Servicemember reports about identity theft are increasing

JAN 12, 2023

Introduction

Identity theft can quickly reverse a good credit report, filling it with unknown, maxed-out credit card accounts or collections accounts for mystery debts. It can spell trouble for anyone, but for servicemembers, identity theft resulting in negative information on a credit report can lead to the loss of a security clearance or even discharge.

Consumer reporting companies, also known as credit bureaus, compile and sell consumer credit reports. By law, they are required to promptly block the reporting of information that consumers allege results from identity theft.1 Consumers attempting to resolve credit reporting inaccuracies related to identity theft often describe a complicated and lengthy process.2 Some consumers have even described giving up and paying a bill they did not owe after a protracted and unsuccessful attempt to resolve a dispute.3 For active duty servicemembers, the problem can quickly cascade and affect their credit, their housing options, and even their careers.

Nationwide consumer reporting companies (NCRCs) must be responsive to the identity theft and credit concerns of servicemembers, veterans, and military families. We also encourage financial institutions to consider how they can strengthen their protections against identity theft. The CFPB will continue to use its available tools to ensure that NCRCs and financial institutions take appropriate action when servicemembers report identity theft.

Servicemembers report identity theft at a higher rate

In 2021, military consumers—who include active duty servicemembers, veterans, and military family members—reported nearly 50,000 cases of identity theft to the Federal Trade Commission (FTC).4 Military consumers reported their information was misused to fraudulently access government benefits, credit cards, bank accounts, loans, and leases; and even to set up telephone and utility services.5

A 2020 report by the FTC found that active duty servicemembers were 22 percent more likely than their civilian counterparts to report that an identity thief used their stolen information to open a new credit card or other account.6 The report, which looked at identity theft data reported to the agency from 2015-2019, also found that servicemembers were 76 percent more likely to report that identity theft resulted in the misuse of an existing account, and three times more likely to report that identity theft resulted in money taken directly from their accounts.7

A steady income may make servicemembers a target for identity thieves looking to set up fraudulent credit accounts or tap into bank accounts. Frequent relocation may also increase servicemembers’ risk of identity theft. Permanent change of station orders can require a new round of home and apartment searches, spouse employment searches, and utility connections that may increase the risk of personal information falling into the hands of identity thieves.8

Identity theft can threaten servicemembers’ security clearances and housing options

Many servicemembers and all officers are required to pass a national security clearance check that includes a review of their credit history and ability to meet their financial obligations.9 Thereafter, the financial status of servicemembers with security clearances is continuously evaluated.10 If a review reveals a history of failing to meet their financial obligations, being in excessive debt, or having a high debt-to-income ratio, the servicemember’s security clearance may be revoked. If identity theft results in fraudulent credit accounts and past-due bills showing up on a servicemember’s credit report, it can swiftly derail the servicemember’s career, undermining military readiness and national security.

Servicemembers may also be disproportionately affected by identity theft because frequent relocations may require them to regularly obtain new housing. We also continue to hear reports of high rent and the high cost of homeownership for servicemembers who live in private housing. Every year, an estimated 400,000 servicemembers make a permanent change of station (PCS).11 A PCS may take a servicemember, and any family living with them, to a different duty location and may require a new mortgage or lease. When information about fraudulent debts appears on credit reports because of identity theft, it can limit housing options further or increase already high costs. Servicemembers seeking rental housing may have their applications rejected or be charged add-on fees due to tenant screening practices that rely in part on inaccurate credit reporting information.12 Homeownership options may be limited because of an inappropriately lowered credit score.

An unrecognized debt may be the first sign of identity theft

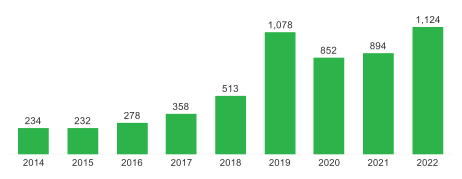

Often, military consumers only learn that their identity was stolen when a debt collector calls them about a debt they do not think is theirs, or a debt they do not recognize appears on their credit report. Between 2014 and 2022, military consumer complaints to the CFPB about debts they said resulted from identity theft increased nearly fivefold, from just over 200 annually in 2014, to more than 1,000 in 2022.

