Office of Research blog: Initial Fresh Start program changes followed by increased credit scores for affected student loan borrowers

In April 2022, the Department of Education announced Fresh Start , a one-time program to help an estimated 7.5 million borrowers with defaulted federal student loans avoid the negative effects of default and gain access to benefits, such as additional federal student aid, eligibility for new government loans, and a temporary end to involuntary collection activity. According to the Department of Education’s announcement, all eligible defaulted loans will be reported as “current” on credit reports until one year after the COVID-19 pandemic-related federal payment suspension ends. In the meantime, borrowers can make payment arrangements to maintain these benefits after that period and to gain access to more benefits like income-driven repayment plans, student loan forgiveness programs, and short-term relief options such as deferments.

In this piece, we look at the effects of the credit reporting changes made through the Fresh Start program on federal student loan borrowers who have at least one student loan default on their credit record that has been made current in the last six months per the conditions of the Fresh Start program. We find:

- The majority of defaulted federal loans no longer appear on borrowers’ credit records because the defaults likely happened more than seven years ago.

- Borrowers affected by Fresh Start are more likely than others with defaulted student loans to live in high-poverty areas, to have other accounts in collection, and to have low credit scores.

- While average delinquencies on other credit products have not changed for these borrowers, the immediate credit reporting changes from Fresh Start coincided with a median increase of more than 50 points to their credit scores, though many of these borrowers continue to have low scores.

Number of borrowers affected by credit reporting changes through Fresh Start

Using the Consumer Financial Protection Bureau’s (CFPB) Consumer Credit Panel, a deidentified sample of credit records from one of the nationwide consumer reporting agencies, we analyzed the credit histories of student loan borrowers who appear to have been affected by the Fresh Start program. As of August 2022, the Department of Education estimated that 7.5 million borrowers had at least one defaulted federal student loan that would be eligible for Fresh Start. However, many defaulted federal student loans are generally not reported on credit records because the loans aged off the borrower’s credit record in compliance with the Higher Education Act . Federal student loans which have been reported to be in default for seven years or more must be deleted from a consumer’s credit record. Under the Department of Education’s Fresh Start Program specifically, the Department deleted reporting about loans that were delinquent for more than seven years . Our analysis of the Consumer Credit Panel suggests that only 2.7 million consumers had a defaulted student loan on their credit record in August 2022.1 That means that more than 60 percent of borrowers with a defaulted federal student loan experienced default at least seven years prior to August 2022.

To classify loans as affected by Fresh Start, we need to observe the loan both in default before the reporting change and then after the change. The credit reporting changes under Fresh Start first started taking effect for many borrowers in December 2022, but these changes were not required for all furnishers until February 2023. As a result, we consider loans affected by Fresh Start to be defaulted loans that have a credit reporting change after November 2022 and by February 2023.

About 620,000 borrowers of the 2.7 million who had a defaulted loan reported in August 2022 no longer had a previously defaulted student loan reported on their credit report by February 2023. In most cases, the borrower no longer had any outstanding student loan reported on their credit record in February 2023, suggesting the loan may have been paid off, discharged, or aged off the borrower's credit record. Some of these loans may be affected by Fresh Start, but we exclude them from this analysis because we do not see any changes for these loans in the Consumer Credit Panel data.

A much smaller group of 200,000 borrowers, which we refer to as “borrowers with loans still reported as defaulted,” had loans in default or collections in February 2023 and did not have changes in the reported payment statuses consistent with Fresh Start. These loans that were still reported as in default may include private loans, federal loans not eligible for Fresh Start, or federal loans eligible for Fresh Start but incorrectly reported as of February 2023. While these borrowers’ credit reports have not been affected by Fresh Start, they may provide a useful comparison group for Fresh Start borrowers.

This leaves about 1.9 million student loan borrowers whose credit record had a student loan reported as defaulted in November 2022 and current in February 2023. We refer to this group as “borrowers with Fresh Start loans.”

