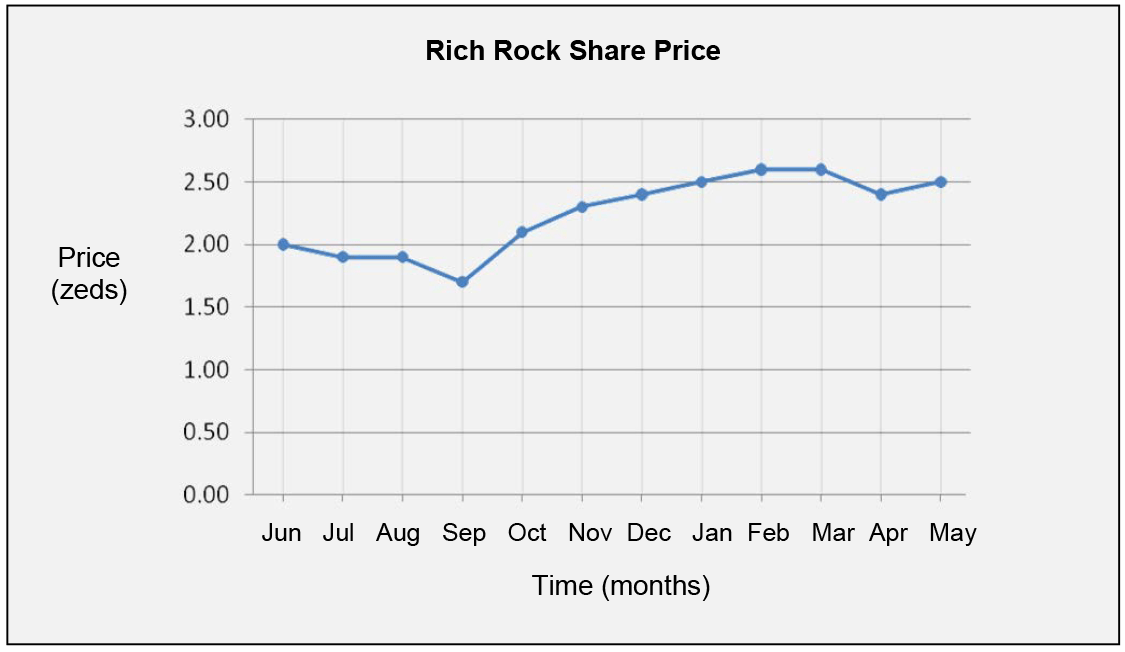

This graph shows the price of one Rich Rock share over a 12-month period.

Question: Which statements about the graph are true?

| Statement | Is the statement true or false? |

|---|---|

The best month to buy the shares was September. |

True / False |

The share price increased by about 50% over the year. |

True / False |

Question 4:

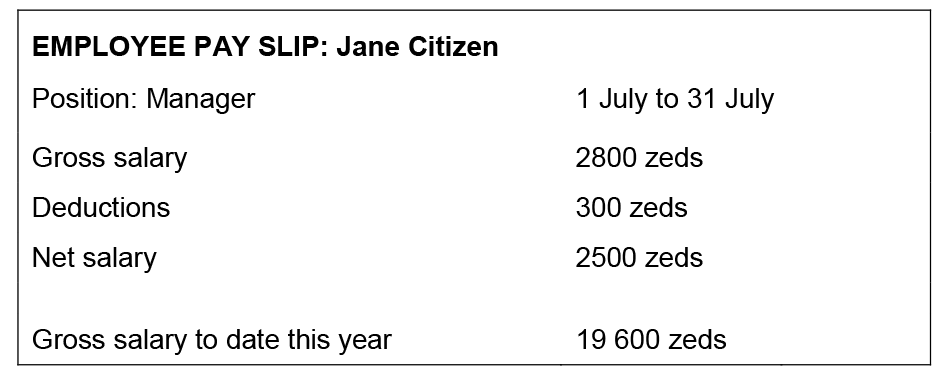

Each month, Jane’s salary is paid into her bank account. This is Jane’s pay slip for July.

Question: How much money did Jane’s employer pay into her bank account on 31 July?

A. 300 zeds

B. 2500 zeds

C. 2800 zeds

D. 19 600 zeds

Question 5:

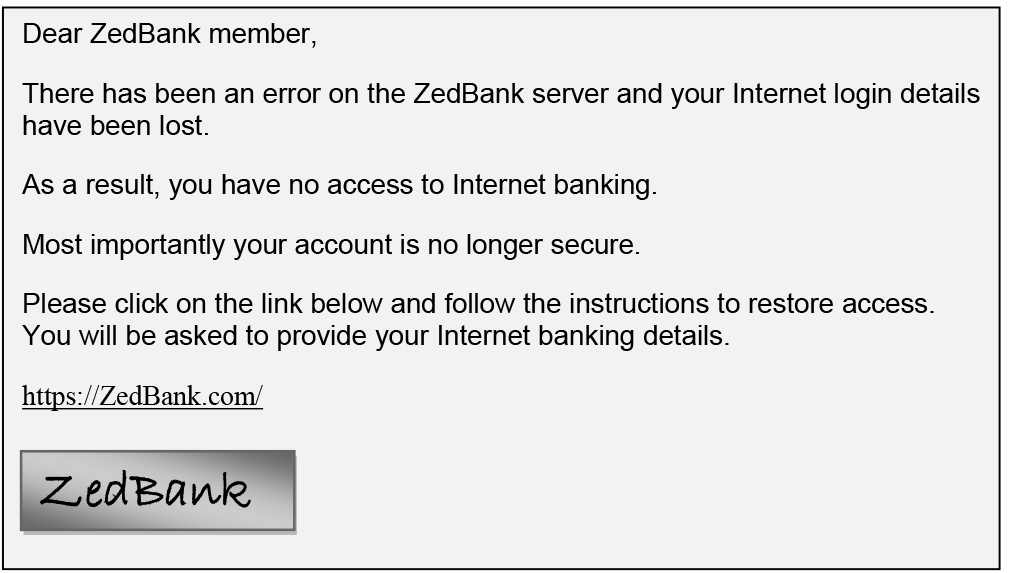

David banks with ZedBank. He receives this email message.

Question: Which of these statements would be good advice for David?

Choose “Yes” or “No” for each statement.

| Statement | Is this statement good advice for David? |

|---|---|

Reply to the email message and provide his Internet banking details. |

Yes / No |

Contact his bank to inquire about the email message. |

Yes / No |

If the link is the same as his bank’s website address, click on the link and follow the instructions. |

Yes / No |

How did you do? Remember if you want to build up your financial literacy we have a lot of tools to help you. And, if you have a problem or issue with a financial product or service you can submit a complaint online or by calling (855) 411-2372.

Note: OECD (2017), PISA Financial Literacy Questions and Answers , OECD Publishing, Paris. The questions and answers presented above belong to OECD and are licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 3.0 IGO license, available here . For the purposes of this post, the Bureau has reformatted a selection of OECD’s questions and answers in the PISA financial literacy test to be more interactive, and added links and references to relevant Bureau tools and resources. Data source: OECD .

Blog updated on June 15 to include the 2015 PISA data of student proficiency.