FIGURE 1:

Military consumer reports of debts attributed to identity theft

This figure displays annual volumes of complaints submitted to the CFPB in which the consumer identified as a servicemember, veteran or military family member and selected the “debt was result of identity theft” as the sub-issue.13

In many of these complaints, military consumers describe their experiences. In the words of one servicemember dealing with an identity theft-related past-due debt on their credit report and concerned about their security clearance:

I filed a dispute in [date] for this account and provided my military orders and an FTC Identity Theft Report. [Credit reporting company] initially agreed with my dispute, added the fraud statement to my account and removed the negative information. In [date] I received a letter stating that the company that now owns the closed account disputed my dispute and certified that this is my account. [credit reporting company] added the negative information back to my account before contacting me. To this day I have not been able to get in touch with the company that owns the debt and I have asked for proof that I own this account and have not been furnished. This negative information has the potential to derail my service. I currently hold a security clearance and bad credit is a disqualifying factor.14

Past-due debts related to identity theft can take their toll on military consumers trying to correct the problem while staying focused on their mission. In the words of one servicemember stationed overseas while trying to deal with a medical debt that was not theirs:

For years, [credit reporting company] adds collections account to my credit report for medical bills that do not belong to me. I am in the [military] and I received medical care in the Army base through Tricare. I am station in [foreign country] and I have not resided in California in years. California is where the original creditor is located…This situation has become extremely frustrating because I am in the military and I can lose my military clearance for having collection accounts in my records. Other, than this, my credit report is excellent…I need help ensuring this remaining collection account is removed from my report, but more importantly to ensure that this does not happen again. I have deal with it for years, and I am exhausted.15

While a debt collection action related to identity theft could threaten to derail an active duty servicemember’s security clearance and career, there is also evidence that veterans are being harmed. In the words of one veteran who reached out to the CFPB:

I filed a victim of identity theft [report with the credit reporting company] and the credit bureau never showed proof that this was my debt and when I called the company [that furnished the debt] they claim they don’t show a record of this at all but somehow they are still reporting me as late on an account that’s saying it’s been closed and charged off! I am in the process of closing on my house and the [company] keeps updating my report showing I’m late. I have no idea why this matter has not been removed when it’s clearly not my debt. I am a military veteran who in that year was not even in the country…16

Financial institutions have an obligation to be the first line of defense

Financial institutions and some creditors are required to have procedures in place to identify suspicious activities, or “red flags,” that may suggest a wider problem of fraud or identity theft.17 While these procedures vary based on business size and activities, they must be able to identify possible signs of identity theft in day-to-day operations, have a process to detect red flags of identity theft when they occur, design a course of action for use when they detect these red flags, and provide a plan to stay current on new threats.18 Many businesses have these procedures in place, but others may not, or may not have procedures sufficient to protect consumers.19 Financial institutions are also required to have programs designed to ensure that customer information remains confidential and to prevent unauthorized access to such information.20 Further, any person who collects certain consumer information that establishes creditworthiness, or eligibility for credit, insurance, employment, or other purposes, must properly dispose of the information.21

Consumers struggle to resolve their disputes about inaccurate information on credit reports

In a 2022 report, the CFPB described consumers’ frustration with submitting complaints about inaccurate information in a credit report.22 In their complaints, consumers described difficulty in managing a complicated dispute process where they are often required to repeatedly dispute inaccurate information while managing other personal issues. Consumers who were attempting to address inaccuracies related to identity theft described a particularly complicated process. They often felt they were stuck in a loop of providing documentation only to have no updates made to their report. In cases where an incorrect debt collection item was placed on their report, some consumers even described paying a debt they did not owe to resolve the issue.23

How military consumers can protect their credit and address identity theft

There are steps you can take now to help protect your credit, and there are actions to take if military consumers have experienced identity theft.

How servicemembers can protect their credit

- Request an active duty alert or security freeze if you are about to deploy

Members of the armed forces (such as the Marines, Army, Navy, Air Force, Space Force, and Coast Guard) can request active duty alerts, which give servicemembers protection while they are deployed.24 These alerts let businesses know that you are probably out of the country and that the business must take reasonable steps to verify your identity before granting new credit in your name. Active duty alerts are free. They last for 12 months but you can renew them for the length of your deployment. If you request an active duty alert at one NCRC, it will apply to all three NCRCs.