Finally, a wholly separate group of “borrowers with pre-pandemic delinquencies” on their student loans serves as another comparison for Fresh Start borrowers. This group consists of another 2.7 million student loan borrowers who had a delinquency (or default) on at least one student loan at the start of the pandemic in February 2020 but did not have a loan reported as in default as of August 2022. For some of these borrowers, the delinquent (non-defaulted) loan was treated as current when reported to consumer reporting companies due to the Coronavirus Aid, Relief, and Economic Security Act and subsequent administrative action; other borrowers may have rehabilitated their loan between March 2020 and August 2022; and others may still have a delinquent student loan.2

Characteristics of student loan borrowers with payment difficulties

While all three borrower groups—Fresh Start borrowers, borrowers with loans still reported as defaulted, and borrowers with pre-pandemic delinquencies—generally have worse credit outcomes than other student loan borrowers, Fresh Start borrowers whose federal student loans still appear on their credit reports have more indicators of financial difficulties and less access to credit than the other two groups.

As seen in the table and discussed in prior CFPB research, borrowers who have missed student loan payments in the last few years show more signs of financial stress than student loan borrowers overall. For example, Fresh Start borrowers who appear in our Consumer Credit Panel sample had the lowest median credit scores across the three groups, at 530 as of September 2022. More than half of these borrowers had deep subprime scores and limited access to credit prior to the implementation of Fresh Start. Meanwhile, borrowers with loans that remained in default and borrowers with pre-pandemic delinquencies had substantially higher—though still quite low—credit scores (589 and 610, respectively) compared to student loan borrowers overall (691). Consistent with these lower credit scores, borrowers in the sample affected by Fresh Start also had dramatically lower median total credit limits ($400) than student loan borrowers overall ($10,500) and even other borrowers with recent student loan repayment difficulties ($2,500-2,700). Further, Fresh Start borrowers had much less available credit remaining in both relative and absolute terms.

Table: Characteristics of student loan borrowers with payment difficulties, September 2022

| Characteristic | All student loan borrowers | Borrowers with Fresh Start loans | Borrowers with defaulted non-Fresh Start loans | Borrowers with pre-pandemic delinquencies |

|---|---|---|---|---|

Median age |

35 |

36 |

34 |

37 |

Median credit score |

691 |

530 |

589 |

610 |

Median total credit limit ($) |

10,500 |

400 |

2,700 |

2,500 |

Median percent available credit (%) |

65 |

25 |

34 |

32 |

Median student loan balances ($) |

20,372 |

15,055 |

26,532 |

21,125 |

Median balance on non-student loans ($) |

10,456 |

0 |

4,737 |

6,711 |

Percent with a mortgage (%) |

26 |

5 |

12 |

13 |

Percent w/non-student loan delinquency (%) |

19 |

41 |

40 |

42 |

Percent w/non-medical collection (%) |

18 |

50 |

37 |

42 |

Percent w/medical collection (%) |

14 |

34 |

21 |

31 |

Percent high-poverty Census tract (%) |

16 |

27 |

22 |

24 |

Number of borrowers (millions) |

45.7 |

1.9 |

0.2 |

2.7 |

Source: CFPB Consumer Credit Panel. Median balances on non-student loans, credit limits, and available credit do not condition on having non-student loan debt and include borrowers with $0 balances and limits. Balances on non-student loans only include balances on installment loans. The percent available credit is one minus the total balances on general-purpose credit cards divided by total credit limit on all cards for each borrower. Non-student loan delinquencies include accounts reported as charged-off. “High-poverty” Census tracts are those where 40 percent or more of adults in the tract have household income below 200 percent of the federal poverty threshold.

Fresh Start borrowers in the Consumer Credit Panel sample also had more than $10,000 less in outstanding balances on non-student loan installment loans, such as auto loans and mortgages, than student loan borrowers generally, and $4,700 less in balances than borrowers with defaulted student loans not affected by Fresh Start. Borrowers affected by Fresh Start had much less revolving and installment non-student loan credit, and they had just over half as much in outstanding student loan balances as borrowers with loans still in default and about two-thirds as much as those who previously had a delinquent student loan.

As discussed in a prior report and blog about the federal student loan payment suspension, delinquencies on non-student loan accounts are higher for borrowers with defaulted student loans than for borrowers with non-defaulted student loans. We see that again here, where delinquency rates on non-student loan products are about twice as high (40 percent) for borrowers who have had payment difficulties on their student loans than for borrowers overall (21 percent).3

Fresh Start borrowers also are more likely to have both medical debt collections and a third-party debt collections reported on their credit record that are not student-loan- or medical bill-related. And, finally, consistent with prior research , borrowers with student loan delinquencies or defaults are much more likely to live in high-poverty areas. For example, borrowers affected by Fresh Start are 50 percent more likely to live in these areas than student loan borrowers overall (27 percent versus 17 percent).

