Servicemembers, arm yourself with basic car buying skills—How to trade in your car

If you live on or near a military base, you've probably heard radio and television ads for car dealerships that go something like: “We’ll give you the best deal for your old car. Behind on your payments? No problem, we’ll pay off your loan no matter how much you owe.”

Be careful to evaluate car trade-in offers. If the ad claims you have no further responsibility for any amount of your prior financing, the ad may be untrue. Since more than 40 percent of car purchases in 2017 included a vehicle “trade-in,” it’s important to understand the trade-in process so you can maximize your trade-in’s value and get a better overall deal. Here are some tips from the FTC.

Know how much your car is worth

Showing up to a dealership without knowing how much your car is worth is like going fishing without any bait. You might make do with what you find, but you’re more likely to get what you want with the right tools.

Before you talk to an auto dealer, take a couple of minutes to consult a few online pricing guides to find out how much your car might be worth. You can also visit more than one dealership and request estimates to get a better sense of the value of your car. Save those quotes and use them along with the online pricing guides as a starting point for negotiations.

What if I own my trade-in car?

When you own your car outright, trading it in to a dealer is more straightforward. You still need to make sure the value of your car offered by the dealer is consistent with online pricing guides (or other sources you consulted), and then negotiate the best amount you can get for the car. The agreed-upon trade-in value is deducted from the new or used car price. You pay the remaining amount for the new car with cash or with auto financing.

Be aware that you can bargain for your trade-in amount. Also know that if you insist on getting a very high trade-in figure, the dealer may be less willing to negotiate on the car price and charge you more for the new car. Or vice versa: If you insist on a low price for the new car, the dealer might knock down your trade-in price. Be prepared to walk away if you don’t think the offered deal is right for you.

What if I still owe money on my trade-in car?