A security freeze is free and lets you freeze or unfreeze your credit files at the three NCRCs—Experian, TransUnion, and Equifax–but you must contact each one separately.25 A security freeze prevents prospective creditors from accessing your credit file at these three companies. Without these credit files, creditors typically will not let you or others open new credit accounts in your name. - Military consumers should review their credit reports regularly and dispute inaccurate information

The CFPB provides resources to help military consumers dispute errors on their credit report and protect their credit history.26 - Active duty servicemembers, reservists on active duty, and members of the National Guard can receive free credit monitoring services

Active duty military, reservists on active duty, and members of the National Guard can get free credit monitoring from each of the three NCRCs but must place a separate request with each NCRC. Servicemembers should specifically request free credit monitoring and report problems accessing this free service to the CFPB.

How military consumers can address identity theft

- Report identity theft to IdentityTheft.gov

IdentityTheft.gov is the federal government’s one-stop resource for people to report identity theft and get a personal recovery plan. IdentityTheft.gov will ask you questions about what happened, then give you detailed guidance, sample letters, and more, to help you fix the problems the identity theft caused. Visit IdentityTheft.gov to get fast and effective recovery help. - Get additional help available to military servicemembers

When a financial problem like identity theft arises, contact your installation’s Personal Financial Manager (PFM)27 or Legal Assistance Office28 for free, expert advice and assistance.

Submit a complaint to the CFPB

If you are a servicemember, veteran, or military family member having problems with your credit report or other consumer financial products because of identity theft or for another reason, you can submit a complaint to the CFPB.29 If you have already experienced identity theft that affected your credit report or financial well-being, you can also share your story with the CFPB to help inform our work to protect consumers and create a fairer marketplace.30

Footnotes

- 15 U.S.C. § 1681c–2.

- Consumer Fin. Prot. Bureau, Annual Report of credit and consumer reporting complaints: An analysis of complaint responses by Equifax, Experian, and TransUnion 37 (Jan. 2022) available at https://files.consumerfinance.gov/f/documents/cfpb_fcra-611-e_report_2022-01.pdf .

- Id. at 38.

- Fed. Trade Commission, Consumer Sentinel Network: Data Book 2021 18 (Feb. 2022) available at https://www.ftc.gov/system/files/ftc_gov/pdf/CSN%20Annual%20Data%20Book%202021%20Final%20PDF.pdf .

- Id. at 19.

- Emma Fletcher., Identity theft causing outsized harm to our troops, Fed. Trade Commission (May, 21, 2020), available at https://www.ftc.gov/news-events/data-visualizations/data-spotlight/2020/05/identity-theft-causing-outsized-harm-our-troops .

- Id.

- See, e.g., Testimony of James S. Rice, House Comm. on Oversight & Reform 2 (July 13, 2022), available at https://docs.house.gov/meetings/GO/GO06/20220713/114983/HHRG-117-GO06-Wstate-RiceJ-20220713.pdf .

- See 32 CFR 66.6(b)(8)(vi). See also Dep’t of Def., DOD Manual 5200.02: Procedures for the DOD Personnel Security Program (PSP) 69 (Oct. 29, 2020), available at https://www.esd.whs.mil/Portals/54/Documents/DD/issuances/dodm/520002m.PDF . (Continuous evaluation is the periodic reviewing of the individual’s background to determine whether they continue to meet the requirements for national security eligibility. DoDI 5200.02 requires all personnel in national security positions to be subject to continuous evaluation).

- Anthony Camilli and Joshua Friedman, WARNO: New security clearance guidelines make it more important than ever for servicemembers to monitor their credit, Consumer Fin. Prot. Bureau (August 20, 2018), available at https://www.consumerfinance.gov/about-us/blog/warno-new-security-clearance-guidelines-make-it-more-important-ever-servicemembers-monitor-their-credit/.

- See Military One Source, PCS: The Basics About Permanent Change of Station (July 2022), https://www.militaryonesource.mil/moving-housing/moving/planning-your-move/pcs-the-basics-about-permanent-change-of-station/ .