Fresh Start coincides with no change in other delinquencies, but immediate increases in credit scores

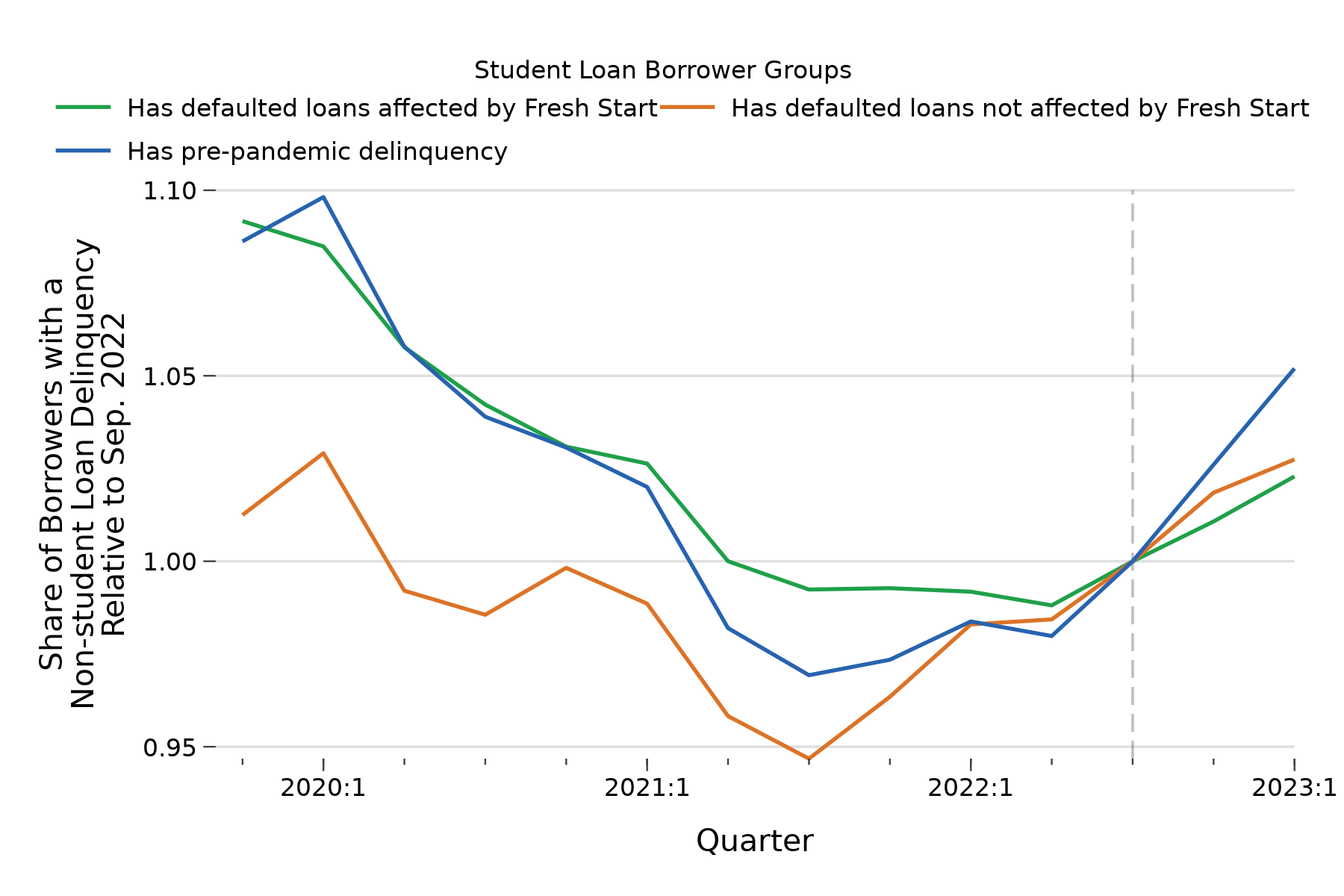

The sharp drop in delinquencies on student loans for borrowers affected by Fresh Start does not appear to have spilled over to other loans for these borrowers. Collection activities were paused for borrowers before the beginning of Fresh Start because of the COVID-19 payment suspension, which began in March 2020, so it is not surprising that delinquencies on other loans are unchanged. Figure 1 shows that delinquencies on non-student loan debts increased slightly for all three borrower groups since September 2022. Borrowers with defaulted student loans, whether they were affected by Fresh Start or not, had similar increases in non-student loan delinquencies. In contrast, borrowers with pre-pandemic student loan delinquencies had an increase in non-student loan delinquencies almost twice as large from September 2022 to December 2022. Student loan borrowers with suspended federal student loan payments (who did not have defaulted student loans prior to the pandemic) also have an increase in non-student loan delinquencies since mid-2021, as documented in a recent blog post.

