Servicemembers’ “immediate actions” for financial success: pay down debt, make a plan, start early

As a member of the military, you are called to serve every day in challenging environments to secure the freedom and prosperity of our nation. To meet these challenges, you engage in “immediate actions” training to better prepare yourself to respond to all kinds of threats and situations. You may also face challenges in another environment—your personal finances. On a daily basis, you may encounter hurdles and threats to your financial freedom and future prosperity. The SEC and the Bureau of Consumer Financial Protection are joining forces to set out specific immediate actions that you can take while navigating your personal finances. These immediate actions will help you secure your financial freedom and ensure that you and your family prosper now and in the future.

Our websites, the SEC’s Investor.gov and the Bureau’s Consumerfinance.gov, provide tools and resources to assist you in preparing for the lifelong mission of financial success. Along with general savings and investing tips, both agencies provide detailed information aimed specifically at addressing the unique personal finance challenges of military personnel through the SEC’s Financial Readiness brochure and the Bureau’s Navigating the Military Financial Lifecycle webpage.

The immediate actions toward financial freedom include three basic steps: first, pay off high-interest debt; second, set goals and make a financial plan; and third, start saving and investing early.

Immediate action #1: ⬇ debt – pay off high-interest debt, ⬆ improve credit score

Before you invest in anything, it’s important to pay off any high-interest debt first. With the average interest rate on a credit card nearing 17 percent , the money you’re paying on interest far outweighs the money you can normally make on most investments. Maintaining good credit and trying to improve your scores go hand in hand when managing your debt. Whether you’re renting an apartment or applying for a mortgage, your credit scores play a prominent role in your financial plan. Trouble with your personal finances can even put your duty status, potential promotions, and your military career in jeopardy. Learn more about how to maintain good credit scores.