- See Consumer Fin. Prot. Bureau, Consumer Snapshot: Tenant background checks 11 (Nov. 2022), https://files.consumerfinance.gov/f/documents/cfpb_consumer-snapshot-tenant-background-check_2022-11.pdf (Through complaints and interviews, as well as independent reporting by outside groups, the CFPB has heard from renters about issues with inaccurate, obsolete, or misleading information being included in tenant screening reports). See also Consumer Fin. Prot. Bureau, Tenant Background Checks Market 22 (Nov. 2022), https://files.consumerfinance.gov/f/documents/cfpb_tenant-background-checks-market_report_2022-11.pdf (prospective tenants can lose housing opportunities, pay multiple application fees, have extended search times, and ultimately obtain less-desirable housing. Renters may also be required to pay add-on charges, extra security deposits, and higher rent based on a negative tenant screening report).

- Complaint data in this report are current as of January 1, 2023. This report excludes some complaints that the CFPB received, including multiple complaints submitted by a given consumer on the same issue (i.e., duplicates), whistleblower tips, and inactionable complaints (e.g., incomplete submissions, withdrawn complaints, and complaints in which the CFPB discontinued processing because it had reason to believe that a submitter did not disclose its involvement in the complaint process).

- Consumer Complaint 5002280, https://www.consumerfinance.gov/data-research/consumer-complaints/search/detail/5002280.

- Consumer Complaint 3605429, https://www.consumerfinance.gov/data-research/consumer-complaints/search/detail/3605429.

- Consumer Complaint 3810540, https://www.consumerfinance.gov/data-research/consumer-complaints/search/detail/3810540.

- 15 U.S.C. § 1681m(e).

- The Red Flags rule is implemented by the Federal Trade Commission at 16 C.F.R. § 681.1(d), the Office of Comptroller of the Currency at 12 C.F.R. § 41.90, the Federal Reserve at 12 C.F.R § 222.90, the Federal Deposit Insurance Corporation at 12 C.F.R. § 334.90, and the National Credit Union Administration at 12 C.F.R. § 717.90. The Consumer Financial Protection Bureau does not enforce the Red Flags rule.

- See, e.g., Securities and Exchange Commission, SEC Charges JPMorgan, UBS, and TradeStation for Deficiencies Relating to the Prevention of Customer Identity Theft (Jul. 27, 2022) available at https://www.sec.gov/news/press-release/2022-131 .

- 15 U.S.C. § 6801(b). The Consumer Financial Protection Bureau does not enforce this provision of the Gramm-Leach-Bliley Act.

- 15 U.S.C. § 1681w. The Consumer Financial Protection Bureau does not enforce the Disposal rule.

- Consumer Fin. Prot. Bureau, supra note 2 at 35.

- Id. at 36-38.

- See Consumer Fin. Prot. Bureau, How can I prevent anyone from using my personal information to obtain credit while I am deployed overseas in the military? available at https://www.consumerfinance.gov/ask-cfpb/how-can-i-prevent-anyone-from-using-my-personal-information-to-obtain-credit-while-i-am-deployed-overseas-in-the-military-en-1367/.

- See Consumer Fin. Prot. Bureau, What does it mean to put a security freeze on my credit report? available at https://www.consumerfinance.gov/ask-cfpb/what-does-it-mean-to-put-a-security-freeze-on-my-credit-report-en-1341/.

- Consumer Fin. Prot. Bureau, Credit reports and military service, available at https://files.consumerfinance.gov/f/documents/cfpb_ymyg-servicemembers-tool_credit-reports-military-service.pdf .

- Military OneSource, Personal Financial Management Counseling Options (May 1, 2020) available at https://www.militaryonesource.mil/financial-legal/personal-finance/personal-financial-management-counseling-options/ .

- Dep’t of Def., U.S. Armed Forces Legal Assistance available at https://legalassistance.law.af.mil/ .

- Consumer Fin. Prot. Bureau, Submit a Complaint available at https://www.consumerfinance.gov/complaint/.

- Consumer Fin. Prot. Bureau, Tell your story about a financial product or service available at https://story.consumerfinance.gov/tell-your-story/s/tell-your-story.