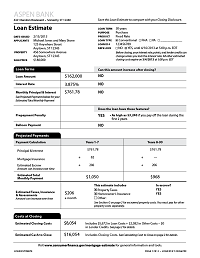

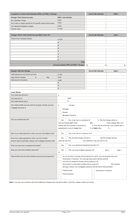

How we improved the disclosures

When shopping for a mortgage, consumers historically received two different, but overlapping federal disclosure forms explaining the terms and costs of the mortgage loans they were considering. Consumers also received two different final disclosures at closing. Congress directed us to combine the existing federal mortgage disclosure forms, which we’ve done by creating the Loan Estimate and Closing Disclosure. The rule implementing the new forms takes effect on October 3, 2015. Here you can see some of the work we’ve done.