Figure 1: Non-student loan delinquencies for student loan borrower groups with payment difficulties relative to September 2022, December 2019-March 2023

Note: All values are relative to the non-student loan delinquency rate for each group in September 2022.

Source: CFPB Consumer Credit Panel

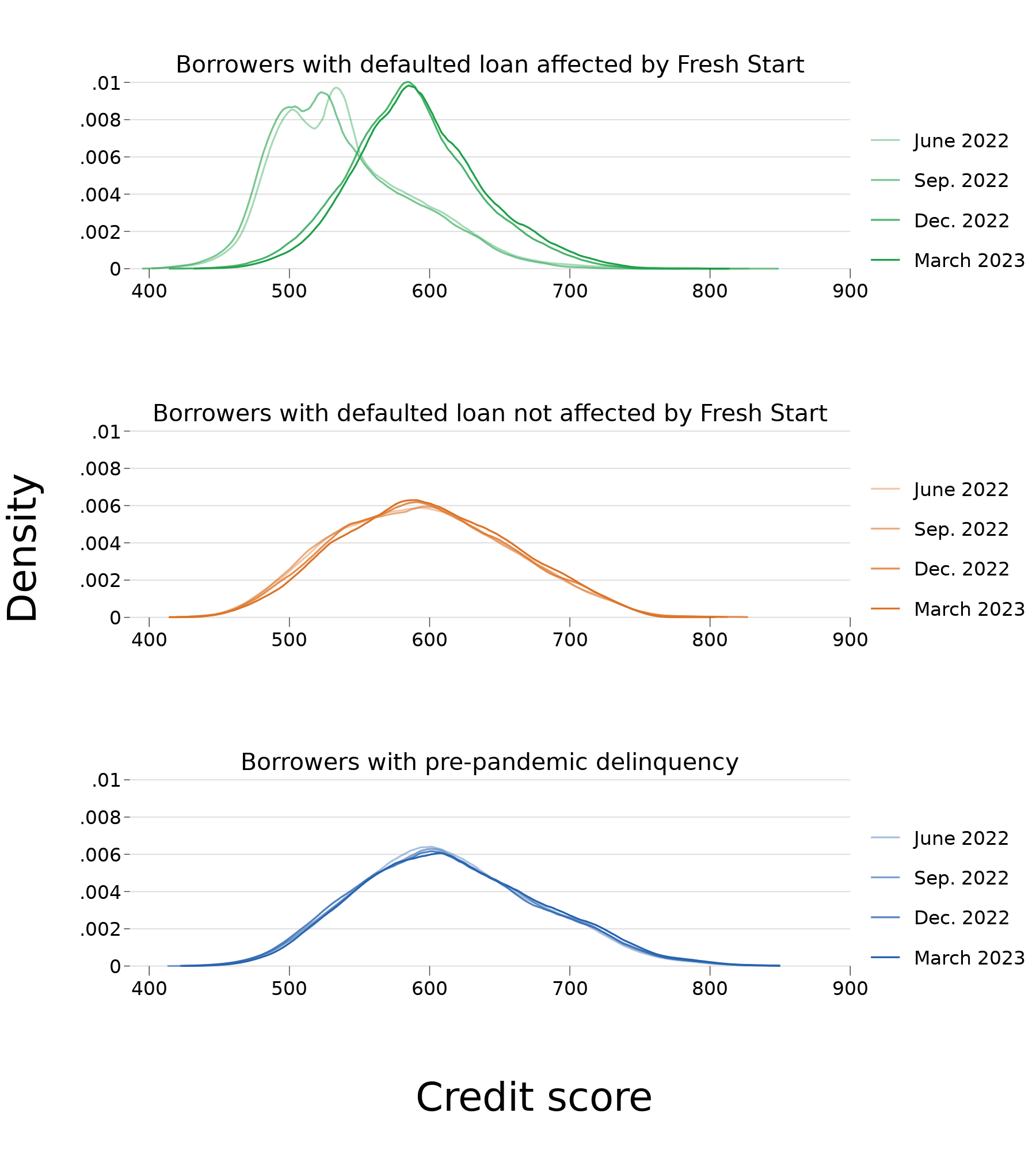

Fresh Start did, however, coincide with an immediate increase in credit scores for affected borrowers. Figure 2 shows the distribution of credit scores each quarter from December 2019 to March 2023 for all three groups. Prior to December 2022, borrowers ultimately affected by Fresh Start had lower scores than the other two groups of borrowers, but there was little overall change in credit scores for all three types of borrowers prior to the beginning of Fresh Start. By December 2022, however, credit scores for Fresh Start borrowers increased dramatically and aligned more with the scores of borrowers whose loans were not affected by Fresh Start.

Figure 2: Credit Score Distribution for Student Loan Borrowers with Payment Difficulties, June 2022-March 2023

Source: CFPB Consumer Credit Panel

After the change in credit reporting, Fresh Start borrowers experienced median credit score increases of about 54 points from September 2022 to December 2022. In contrast, student loan borrowers whose defaulted loans did not appear to be affected by Fresh Start or who had delinquencies at the start of the pandemic had almost no change in their scores (median changes of 2 points and 1 point, respectively).

This increase for Fresh Start borrowers represents a meaningful change as approximately 48 percent of these borrowers moved up at least one credit score tier—including from deep subprime to subprime—in late 2022, while only about 13 percent of borrowers in the other two groups moved up at least one credit score tier over the same period. Prior to this new program, borrowers affected by Fresh Start were less than half as likely to move up a credit score tier from one quarter to the next.

As discussed in a recent blog post, credit score increases that move people into higher credit score tiers may increase their access to credit and result in new credit access at lower interest rates. Many borrowers whose credit scores increased following Fresh Start still have low credit scores and limited access to credit, but now more than 25 percent of those borrowers have a near-prime score or better, as compared to less than 8 percent before Fresh Start. Such score increases may result in substantial decreases in interest costs for borrowers. For example, this sort of change might correspond to $1,700 in interest savings for a typical auto loan, holding everything else the same.4 It remains to be seen whether these changes have resulted in new credit applications and account openings, especially as overall consumer credit access tightens and if delinquencies on borrowers’ non-student loan accounts continue to rise. We will continue to monitor how credit access, take up, and repayment change for these borrowers.