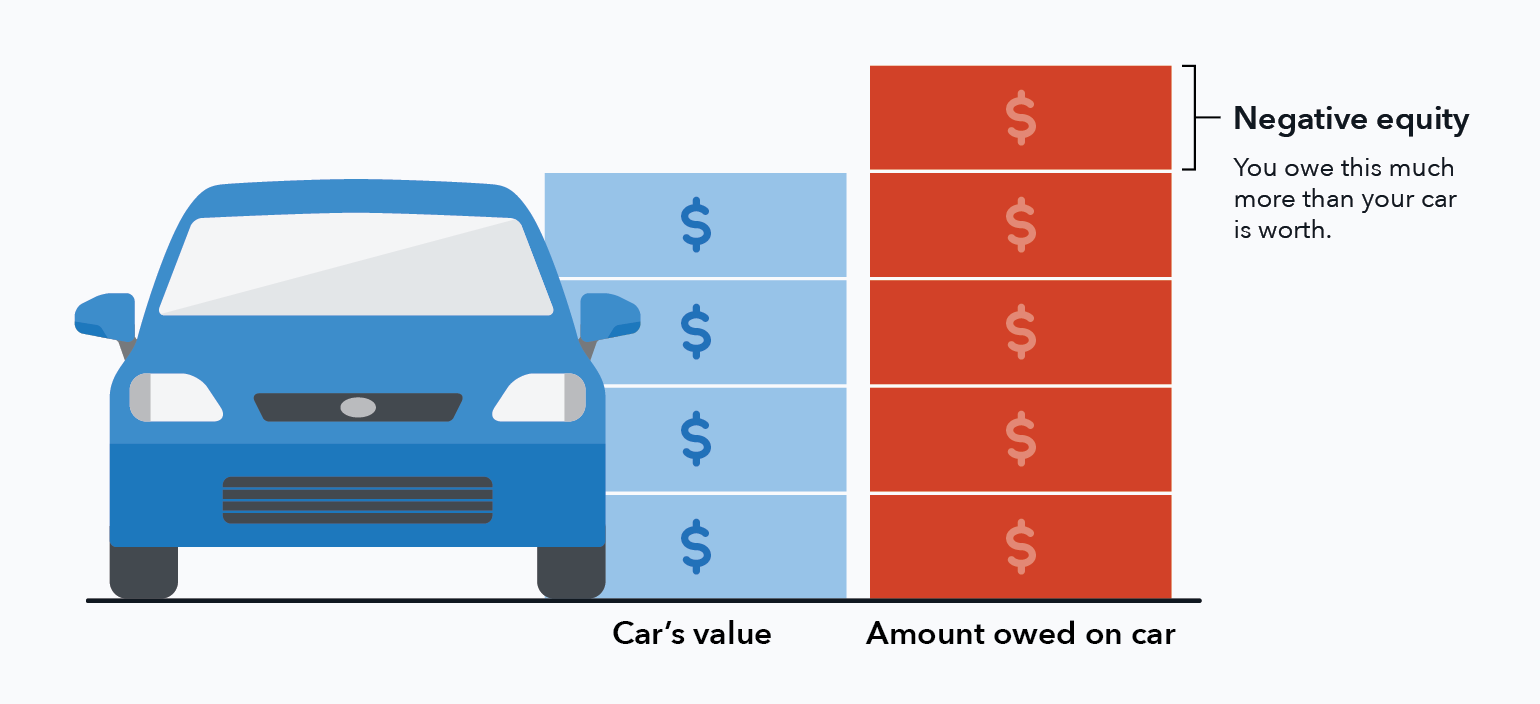

Things get more complicated when you still owe money on your trade-in. Some dealers advertise that when you trade in one vehicle to buy another, they will pay off the balance of your loan—no matter how much you owe. But some people owe more on their car than the car is worth. This is called "negative equity," and the dealer's promise to pay off the entire prior amount owed may not tell you the whole story, because that amount might be added to your new financing.

Negative equity has been on the rise in recent years. In 2017, nearly 1 in 3 trade-in vehicles had negative equity, with an average amount of $5,195. We have heard from some servicemembers and veterans that negative equity is increasingly common for the military population as well.

If you have negative equity, you should pay special attention to vehicle trade-in offers. Dealers may include the negative equity in your new car financing. That would increase your monthly payments by adding principal and interest.

Here's how that might play out: Say you want to trade in your car for a newer model. Your financing payoff is $18,000, but your car is worth $15,000. You have negative equity of $3,000, which must be paid off if you want to trade-in your vehicle. If the dealer promises to pay off this $3,000, it should not be included in your new financing. Nevertheless, some dealers may add the $3,000 to the financing for your new car, or deduct the amount from your down payment. In either case, this would increase your total cost and your monthly payments: not only would the $3,000 be added to the principal, but you would be financing it too, paying interest on that increased amount.

If you have negative equity, either on your current car financing or a rollover you already experienced from your previous financing:

- Think about postponing your purchase until you're in a positive equity position. For example, consider paying down your financing faster by making additional, principal-only payments.

- Think about selling your car yourself to try getting more for it than its wholesale value. However, if you financed the purchase of the car and still owe a balance, you likely will need to notify the company holding the lien before selling the car. Check your finance contract for what's required.

- If you decide to go ahead with a trade-in, ask how the negative equity is being treated in the trade-in and the financing. Read the contract carefully, making sure that any promises made orally are included. Don't sign the contract until you understand all the terms, including how the negative equity is being treated, the total amount you're borrowing, and the amount you will be paying every month.

- Keep the length of your new financing term as short as you can manage. The longer your new term, the longer you will take to reach positive equity in the vehicle.

As with all aspects of the car buying process, it’s important to educate yourself on how to trade-in a car in order to help you get the most value for your vehicle.

This is the third post in our blog series written in collaboration with the FTC. Read the other three posts in the series on shopping for auto financing, making the decision to buy a new or used car, and standing your guard when it comes to add-on products. Learn more about auto financing and the car buying process at www.FTC.gov/cars and at www.cfpb.gov/auto-loans.