Immediate action #2: ✔ set goals and make a plan

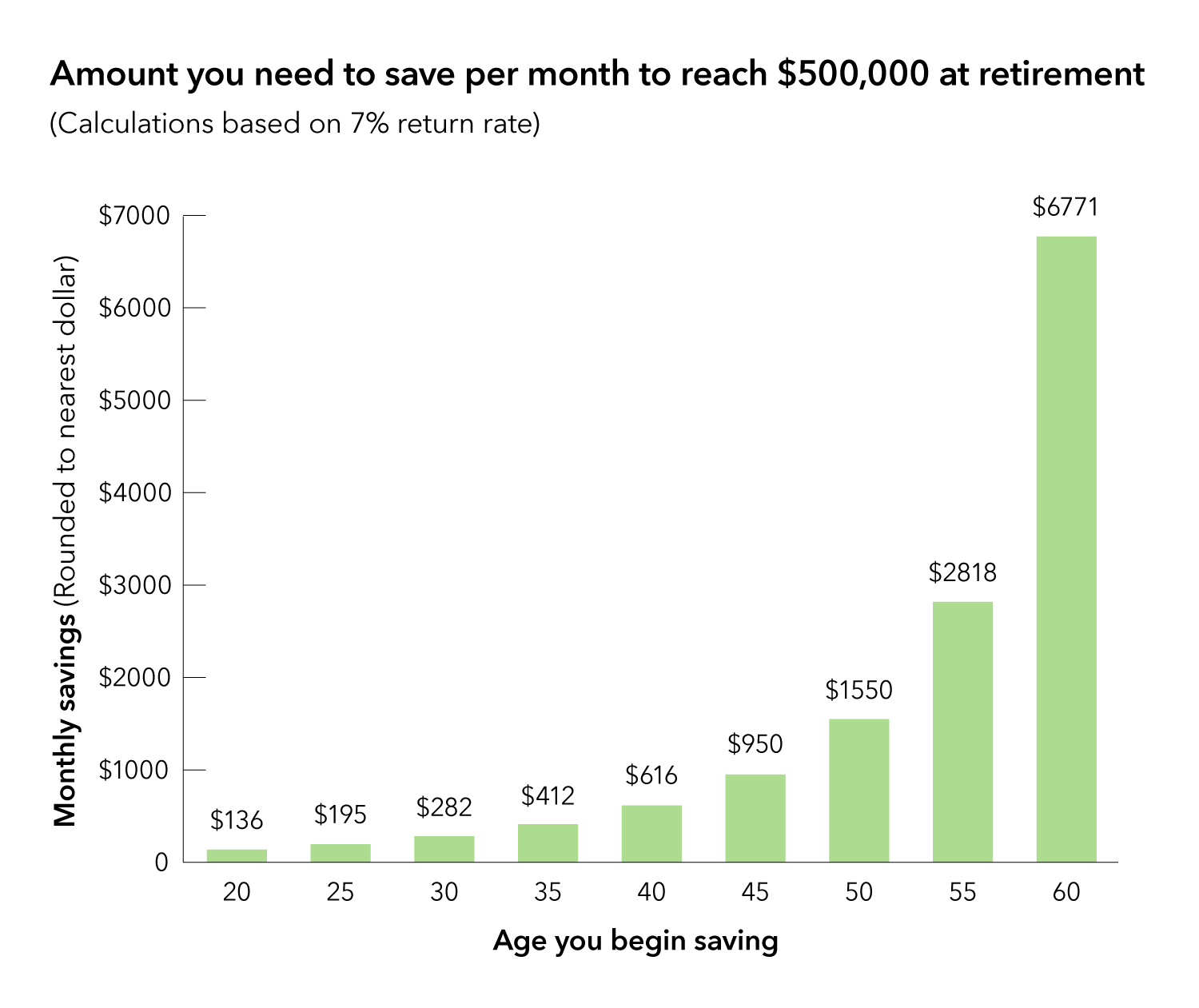

Saving and investing for the long term is the best way to achieve financial security. Start off with determining what you want to save for in life—an emergency fund, a vacation, a house, or college. Decide what’s most important and make a plan accordingly. You can use the SEC’s Savings Goal Calculator to see how much you need to save each month to meet your goals. It’s easy. Plug in your desired final savings goal, how much money you have readily available to invest, how long you plan to save, and a few assumptions. The calculator will show you how much money you need to contribute each month in order to reach that goal.

Immediate action #3: ✔ start saving and investing early

The fastest way to see your money grow is through compound interest, especially when you start early. The power of compound interest calculated on the initial amount of money you invest, and also on interest earned, can provide tremendous long-term benefits. For example, if you want to save $500,000 for retirement at age 65, by starting at age 25 and investing in a mutual fund averaging seven percent a year, you’d only have to contribute roughly $200 per month. If you get a later start and don’t begin saving until age 50, you’d have to save more than $1,500 per month, nearly eight times the amount, to reach the same total savings.

Take advantage of the Thrift Savings Plan and matching contributions in the Blended Retirement System

The Thrift Savings Plan (TSP) is the federal government’s version of a 401(k) retirement plan and is one of the best options for retirement investing for servicemembers. Unfortunately, despite the significant benefits it provides in saving for retirement, only half of servicemembers take advantage of, and invest in, the TSP. For those who do, TSP contributions are automatically deducted from your pay and provide tax advantages either today (traditional) or in the future (Roth) . TSP offers fees that are much lower than the average mutual fund. The TSP.gov explains the benefits available to the military. Sign up for TSP using MyPay .

The TSP offers a selection of stock and bond funds with different strategies and varying degrees of risk. This allows you to personalize where your money goes to take into account factors like your investment goals, risk tolerance, and time until retirement. You might also consider a lifecycle fund (L Fund), which is designed to make investing for retirement more convenient by automatically changing your investment mix and fund allocation over time, based on a target retirement date. Make sure your TSP allocation reflects your preference.

If you entered service on or after Jan. 1, 2018, you are automatically enrolled in the new Blended Retirement System (BRS) . With the BRS, you don’t have to serve 20 years to walk away with government-provided retirement benefits like under the old system. For those who just entered service and are automatically enrolled, after 60 days the government will automatically contribute the equivalent of one percent of your base pay into your TSP account. After two years of service, you’ll be vested in that amount and the government will also match up to an additional four percent of your actual TSP contributions. That’s a grand total of five percent government contribution to your TSP! For those who have less than 12 years of service as of Dec. 31, 2017, you are eligible to opt-in, and you can immediately begin taking advantage of a TSP match. Check out the DoD’s BRS resources to make a choice about which system is best for you. Whether you entered under the BRS or have opted in, make sure you contribute at least five percent to your TSP so you don’t miss out on all of the free money!

Understand how your retirement plan ties into your long-term savings goal. As you train to take immediate actions for our country, remember to take immediate actions for yourself and your family. Start your saving and investing plan now for a strong financial future.

Patrick Campbell, Acting Assistant Director of the Bureau of Consumer Financial Protection’s Office of Servicemember Affairs

Lori Schock, Director of the SEC’s Office of Investor Education and Advocacy*

* The Securities and Exchange Commission disclaims responsibility for any private publication or statement of any SEC employee or Commissioner. This article expresses the author’s views and does not necessarily reflect those of the Commission, the Commissioners, or other members of the staff.