Fresh Start’s change to the information furnished to consumer reporting companies for defaulted student loans is automatic, but borrowers with defaulted loans must contact their loan holder to proactively take advantage of Fresh Start in order to get their loans out of default and enroll in income-driven repayment plans, student loan forgiveness programs, and short-term payment pauses. If affected borrowers take no action, their loans may again be reported as being in default and their credit scores may drop back down.

In the meantime, some borrowers affected by Fresh Start may have their loans discharged before they re-enter repayment or are again subject to involuntary collection activity as the Department of Education continues to take steps to ensure federal student loan borrowers receive discharge benefits to which they are entitled, including disability or borrower defense.

The views expressed here are those of the author and do not necessarily reflect the views of the Consumer Financial Protection Bureau. Links of citations in this post do not constitute an endorsement by the Bureau.

Footnotes

- These defaulted student loans reported on consumer credit records had balances totaling $62 billion. These estimated borrower counts and balances also include some private student loans. Some defaulted student loans may disappear temporarily due to transfers and reporting lags, but many delinquencies have aged off credit records. Loans reported as charged-off are likely private student loans and are not included in these counts.

- Borrowers with private loans (and federal loans not subject to the payment suspension for federally held loans) may have delinquent student loans. Additionally, some borrowers with a previously delinquent or defaulted loan may have benefitted from a partial loan discharge since the start of the pandemic.

- The delinquency rates reported here mostly closely correspond to the 19 percent student loan borrowers who had at least one delinquency on a non-student loan account before the pandemic noted in the 2022 report. That is, these delinquency rates include accounts reported as charged-off or in collections.

- This calculation is based on a $20,000 six-year loan with an interest rate decrease of 2.4 percentage points. Potential interest rate changes and savings may vary by borrower and lender.