What we’re hearing from consumers in New Mexico

- English

- Español

This week, Consumer Financial Protection Bureau Director Rohit Chopra will visit Gallup and Albuquerque, New Mexico, to meet with elected officials, tribal leaders, community leaders, and consumer advocates to discuss issues New Mexicans are facing—particularly issues related to medical debt and junk fees.

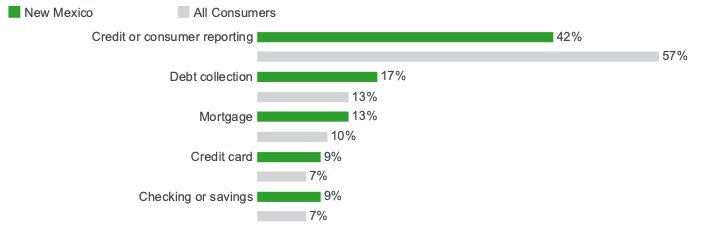

The CFPB’s public Consumer Complaint Database lends valuable insights into these subjects. Since 2011, the CFPB has published more than 11,600 complaints from New Mexicans. Mirroring nationwide trends, complaints about credit reporting make up most of these complaints (42%), followed by debt collection (17%) and mortgage (13%) (Figure 1). New Mexicans also submit complaints about debt collection, mortgage, credit cards and checking or savings at greater rates than all consumers.

FIGURE 1. COMPLAINTS SUBMITTED BY NEW MEXICANS AND ALL CONSUMERS, TOP FIVE PRODUCTS

Insights from complaints

The tangled web of medical debt

Credit reporting and debt collection together create a complex web of problems when medical billing errors are involved. The CFPB reported in 2022 that 17.94% of New Mexico’s population had medical debt totaling approximately $881 million, and the average amount owed is $2,692.

New Mexico is among a handful of states that have enacted new laws governing medical debt collection. However, the CFPB has heard from New Mexicans how they continue to confront predatory pricing, faulty billing, or insurance company runarounds that result in medical bills they are unable to pay.

One individual reported how they were given the runaround when trying to address a medical billing error and related problems with erroneous debt collection and credit reporting:

“In [2016] I was in a severe motor vehicle accident, and spent 5 days in the trauma unit of [hospital]. I was insured by [insurance company] at the time, and they initially denied coverage for some of the [hospital] medical bills. I appealed that denial, and was successful in my appeal. During the lengthy appeal process, several bills were sent to [debt collector] by [hospital] for collections. I informed [debt collector] that they were disputed medical bills, and that I was appealing their status with my insurance company. I had also communicated the dispute to the [hospital] billing department long before they sent the bills to [debt collector] for collections, and I made [debt collector] aware of that fact. I continued to inform [debt collector] that the appeal was ongoing, and yet [debt collector] reported them as delinquencies to the credit bureaus …

I have attempted several times to resolve this issue with [debt collector] via phone and fax, but have been unsuccessful. I have also contacted [hospital] billing, who has informed me that only [debt collector] can address my issue. … I have also filed disputes with each of the three credit bureaus, only one of which has removed the negative reporting.

It is also worth noting that I paid the bills out of pocket while the appeal process with my insurance company proceeded. I mentioned this to one of [debt collection] representatives on the phone, who then indicated that by paying the bill I was myself implying that the bill was legitimate, which I feel was a false representation … My credit reports do show the items as paid, but that does not remove the negative reporting of collections.

Because the bills which were sent to [debt collector] were the responsibility of [insurance company], and [insurance company] has confirmed that, I feel that it is wrong for these items to adversely affect my credit rating.”

Recent changes made by the three largest consumer reporting companies have resulted in the removal of all paid medical debts from consumer credit reports, of medical debts less than a year old, and of all medical collections under $500. However, those changes alone do not end the downstream financial consequences endured by millions of Americans just because they get sick or injured. Even before medical debt may land on a consumer report, the CFPB wants to understand how medical debt affects consumers’ financial lives.

The CFPB is taking concrete steps to address the burden of medical debt and to lower healthcare costs for patients and families. Recently, the CFPB launched a public inquiry with the U.S. Department of Treasury and the U.S. Department of Health and Human Services to gain a better understanding of the consumer harms and financial challenges raised by specialty medical payment products, such as medical credit cards and installment loans.

You can’t budget for junk fees

Along with several other states, New Mexico has alerted the CFPB to their concern about fees that consumers are routinely compelled to pay to access consumer financial services or forced to pay for services they do not want.

An individual from Rio Rancho reported how they were charged a credit card late fee despite mailing their payment several days before the due date. A servicemember from Las Cruces described how their account was closed after incurring an overdraft fee. As many Americans know, these junk fees can quickly add up and throw off a carefully planned budget – not to mention the hassle that comes from having to open a new bank account if your current bank decides to close yours or of having to close an account that was reopened without your permission.

The CFPB is focusing on ways to increase competition and reduce costs in financial services. Earlier this year, the CFPB proposed a rule to curb excessive credit card late fees that cost American families about $12 billion each year. The CFPB also recently took steps to save Americans money by addressing junk fees in banking, by issuing guidance about two junk fee practices – surprise overdraft fees and surprise depositor fees.

Learn more, take action

The CFPB has resources to help you learn more about our work around medical debt and junk fees, and act when you have a problem.

Medical debt

Learn about the impact of unfair medical debt collection and coercive credit reporting practices.

Junk fees

Learn about different types of junk fees, and what the CFPB is doing to protect consumers.

Submit a complaint

If you have a problem with credit reporting, medical debt collection, or unexpected fees, you can submit a complaint with the CFPB.