Servicemembers exhibit higher levels of financial well-being than the U.S. population overall

Recently, the Department of Defense (DoD) released its Annual Report on the Financial Literacy and Preparedness of Members of the Armed Forces, which shows that servicemembers exhibit slightly higher levels of financial well-being compared to the general U.S. population. Last month, the CFPB’s Office of Servicemember Affairs (OSA) released a research brief on the financial well-being of veterans. The research showed that veterans, similarly to servicemembers, experience somewhat higher levels of financial well-being than non-veterans.

Individuals’ financial well-being comes from their sense of financial security and their freedom of choice—both in the present and when considering the future. Following a rigorous research effort to develop a consumer-driven definition of financial well-being, the CFPB developed and tested a set of questions–a “scale”–to measure financial well-being. An individual’s score on the scale is a number between 0 and 100, with a higher score correlating to higher levels of financial well-being.

For the first time in 2017, the DoD included the CFPB’s financial well-being scale in the Status of Forces Survey. This scale enables the DoD and the CFPB to measure servicemembers’ financial well-being over time and understand how the military population compares to the national population at large.

Servicemember responses to the financial well-being questions showed that the average score was 61 for servicemembers on active duty and 60 for reserve component members. Comparatively, the average financial well-being score for U.S. adults was 54 according to the CFPB’s report from 2017.

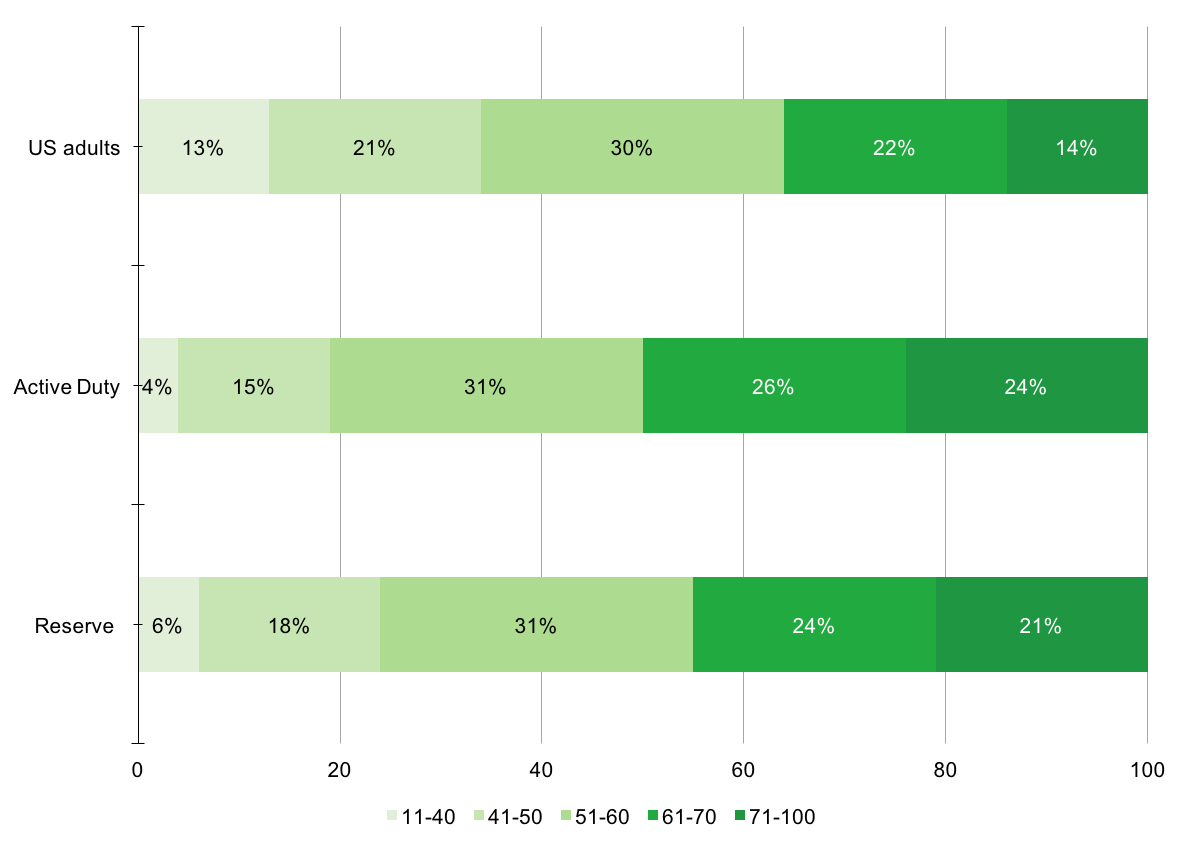

Distribution of Financial Well-Being Scores

In addition to a higher average score, servicemembers had a larger concentration of individual scores at the higher end of the spectrum as you can see in the figure above. For example, 50 percent of active duty servicemembers and 45 percent of reserve component members had a score of 61 or higher, compared to just 36 percent of the general U.S. population.

The higher levels of financial well-being exhibited by servicemembers may be explained by certain characteristics and benefits of military service. For example, the CFPB found in its research that U.S. adults with a stable month-to-month income had a higher score (56) than those whose income varies from month-to-month (50). Individuals with employer-provided health benefits had a higher score (56) than those without (51). Employer-provided retirement savings benefits were also connected to higher levels of financial well-being. Under DoD’s new Blended Retirement System, significantly more servicemembers will separate from the military with some employer-provided retirement benefit even if they don’t serve the 20 years required to receive a military defined benefit pension.

"Roughly one-third of servicemembers have less than one month of emergency savings, and about 23 percent of junior enlisted servicemembers had no emergency savings fund at all."

— Department of Defense Status of Forces Survey

While servicemembers demonstrate higher levels of financial well-being compared to the general U.S. population, this doesn’t mean that they don’t have financial challenges. The survey found that roughly one-third of servicemembers have less than one month of emergency savings, and about 23 percent of junior enlisted servicemembers had no emergency savings fund at all.

The DoD’s and the CFPB’s financial education efforts include a focus on educating servicemembers about smart options to handle emergency expenses while avoiding harmful financial habits and high-cost credit products. The CFPB recently started its Start Small, Save Up initiative, after research showed that 40 percent of Americans could not cover even a $400 emergency expense. With the Start Small, Save Up initiative, the CFPB seeks to encourage all consumers, including servicemembers, to create, maintain, and grow emergency savings accounts as part of their overall financial well-being. As part of the initiative, the CFPB offers resources that can help servicemembers begin an emergency savings account and establish a habit of saving. In addition, DoD provides servicemembers and families free financial education and counseling from nationally accredited personal financial managers and counselors.

The financial well-being of servicemembers is of particular importance to the DoD and the CFPB since financial readiness can impact a servicemember’s ability to perform wartime responsibilities. Inability to manage financial obligations, such as meeting routine or unexpected expenses, can have a negative impact on health and family relations, undermine personal and family readiness, and, as a result, unit and mission readiness. The DoD and the CFPB will continue to collaborate and use the financial well-being scale as a tested method to assess the financial well-being of servicemembers as a group, with a particular emphasis on tracking changes over time.

If you would like to measure your own financial well-being using the CFPB scale, take the quiz.

Mr. Andrew Cohen is the Director for the Office of Financial Readiness in the Office of the Deputy Assistant Secretary of Defense for Force Education and Training. Mr. Jim Rice is the Assistance Director for the Office of Servicemember Affairs at the CFPB.